You can file to get $12 because of a settlement in a class action lawsuit against Chase which alleged the bank enticed customers with promo interest rates on balance transfers, but then didn’t do a good enough job of telling them when the rates would expire. [More]

credit cards

Credit Card Companies Begin Flirting With Subprime Borrowers Again

After getting all hot and heavy leading up to the recession, then turning completely cold shoulder, credit card companies are once again starting to selectively flirt with subprime borrowers. [More]

Credit Card Marketer Uses Clever Way To Circumvent New Regs

Looks like at least one credit card marketer has cooked up a clever way around regulations that forbid unsolicited credit cards from being issued and showing up in your mailbox. [More]

Negotiate Before You Sign To Get A Better Deal On Your Credit Card

Just like some people don’t kiss on the first date, it can be wise to hold out on a potential credit card company. Don’t give it all up, by which I mean your signature, without playing a little hard to get. Instead of replying to the credit card offer immediately or sending in that online application, call them up and negotiate and get a better deal before you hop into bed with them. [More]

Banks Attempt To Woo Customers With Lower Credit Card Rates

Banks know consumers are angry at them for doing things like charging $5 a month for a checking account (not naming any names, but rhymes with Shank of Clamerica). So in order to lure back your business, banks are offering lower rates on their credit cards. [More]

Flying Relatives Home On United For The Holidays? Better Just Send Them A Check

When Cindy purchased her adult daughter’s plane tickets to visit for the holidays, she didn’t realize that United would rather have her just send her daughter the cash. At least, that’s the only logical explanation for the rule she learned about only after the purchase was complete: the credit card used to buy the tickets must be available at check-in. How is Cindy’s daughter supposed to present her credit card? [More]

Microsoft Zombie-Bills Expired Credit Card For Xbox Live

Earlier this year, we posted a handy tip to avoid zombie billing: for a service that you plan to stop using after your contract is up, use a credit or debit card with an expiration date shortly after the end of the contract. The idea behind this plan is that an expired card can’t be billed. This didn’t work so well for Rob, whose expired credit card was zombie-billed by Microsoft for his Xbox Live subscription. [More]

VISA And Mastercard Plan To Hike Debit Card Fees On Small Items For Merchants

VISA and Mastercard are planning to sharply raise the debit card transaction fees for small purchases for merchants, according to an analyst note. A $2 cup of coffee incurs about an 8 cent fee currently, but under the new policy, the fee will hike to 23 cents. [More]

Visa Will Incentivize Stores To Install Smart Card Terminals

We could start to see “smart cards” — credit cards embedded with a PIN-encoded chip instead of just a magnetic strip — take hold in America next year due to a big move by Visa. They are offering some very enticing financial incentives to stores to get them to install point of sale terminals that can read smart cards. [More]

Credit Card Bills So Bad I Avoided The Mailbox

Young, dumb, and full of debt, Beverly was dealing with it in the worst possible way: not dealing with it. Things got so bad that her plan for coping with all the angry letters from creditors filling her mailbox was to simply not get her mail anymore. [More]

What To Do When You Get Your First Credit Card

Since credit cards don’t come with manuals that teach you how not to get buried in debt and saddle yourself with ludicrous interest rates and fees, it’s best to start slowly and work your way into a comfort zone. Use credit with discipline and it can yield tremendous advantages. [More]

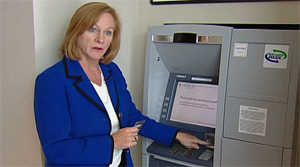

Federal Prosecutor Is Latest Credit Card Skimming Victim

ATM credit card skimming has gotten so pervasive that thieves managed to snag the digits of U.S. Attorney Jenny Durkan, a federal prosecutor, and lift $1,000 from her bank account. [More]

I Decline Credit Card, Brooks Brothers Signs Me Up Anyway

You might think that Brooks Brothers would be a classy establishment. Maybe it is fashion-wise, but Not when it comes to meeting quotas for signing customers up for credit cards, apparently. [More]

Discover Ends Disposable Credit Card Number Program

Discover sent around an email last night informing customers that it would be ending the “Secure Online Account Numbers” service. This feature helped you mitigate the potential for online fraud by letting you generate unique credit card numbers you could use per online retailer or even per transaction. A few Consumerist readers were bummed to see it go. [More]

Can You Access BofA & Chase Credit Card Account Info With Just 4-Digits And A Phone Number?

Last week, ConsumerWorld.org claimed that anyone could access credit card account info for Chase and Bank of America customers armed only with the customer’s phone number and the final four digits of their credit card. That’s certainly alarming, so MSNBC tested it out. [More]

Late Credit Card Payments At Lowest Rate Since Mid '90s

We mentioned a few weeks ago that more Americans have begun paying down their credit card debt during the last two years rather than maxing out their accounts with stuff they can’t afford. Now comes another sign of more responsible behavior… the rate of late credit card payments is the lowest it’s been in 17 years — .That’s an entire Bieber! [More]