Although “Hoverboard” scooters – you know, those boards that don’t actually hover at all, in spite of the nickname – have taken over the Internet and the holiday wish lists in recent months, they’ve also made headlines for all the wrong reasons, such as allegedly exploding while charging and being under investigation by federal safety officials. And now the devices are the center of a lawsuit between big-time scooter manufacture Razor and Swagway -a leading hoverboard distributor. [More]

complaint

Man Who Sued Costco After Altercation Led To Broken Leg Loses Case

Last September, a man in Oregon filed a $670,000 lawsuit against Costco claiming that a receipt-checking dispute left him with a broken leg. This week, a jury refused to award the man damages in the case. [More]

Regulators Take Action Against Online Lender For Deceiving Borrowers On Default Charges

When a company’s name has the word “integrity” in it, you may assume it’s a wholesome, truthful operation forthcoming with information that its customers would find beneficial. That apparently wasn’t the case with Integrity Advance, as federal regulators accused the short-term online lender of deceiving borrowers about the true cost of its loans. [More]

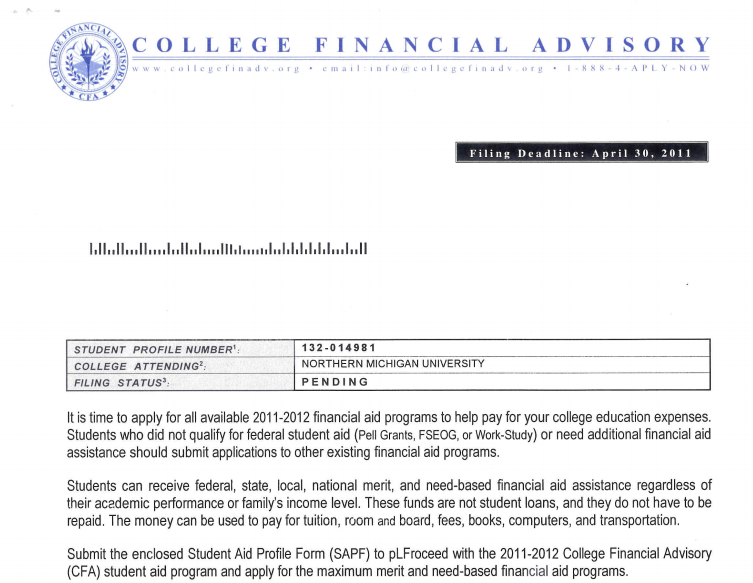

Feds Sue Scammers Who Charged For Bogus Student Financial Aid Assistance

Paying for college out of pocket is nearly impossible for millions of prospective students. Instead, these individuals turn to scholarships, grants, and student loans, often relying on financial service programs to assist them in obtaining the funds. But not all of the companies promising a helping hand are looking out for your best interests. That was apparently the case for a California company accused of ripping off tens of thousands of victims in a nationwide financial aid scam. [More]

UPS Agrees To Pay $4.2M To Resolve False Delivery Claims With 17 States

We’ve all been there: you’re waiting for a package, you check the tracking, and it says they tried to deliver. Except you’ve been paying attention the whole time, and no knock has ever come. When it’s just one resident, that really stinks. When it’s a whole bunch of packages being delivered on government contracts, though, it’s lawsuit time. [More]

Regulators Shut Down Debt Relief Operation That Took Millions From Consumers

The Florida Attorney General’s Office and the Federal Trade Commission make a pretty effective pair when it comes to putting an end to companies and operations taking advantage of consumers. Just a day after the regulator and state’s attorney general teamed up to sue a company behind medical alert robocalls, the two entities announced they shut down a debt relief scheme that took million from consumers with credit card debt. [More]

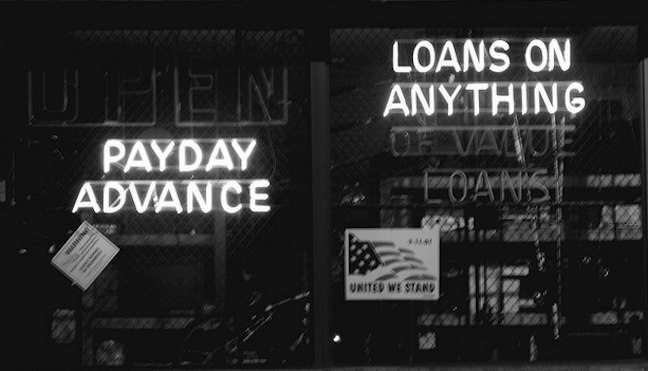

Operators Of Massive Payday Loan Scheme Banned From Industry

The masterminds behind a massive payday loan scheme have agreed to be banned from the consumer lending industry to settle federal regulators’ charges they bilked millions of dollars from customers by trapping them into loans that were never authorized. [More]

Kohl’s To Pay Nearly $1M To Settle Allegations It Overcharged Customers In California

Kohl’s Corporation must shell out nearly $1 million to settle lawsuits with four California counties over allegations the company charged customers more than the price advertised on shelves and signs. [More]

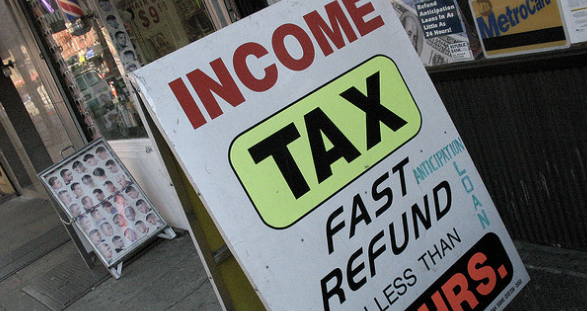

CFPB, Navajo Nation Team Up To Put An End To Tax Scheme Targeting Low-Income Consumers

For many low-income consumers, tax time provides an opportunity to catch up on bills and get back on track financially. Unfortunately, there are unscrupulous companies out there that aim to make money of these same consumers by pointing them in the direction of high-cost tax-refund-anticipation loans. That appears to be the case for the owner of New Mexico-based H&R Block franchises and a tax-time loan company operating an alleged illegal tax-refund scheme. [More]

FTC Temporarily Halts Deceptive Practices Of Mortgage Relief Operation

The Federal Trade Commission continued its crackdown of deceptive mortgage relief companies this week as a federal court granted the agency’s request to temporarily halt a Los Angeles-based company that charged consumers excessive upfront fees for services they never performed. [More]

Reader Gets Free HBO, Cinemax And Showtime For Suffering Internet Outage

We Consumerist bloggers just love those stories of reader complaints that are generously solved by customer service before we even get around to posting the gripes.

UPS Damages $1,700 Worth Of Shipped Items, Admits They Messed Up, Still Won't Pay

Awesomely-named reader DrSpaceMonkey tells us he shipped some stuff to himself during a move, discovered it was damaged, and now can’t collect on his insurance.

Capital One All Hassle Credit Card

How hard should you have to work to pay your bills? No, not to make enough money to pay your bills, but to actually give your money to someone else? Reader Matt has been trying to convince Capital One to take his money for several months now. They’re not taking his money, or his calls, but they are willing to send him to collections! Check out his story, inside.

UPDATE: Comcast Tech Fails Installing Cable to Customer’s Heart

Eager to prevent another snakesonablog style sleepy tech debacle, a Comcast rep contacted us about the unwelcomlingly amorous cable installer. She says:

Comcast Tech Fails Installing Cable to Customer’s Heart

It’s expected that Comcast cable installs are both late and flawed, but Andrew W’s friend adds a new wrinkle: unwelcome love advances.