This month is the first in which student loan borrowers enrolled in the Department of Education’s Public Service Loan Forgiveness program were expecting to see their student loan tab cleared. But that’s not happening for some borrowers after learning they were never actually enrolled in the programs, despite assurances from the companies servicing their debts. [More]

consumer financial protection bureau

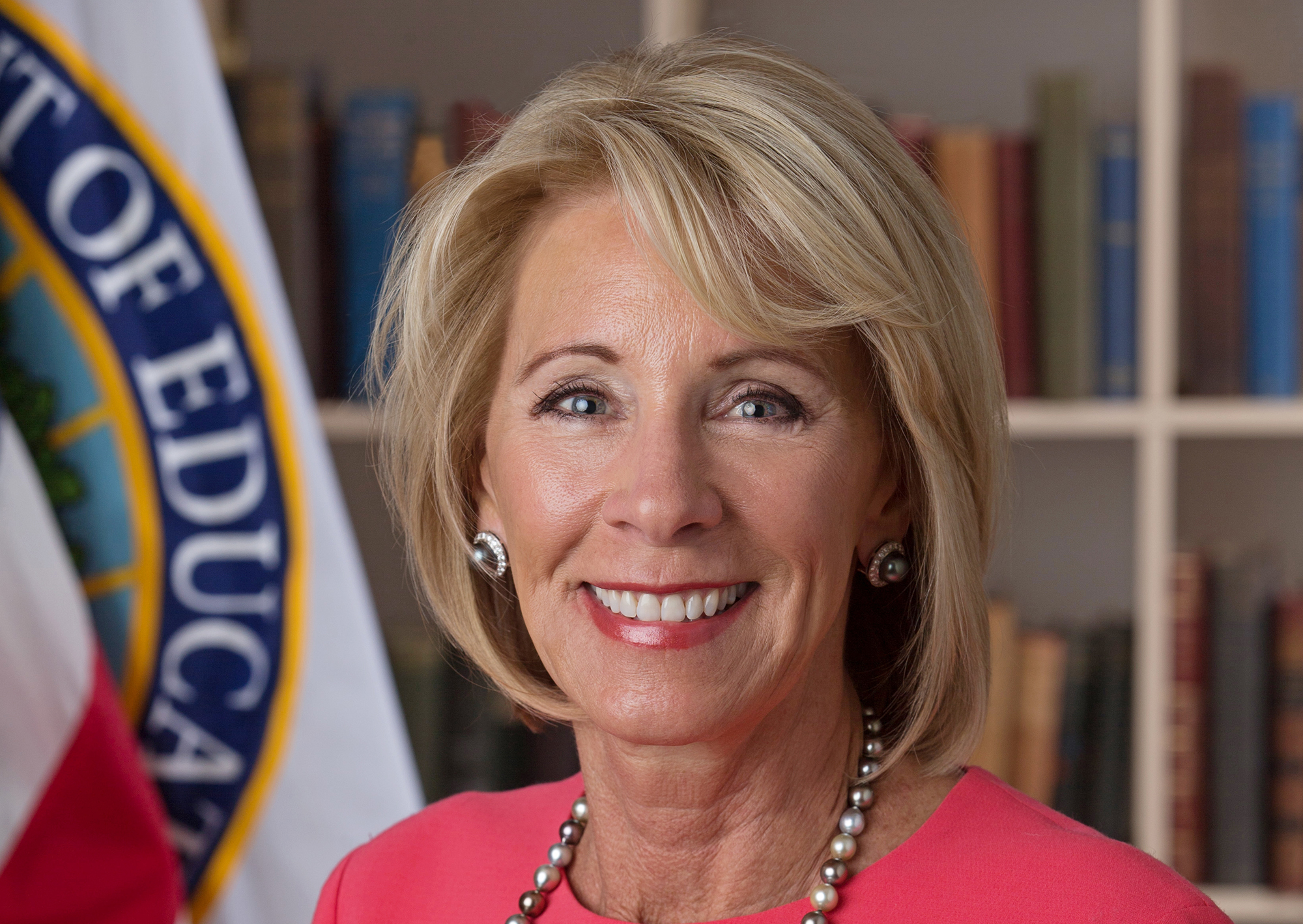

Bank-Backed Congressman Praises Betsy DeVos For Cutting Ties With Consumer Protection Agency

Congressman Jeb Hensarling of Texas, whose campaign has received more than $8 million from the financial sector since 2010, has long endeavored to undercut the Consumer Financial Protection Bureau, an agency that regulates many of the businesses that keep Hensarling’s election campaigns flush with contributions. So it’s of little surprise that the lawmaker is thrilled at Education Secretary Betsy DeVos’ recent decision to stop working with the CFPB on student loans — even though the Bureau has returned hundreds of millions of dollars to screwed-over student borrowers. [More]

Sketchy Debt Relief Company Accused Of Impersonating Federal Agency

In a sweet case of karma, a debt relief operation that claimed to wipe away consumers’ debt through an affiliation with the Consumer Financial Protection Bureau has been sued by none other than that exact same agency. [More]

