There are about 200 fewer adulterated dietary supplements on the market today after a district court ordered an Iowa company and its owners to stop production of products over allegations the company sold potentially unsafe dietary supplements and falsely advertised them as treatments for diseases ranging from colds to cancer. [More]

complaints

Court Shuts Down Iowa Supplement Company Distribution Over Misbranding, Unfounded Safety Promises

Operators Of Credit Repair Business Masquerading As The FTC Must Return $2.4M To Consumers

Three months after regulators shut down a credit repair company catering mainly to Spanish-speaking consumers for falsely claiming to have a close relationship with the federal government – calling itself “FTC Credit Solutions” – and bilking thousands of dollars from individual consumers with empty promises of boosting their credit scores, the real Federal Trade Commission announced it has reached a settlement that will result in the return of $2.4 million to victims of the scam. [More]

Citigroup Facing Federal Investigation Into Student Loan-Servicing Practices

Just last month federal regulators announced that an ongoing probe into potentially unscrupulous student loan-servicing practices resulted in nearly $18.5 million in refunds and fines from Discover Bank. Now, regulators appear to have Citigroup in their crosshairs, as the financial company announced it was party to an investigation. [More]

Class-Action Suit Accuses CVS Of Overcharging Customers For Generic Drugs

The country’s second largest pharmacy chain is the latest party in a class-action lawsuit that accuses CVS of deliberately overcharging hundreds of thousands of patients for generic prescription drugs. [More]

Discover Bank Must Pay $18.5 Million Over Illegal Student Loan Servicing Practices

As federal regulators continue to probe potentially unscrupulous student loan servicing practices, the Consumer Financial Protection Bureau has ordered Discover Bank and its affiliates to pay nearly $18.5 million in refunds and fines for, among other things, overstating amounts due on student loans and failing to notify borrowers of their rights. [More]

CFPB Launches Monthly Reports To Showcase Financial Difficulties In Specific Areas Of The U.S.

Have you ever wondered if people on the other side of the country run into the same difficulties dealing with financial institutions as you do? Well, wonder no more, as the Consumer Financial Protection Bureau announced today that it will provide a peek into the overall state of consumer complaints in the U.S. and how individuals in certain areas deal with companies providing financial products and services through a new monthly series. First up: Milwaukee, WI, and debt collection. [More]

Report: GM Threatened With Regulatory Investigation Before Issuing Recall For Fire-Prone Hummers

Last week, General Motors announced that it would recall nearly 196,000 Hummer vehicles because simply turning on the heating or cooling system could set the car ablaze. While we reported that federal regulators had received nearly two dozen consumer complaints about the issue over the past seven years, a new report finds that the real number of reported incidents is much higher, and that GM may have continued to put off issuing the recall had it not been for threats of an investigation. [More]

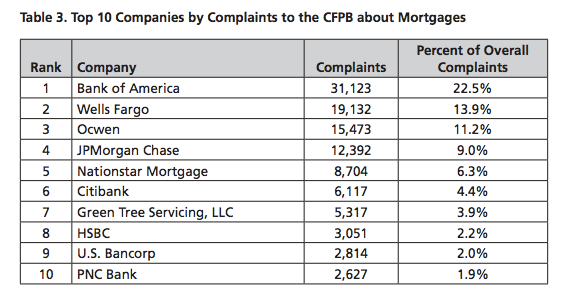

Bank Of America, Wells Fargo Top List Of Most Complained About Mortgage Issuers

For the past four years, the Consumer Financial Protection Bureau’s Consumer Complaint Database has seen its fair share of consumer issues related to mortgages. In fact, complaints regarding loan modification, collection, foreclosure, loan servicing, payments and escrow accounts continue to be one of the biggest financial thorns in consumers’ sides. And the worst offender? Bank of America. [More]

Marketers Of Memory Supplement Must Pay $1.4M To Settle Deceptive Advertising Charges

