Who isn’t suing Countrywide lately? Phuong Cat Le from the Seattle Post-Intelligencer says that a group of homeowners are now suing Countrywide, alleging that the lender steered them toward high-risk loans without disclosing the inherent risks.

countrywide

Donald Trump Saves Ed McMahon From Foreclosure!

Donald Trump doesn’t know Ed McMahon, but he “grew up watching him on tv,” so he’d like to be his new landlord. McMahon is currently facing foreclosure from Countrywide, and had 2 weeks to sell his house before the bank repossessed it. Mr. Trump has agreed to buy the house and lease it to McMahon, says the LA Times.

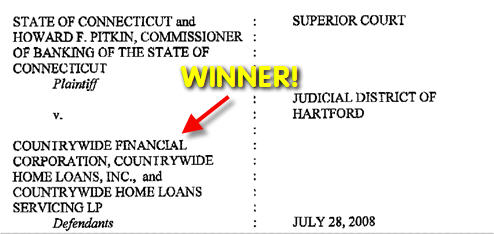

Throwdown! Connecticut Sues Countrywide For Deceptive Lending

Someone ring a bell because Connecticut Attorney General Richard Blumenthal has just sued Countrywide (and, of course, Bank of America) for deceptive lending practices. They’re seeking damages of $100,000 for each violation, as well as “up to $5,000 per violation of state consumer protection laws, disgorgement of all ill-gotten gains and an order compelling the company to cease its illegal practices.”

Former Countrywide Employee Arrested For Stealing, Selling Customer Identities

The FBI has announced that a former Countrywide employee and his accomplice were arrested on charges related to “illegal access of computers containing personal information,” and “illegal sale of the data.” A criminal complaint filed last Friday alleges that one of the men, Rene L. Rebollo Jr., a senior financial analyst for Countrywide Home Loan’s subprime mortgage division (who was let go in July), had been harvesting data from Countrywide’s computers for the past two years — downloading and storing the information on personal flash drives.

If My Bank Collapses, How Long Before The FDIC Pays Up?

If your FDIC-insured bank implodes, how long does it take for the FDIC to start paying depositors? Ever since IndyMac imploded, the question has no doubt been on many people’s minds. One reader emailed me saying that he had asked the his banker about how long it might take. Allegedly, the banker squirmed around before finally saying that the FDIC had 20 years to pay people back. This is not true.

