Call it an about-face, a switcheroo or an epiphany, but whatever you call it, ex Citigroup CEO Sandy Weill is surprising plenty of people in the industry by saying megabanks should be broken up. This, from the man who helped steer Citigroup to its current ginormous conglomerate status. [More]

citigroup

Citibank Doesn't Want Your Gross Punctuation Marks

Sandra wanted to contact Citibank about a fee, and figured that contacting them using secure account e-mail from within their site was a good way to do it. When she tried to send the message, the system rejected it, telling her to remove any special characters. “What special characters?” she asked. Turns out the e-mail form didn’t like quotation marks. At least it wasn’t apostrophes? [More]

Citi Shareholders Sue Bank's Directors For Paying Executives Too Much

Earlier this week, the shareholders of Citigroup said “hell no!” to the notion of paying company CEO Vikram Pandit $15 million. Today, they took their anger a step further and filed a lawsuit in federal court, saying Citi execs should not be rewarded for doing a so-so job. [More]

Citigroup Shareholders Vote Against CEO's $15 Million Raise

Score one for the little guys, where the little guys are shareholders of Citigroup and the Goliath in need of a slingshot of reality is its CEO seeking a $15 million raise. Sure, he only made $1 the year before, but this is big news as it’s the first times shareholders have rejected the executive pay package at a major bank since the Dodd-Frank act made votes mandatory a year ago. [More]

Federal Judge Signs Off On $25 Billion Mortgage Settlement With Top 5 Banks

It’s just like reality TV, but not at all — America, here are your top five big greedy banks, and here is the $25 billion mortgage settlement they’re all going home with, now that a federal judge has approved it. That’s their load to carry, after allegations of foreclosure abuses and misconduct in servicing home loans. [More]

Worst Company In America Sweet 16: Bank Of America Vs. Citi

A perennial Golden Poo favorite slips into a red, white and blue unitard and struts into the WCIA Rollerball arena to the strains of Hulk Hogan’s “Real American,” thinking this is the year they win it all… Well, not if a scrappy underdog from New York City has anything to say about it. [More]

Please Join Us In Welcoming Your Worst Company In America 2012 Sweet 16!

The floor of the Worst Company In America BattleDome is stained with the blood of the vanquished. But only one company can earn the privilege of placing the WCIA Golden Poo in its trophy case, so the violence must continue. [More]

How Much Have The Big Banks Been Penalized Over Mortgage Mess And Where Is All That Cash Going?

The last few years have seen numerous settlements between the nation’s biggest mortgage lenders and various federal and state authorities. And while we hear numbers like “a total of $25 billion,” exactly which banks are responsible for the biggest chunks of these settlements? [More]

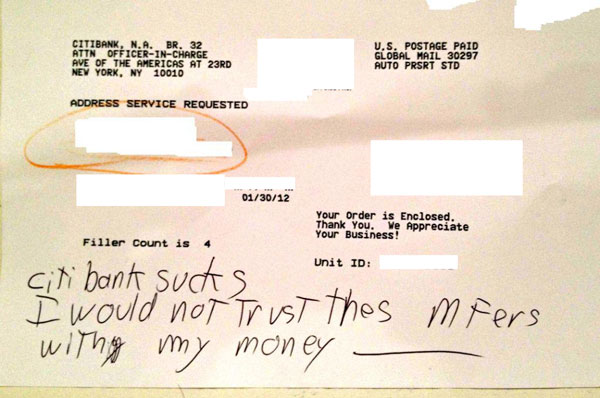

Helpful Stranger Delivers Your Mail, Curses Out Your Bank

It’s just plain heart-warming when a stranger does something nice for you. When Efrem’s box of new checks from Citibank went astray, the person who did receive them brought them by, with a helpful note about Efrem’s choice of financial institutions. “Citibank sucks,” the Good Samaritan wrote. “I would not trust [these] MFers with my money.” [More]

Citibank May Have Double-Charged Customers Using Its Bill-Pay App

Whoopsadaisy! Citigroup has accidentally been charging many customers more than what they owe for months, with some of them not even realizing it was going on until the bank sent out a notification. Cit’s bill-pay app for iPads was the culprit in many cases, charging customers twice what they owed for bills or mortgage payments. [More]

Mainland China Will Finally Be Granted The Honor Of Citigroup's Credit Card Presence

Take that, other Western banks — Citigroup will be the first one to issue credit cards under its own brand in mainland China after the China Regulatory Commission granted their approval. It’s coup for Citi, and now they can brag about it to all their credit card company frenemies. [More]

SEC Would Rather Fight Judge Than Try To Win A Real Victory Over Citigroup

Back in November, a U.S. District Court judge in Manhattan rained all over the Securities and Exchange Commission’s Thanksgiving parade when he refused to sign off on the regulator’s $285 million settlement with Citigroup because — as is usual in these sorts of deals — the bank neither admitted guilt nor defended itself. But rather than take the judge’s decision as an impetus to push harder on Citi, the SEC reportedly just wants the court to stop being such a wet blanket and let it have its settlement already. [More]

Judge Blocks $285 Million Settlement Against Citigroup Because The Bank Won't Admit Wrongdoing

Earlier this fall, the Securities and Exchange Commission announced a whopping $285 million settlement with Citigroup over allegations that the bank misled investors in a 2007 mortgage derivatives deal. But that triumph was short-lived, as a judge has decided to block the settlement because of a standard settlement condition wherein the bank is allowed to close the case without admitting guilt or denying the allegations. [More]

Citi "Simplifies" Banking By Raising Monthly Service Fee

Citi customers with the bank’s “Basic Banking” package currently pay an $8/month service fee that can be waived if the customer makes five qualified transactions per month. The good news is that they are reducing that requirement; the not-so-good news is that Citi is raising the monthly fee for people who don’t make the necessary number of transactions. [More]

Investigation: Banks Took $6 Billion In Home Insurance Kickbacks

According to a HUD investigation, big banks raked in over $6 billion in a decades-long insurance kickback scheme that violated RESPA. [More]

Former Citi VP Admits To Stealing $22 Million From Bank

If you think you need Ben Affleck in a creepy nun mask to heist millions from a bank, there’s a former VP of Citigroup who can teach you a thing or two about a bloodless robbery. Of course, this guy also got caught and has pleaded guilty to embezzling more than $22 million from his former employer, so he’s probably not one to look to for get-rich-quick advice. [More]

Chase, Bank Of America, Citi & Wells Fargo Allowed To Start Foreclosing Again In New Jersey

It’s been a quiet 2011 on the foreclosure front in New Jersey, as several banks froze seizure proceedings late last year following the revelation that foreclosure documents were being rubber-stamped by untrained “robo signers.” But a judge in the Garden State has given the go-ahead for Bank of America, JPMorgan Chase, Citigroup and Wells Fargo to resume uncontested foreclosures. [More]