Republican senators have a buzzy little bee in their collective bonnets over the appointment of Richard Cordray as the director of the Consumer Financial Protection Bureau. See, they’re mad that President Obama took it upon himself to finalize the deed while the Senate was in recess, and say his “invalid” appointment will hurt business. [More]

consumer financial protection bureau

Republicans: Expect Legal Challenges To Richard Cordray's 'Invalid' Appointment As CFPB Head

President To Just Go Ahead And Appoint Cordray As Financial Protection Chief

It’s been nearly six months since President Obama picked former Ohio Attorney General Richard Cordray as his nominee to head the recently created Consumer Financial Protection Bureau. But with Senate Republicans continuing to block a vote on Cordray’s appointment, the President has decided to go ahead and use his authority to fill the position by making a recess appointment. [More]

Republican Senator Summons Soviet Russia Comparison For Consumer Financial Protection Bureau

After Republicans blocked the confirmation of Richard Cordray as director of the Consumer Financial Protection Bureau, North Carolina’s Sen. Lindsey Graham is explaining that he just doesn’t want a Soviet dictator like Joseph Stalin to have so much control. Ostensibly in this comparison, Cordray is Stalin? We’re not quite sure. [More]

White House: GOP Efforts To Block Confirmation Of CFPB Director Will Hurt Consumers

Deputy Director of the National Economic Council, Brian Deese, spoke with Consumerist today during a conference call where he stressed the importance of Richard Cordray’s confirmation as director of Consumer Financial Protection Bureau, a confirmation that was blocked earlier today by Senate Republicans. [More]

Senate Blocks Vote On Confirmation Of Richard Cordray As Consumer Financial Protection Bureau Director

A vote today in the Senate over whether or not to confirm Richard Cordray as the new director of the Consumer Financial Protection Bureau has been blocked with a filibuster by opponents of the current structure of the bureau. [More]

Consumer Financial Protection Bureau Proposes Two-Page Credit Card Forms

Anyone who hand shreds unwanted credit card solicitations knows how thick those envelopes can be — with forms full of interest rates, fine print and unnavigable terms. The Consumer Financial Protection Bureau proposed a new, shorter form yesterday, so that you wouldn’t have to wade through pages full of credit jargon. [More]

Senate Expected To Vote On Consumer Financial Protection Bureau Director Tomorrow

It feels like it was ages ago when former Ohio Attorney General Richard Cordray (not to be confused with his doppelganger NBC page Kenneth Ellen Parcell) was announced as the White House’s nominee for director of the recently formed Consumer Financial Protection Bureau. Now it’s almost time to cue some sort of dramatic music as the Senate is expected to thumbs-up-or-down the nomination on Thursday. [More]

Cordray One Step Closer To Becoming CFPB Head

Nearly three months after President Obama nominated Richard Cordray as director of the new Consumer Financial Protection Bureau, the former Ohio Attorney General has gotten one step closer to filling that position after the Senate Banking Committee voted to approve the nomination. [More]

CFPB Launches Credit Card Complaint Portal

Yesterday, the Consumer Financial Protection Bureau finally took down its “Coming Soon” sign and hoisted the “Open For Business” banner. And as part of its grand opening celebration, the CFPB kicked things off with the launch of its credit card complaint portal. [More]

Poll: Overwhelming Majority Of Voters Want A Strong, Undiluted CFPB

While Republicans in the Congress and Senate continue to grouse about the structure of the newborn Consumer Financial Protection Bureau, a new poll indicates that those politicians’ actions may not be a reflection of their constituents’ desires. [More]

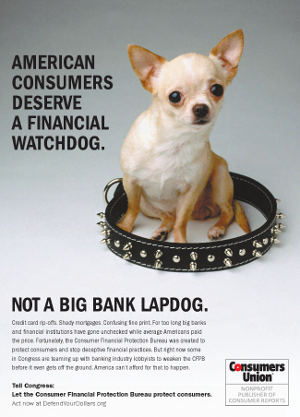

Consumers Union: Americans Deserve A Financial Watchdog Not A Big Bank Lapdog

As some members of the Congress and Senate continue to do their best to neuter the still-nascent Consumer Financial Protection Bureau, our benevolent benefactors at Consumers Union are asking the folks on Capitol Hill to not put a muzzle on the CFPB. [More]

House Committee Approves Legislation To Weaken Consumer Financial Protection Bureau

Because it would apparently really suck to have a Consumer Financial Protection Bureau that could actually do anything to protect consumers, the House Financial Services Committee has given the thumbs-up to three pieces of legislation that would weaken the agency before its even born. [More]

House Subcommittee Approves Bills That Would Effectively Shackle Consumer Financial Protection Bureau

As we reported yesterday, a House of Representatives subcommittee was set to review various proposed bills that would effectively disarm the new Consumer Financial Protection Bureau before it even had a chance to do any protecting of consumers. Sadly, but not surprisingly, all three bits of proposed legislation have been approved. [More]

Washington Already Considering Ways To Ruin Consumer Financial Protection Bureau

The still nascent Consumer Financial Protection Bureau is already on its way to becoming the latest victim in Washington’s efforts to make sure American consumers have their voice taken away. Tomorrow, the House Subcommittee on Financial Institutions and Consumer Credit is scheduled to consider a number of bills that, if passed, would undermine the CFPB’s ability to protect consumers. [More]

GAO: Consumers Only Getting $.21 On The Dollar Out Of Credit Card Debt Protection Fees

In 2009, U.S. consumers spent at least $2.4 billion in fees for credit card debt protection products that provide them with the ability to suspend or cancel a part of their debt obligations as a result of things like disability and involuntary unemployment. However, a new Government Accountability Office report finds that the credit card companies are making a substantial profit from these fees. [More]

Auto Dealers Win Exemption From Financial Protection Bureau Oversight

Some shady auto dealers are known to fake financial docs to get customers approved for loans they can’t afford. They refer to senior citizens as “people with oxygen tanks” and even straight up steal money from their ATM account. So, good thing that they can afford good lobbyists, because in the final hours they succeeded in making it so the new Consumer Financial Protection Bureau doesn’t apply to them. [More]

Know The Differences Between House And Senate CFPA Bills

Quick, what’s the differences between the House and the Senate bills for creating the Consumer Financial Protection Agency? 4,3,2,1, okay, you can stop sweating, NYT has got you covered. Left column shows House, right column shows Senate. Choose the key areas to focus in on, like consumer protection, risk and executive pay on the left. Then dazzle your friends at the bar tonight!

Senate Bill Adds Consumer Protections; Advocates Want More

Senate Banking Committee Chairman Chris Dodd (D-CT) unveiled a 1,336-page financial reform bill today, as consumer advocates warned that it doesn’t offer enough to protect the public and concentrates too much power in the Federal Reserve, and bankers complained the bill would “confuse consumers and businesses.” No wonder Dodd’s quitting his job. [More]