Study: More Than 40% Of Americans Struggling To Make Ends Meet

There are no shortage of surveys and studies that have found consumers aren’t doing so great with their finances: from 45% of Americans carrying at least $25,000 in debt to one-in-four families failing to seek medical attention because of financial worries. Now, another survey — this time from the Consumer Financial Protection Bureau — found that more than 40% of adults struggle to make ends meet. [More]

States Ask Betsy DeVos To Not Drop Protections For Student Loan Borrowers

Earlier this month, Secretary of Education Betsy DeVos declared that the Department of Education would no longer work with the federal Consumer Financial Protection Bureau to root out bad players in the student loan servicing arena. While the CFPB fired back, accusing DeVos of misunderstanding just what the Bureau does, a coalition of state attorneys general are now joining the choir, claiming the decision to end the agencies’ agreements undermine protections for student borrowers. [More]

It’s Not Just You: Writing A Check Can Be Tricky

Between credit cards, online payment services, and good ol’ cash, many consumers have sequestered their checkbooks into cupboards and drawers that seldom see the light of day. Still, not everyone has left their checkbooks to waste away; many consumers use the notebooks from time to time, whether it be paying a bill, rent, or other expenses where plastic or cash aren’t options. [More]

Student Lender, Debt Collector To Refund More Than $3.5M To Borrowers

Two months after private student loan lender National Collegiate Student Loan Trust came under scrutiny amid reports that the company, along with its debt collector TransWorld, filed illegal student loan debt collection lawsuits against defaulted borrowers without citing proper or correct paperwork, federal regulators have ordered the companies to pay $21.6 million in refunds and penalties, and revise their collection practices. [More]

CFPB Asks Education Secretary DeVos To Not Give Up On Protections For Student Loan Borrowers

A week after Secretary of Education Betsy DeVos essentially broke up with the Consumer Financial Protection Bureau, ending the agencies’ agreements to work together to root out bad players in the student loans servicing arena, the CFPB is firing back, accusing DeVos of misunderstanding just what the Bureau does. [More]

Betsy DeVos Refuses To Work With Consumer Protection Agency On Student Loans

The Department of Education will no longer work with the federal Consumer Financial Protection Bureau to root out bad players in the student loan servicing arena. That’s according to Education Secretary Betsy DeVos, who recently notified the CFPB that her department is ending years of formal cooperation combating student loan fraud. [More]

Feds Investigating Wells Fargo Sudden Account Closures

Last year, federal regulators fined Wells Fargo $185 million for its fake account fiasco in which employees were found to have opened more than two million accounts without customers’ authorization. Now, the bank says it’s under investigation for wrongly closing some accounts. [More]

Frequent Overdrafters Spend $450 More In Fees Each Year, More Disclosures Could Help

Under federal law, depository institutions are prohibited from charging overdraft fees on ATM and one-time debit card transactions unless consumers affirmatively opted in. But a new report suggests that those who do opt-in might not know the cost of such a decision, with opted-in frequent overdrafters spending about $450 more in fees each year than non-opted-in frequent overdrafters. [More]

Don’t Strip Consumers Of Their Right To A Day In Court, Say Advocates, Senators

Last week, bank-backed lawmakers revealed their plans to pass fast-track legislation that would undo the Consumer Financial Protection Bureau’s recently finalized rules that prevent banks and other financial institutions from stripping customers of their constitutional right to a day in court. Now, consumer advocates are urging the rejection of the legislation, expected to be voted on this week. [More]

Sen. Cory Booker Concerned Over Hefty Overdraft Fees, Seeks Info From Top Banks

Each year, banking customers spend an estimated $32 billion on overdraft fees. While many banks have modified their policies regarding the costly fees, recent reports found those changes aren’t enough to protect most consumers. Now, in an effort to add to those protections, one lawmaker is pressing banks for more information on their policies. [More]

CFPB’s Finalized Arbitration Rule Takes Away Banks’ ‘Get Out Of Jail Free Card’

Roughly 240 days from now, banks and other financial companies will no longer be allowed to prohibit customers from banding together in class-action lawsuits through the use of binding arbitration clauses, as the Consumer Financial Protection Bureau today released a long-awaited finalized rule on arbitration. [More]

Four Credit Repair Agencies Accused Of Misleading Customers, Charging Illegal Fees

Four different “credit repair” operations have been ordered to pay a total of more than $2 million in penalties for allegedly tricking people into thinking their bad credit could be easily fixed. [More]

Are The Comments Opposing Payday Loan Rules Legitimate?

Last summer, the Consumer Financial Protection Bureau released proposed rules intended to prevent borrowers from falling into the costly revolving debt trap that can leave people worse off than if they hadn’t borrowed money in the first place. Since then, those in the payday lending industry have ramped up their efforts to ensure the proposal isn’t finalized. [More]