Using fake news stories and trumped-up, unsubstantiated claims, the marketers of a supplement that claimed to be the answer to memory loss problems sold nearly $100 million worth of the stuff in just a few years. Now they have to fork over $1.4 million to federal and state authorities for making these deceptive statements, and face millions more in penalties if they fail to comply. [More]

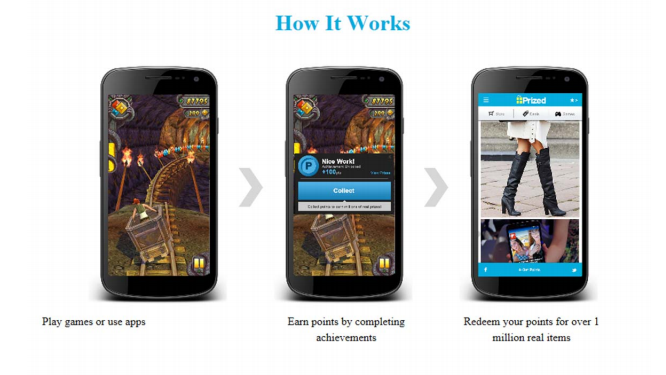

App Developer Settles Charges It Hijacked Consumers’ Phones To Mine Virtual Currency

Some reward programs aren’t really rewarding. In fact, some are downright harmful to consumers. That was apparently the case with an Ohio-based smartphone app developer that recently agreed to settle charges that it hijacked consumers’ phones through a seemingly innocuous gaming app. [More]

FTC Says Some Of Those “Risk-Free Trials” For Skincare Products Are Bogus, Shuts ‘Em Down

Sometimes it’s hard to ignore the lure of a “risk-free trial” when it comes with a product that promises to leave your skin youthful, radiant and as soft as a baby’s bottom. But as the Federal Trade Commission once again reminds us, those deals often come with strings attached and hollow promises. [More]

The First Complaint Of Net Neutrality Violation Is In, And It’s Against Time Warner Cable

Net neutrality only went into effect last Friday, but the first formal complaint against an ISP for breaking the rule is already on its way. The target? Time Warner Cable. [More]

Is Your ISP Not Following Net Neutrality? The FCC’s Got A Complaint Form For That.

Hooray! Net neutrality is finally, well and truly, the law. The courts did not uphold industry groups’ requests to press pause on the implementation, and so as of right now, ISPs are common carriers under Title II and are not allowed to mess around with your connections. [More]

CFPB Fines Mortgage Company $20M For Pushing Customers Into Spending More Than They Had To

While a report earlier this year suggested that consumers don’t spend nearly enough time shopping for the right mortgage, that doesn’t mean lenders are off the hook for purposefully steering potential homeowners into costlier mortgages. Because doing so will land a company in hot water with federal regulators. Just ask RPM Mortgage and its top executive, who must now pay $20 million for their allegedly deceptive practices. [More]

Ford Recalls Nearly 445K Vehicles For Power Steering Failure, Fuel Leak Issues

Ford Motor Company issued two new recalls Wednesday covering nearly 445,000 vehicles after receiving numerous complaint and incident reports, including at least four accidents related to loss of power steering and high underbody temperatures. [More]

FTC Puts A Stop To Three Debt Collection Operations Using Threatening Text Messages, Robocalls

For the most part, we can’t say many glowing things about the debt collection industry that has, in the past, been known for using a litany of abusive and deceptive practices to pry money from consumers. Three such companies will no longer be bothering people after the Federal Trade Commission temporarily shut down the operations for engaging in nearly all of the hallmarks of shady collectors: threatening lawsuits or arrest, impersonating law enforcement and government officials and illegally contacting supposed debtors. [More]

4 Cancer Charities Accused Of Swindling Donors Out Of $187 Million

Federal regulators, state officials and prosecutors and law enforcement officers from all 50 states and the District of Columbia partnered today to charge four cancer charities and their operators for running a scheme that swindle consumers out of $187 million in charitable donations. Two of the charities have agreed to settle the charges and dissolve their businesses, while two other plan to fight the charges in court. [More]