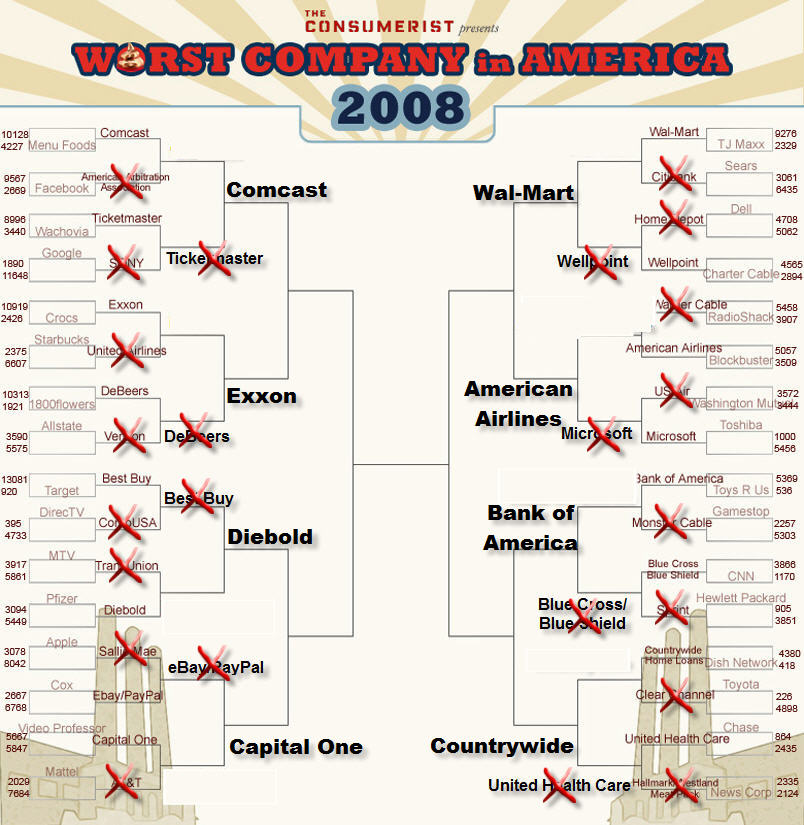

Countrywide Home Loans Wins Consumerist's Worst Company In America Contest

Duhn duhn da duhn! Envelope please… yes, America has voted and… the Worst Company in America award goes to…. Countrywide Home Loans (now owned by Bank of America)! The final vote was…

Worst Company In America Final Death Match: Comcast VS Countrywide Home Loans

Well, folks. This one is for all the marbles and a beautiful lucky golden shit statue, suitable for display in the corporate headquarters of either Comcast or Countrywide (now Bank of America).

Worst Company In America: "Final Four" Countrywide VS Wal-Mart

Here’s your second “Final Four” matchup: #3 Wal-Mart VS #15 Countrywide Home Loans.

../../../..//2008/07/01/now-that-countrywide-has-been/

Now that Countrywide has been acquired, Florida wants some of that Bank of America money!

Ex Countrywide Manager Exposes Its Lies

A former regional manager for Countrywide Home Loans, the mega mortgage company whose shady mortgage mill came to epitomize the subprime meltdown, went on The Today Show camera to detail some of the company’s questionable practices. Here’s some of the tricks he warned upper management about during his 6-month stint before he was fired for refusing to give loans to unqualified buyers:

Worst Company In America "Final Four" Bracket!

It’s down to the final four worst companies in America, folks. The bracket has been updated and the next round will begin on Monday. Congratulations to the four companies that made it this far. You’ve really achieved something! Who do you think will win it all?

Worst Company In America "Elite 8": Countrywide VS Bank of America

ATTENTION: Bank of America is currently in the process of purchasing Countrywide, but the transaction is not yet complete. For the purposes of this contest we ask that you evaluate their track record with consumers separately. Thank you.

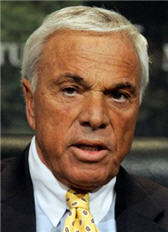

Countrywide CEO: "Countrywide Has Made A Positive Impact On The Country"

Countywide CEO Angelo Mozilo thinks his company being treated unfairly by the media according to a article in BusinessWeek. At the Countrywide annual shareholders meeting, Mr. Mozilo said:

Illinois And California Are Suing Countrywide For Deceptive Lending And Fraud

The Attorneys General of Illinois and California announced today that they are suing Countrywide Financial for its role in the subprime mortgage meltdown.

Fifteen Shocking CEO Severances

Here’s another tip for our Make the Most of Unemployment guide: if you’re going to get fired, be a CEO. HR World has rounded up 15 of the most shocking golden parachutes given out by big corporations to their departing leaders. Some of our favorites, inside.

Worst Company In America 2008 "Elite 8" Bracket!

The bracket has been updated as we prepare for Round 4 of our Worst Company In America contest. See the full-sized graphic, suitable for framing or forming the basis of informal office betting pools, inside…

Worst Company In America 2008 "Sweet 16": Countrywide VS United Health Care

Here’s your eighth and final “Sweet 16” match-up:

Countrywide CEO Gave Below Market Rate Loans To Senators From A Special "VIP Desk"

Does Angelo Mozilo spend all of his time thinking of ways to be shady? Now ABC News says that Countrywide had a special “VIP desk” that gave out below market rate loans to Senators and other politically connected people.