The holiday shopping season is over, which means that the holiday scavenger season has begun. As we return our gifts, those items make their way to brokers who sell random stuff by the truckload, eventually ending up on the shelf of a discount store in the next state, in a popular eBay store, or a flea market table on the other side of the world. [More]

brokers

Proposed Rules Target Fees Collected By Retirement Financial Advisers, Brokers

When visiting a financial adviser for consultation about retirement savings one might assume those counselors have their best interests in mind. Unfortunately, that’s not always the case. To better ensure consultants are working for consumers and not for fees, the Labor Department will propose new rules to increase standards for brokers who recommend investments for retirement accounts. [More]

Convicted Fraudsters Still Have Real Estate Licenses

So, whaddya gotta do to lose a real estate license? A Sacramento Bee investigation uncovered licensed real estate brokers who were suspected or even convicted of fraud, some of them even convicted for committing mortgage fraud. [More]

Be Sure To Confirm Age Requirements Before Buying Airline Tickets For Kids

A man in California ended up fighting with Expedia over compensation after his kids, ages 12 and 16, were left stranded overnight in a Virginia airport, because the airline wouldn’t let them board the connecting flight without being accompanied by someone 18 or older. The man told Expedia the kids’ ages before buying the tickets but the company’s system didn’t send up any red flags, so he thought the trip would be fine. [More]

Keep PayPal From Using The Default ATM Debit Setting

PayPal exists to make money, not to help you. That’s why the unregulated money broker likes to ensure that when you pay with a linked account, you pay via the ATM debit card setting, because it’s cheaper for PayPal. Of course, that “savings” is sometimes deducted from you in the form of a transaction fee by your bank, but PayPal doesn’t care. If you want to change that payment method the next time you use PayPal, be prepared to jump through a lot of hoops. [More]

Taking Credit Card Offers Hurts Your Credit

Last week, I wrote about how to turn your good credit into cash. I purposely excluded credit card offers from the list because I wanted things that, should you implement them, wouldn’t hurt your credit. Today, I want to warn to the overzealous.

Let's Perma-Ban Consumer Predators

Regulating consumer predators is a bit like Whac-a-Mole. No matter how many times you put the bad guys out of business, they keep popping up again and again. Maybe it is time to consider a lifetime ban from financial services for the worst offenders. The Consumer Financial Protection Agency proposed by the President may be just the right watchdog for the job of handing out such banishments.

Deposit $75,000 With TD Ameritrade And Get A Free iPod! OMG!

We guess there’s really no point at which you’re “comfortable” enough to not be tempted by a FREE iPOD! OMG! Reader Jonathan forwarded this email from TD Ameritrade in which they tried to entice him to deposit either $75,000 or $50,000 in order to get himself a free iPod Touch.

Personal Finance Roundup

5 Simple Steps to a Successful Cover Letter [Yahoo Hotjobs] “[Here’s] an easy-to-follow, five-step formula for cover letter success”

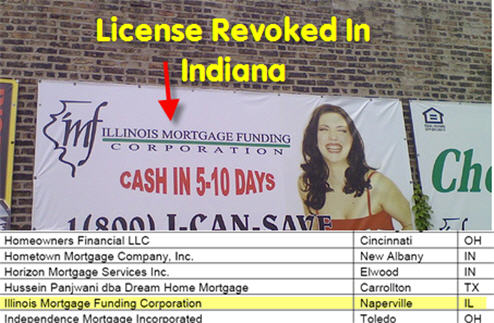

Oh Sh*t! 40% Of Indiana's Mortgage Brokers Lose Their Licenses

40% of Indiana’s mortgage brokers have lost their licenses because they did not comply with a new law aimed at “raising the standards” of the mortgage lending industry. The law requires mortgage brokerages to “name a principal broker with at least three years experience who has passed a state exam and will oversee his company’s business affairs,” says BusinessWeek. Sounds reasonable, doesn’t it?

Why Few Seem To Be Able To Work Out Better Loan Terms

Call it what you will, the borrower bailout/rescue/whatever does not seem to be working. Foreclosures are still on the rise along with defaults and sad stories. And while those numbers go up, the economy continues to worsen.

FBI Starts Investigating The Entire Mortgage Industry

The New York Times says that the FBI has begun an investigation that includes almost the entire mortgage industry—from the lenders to the brokers to the Wall Street banks who packaged the loans as securities. They’re cooperating with the SEC and wouldn’t name which firms they’re targeting, but the Times said that it includes 14 companies.

Retirement Investment Scams And How To Avoid Them

People who are about to retire often find themselves faced with a million different brokers who have a million different great ideas about what they should do with their savings. It can be overwhelming, but Kiplinger has a great article about shady investment scams and how to avoid them.

../..//2007/12/18/the-ftc-sued-milwaukee-multiple/

The FTC sued Milwaukee Multiple Listing Service for shutting out the homes of consumers who used non-traditional listing contracts, illegally restraining competition. [FTC]

Call For Advice: Reader Wants Discount Brokerage Recommendations

Onoodles writes, “I’ve managed to put away 20k into a Roth IRA. I started it directly through one mutual fund and now I’m looking to move it to a discount brokerage firm to diversify. So my question is, which one is the best?!” For a general overview and comparison of leading brokerages, we suggest looking into SmartMoney’s 2007 Broker Survey from a few months ago. And note that by going with a discount brokerage firm, you’ll likely be trading better customer service, research tools, and trading tools for cheaper fees.

Investigate Neighborhoods Online With Real Estate Gossip Sites

You find a home you love, and the asking price makes it practically a steal. But you wonder: how do you know it wasn’t built on top of a “relocated” cemetery? Or what if it’s only a few blocks away from the city’s longest-running crackfest? Thanks to several websites and blogs, new home shoppers can now collect “real world” data about prospective neighborhoods and real estate from actual residents, other buyers, and anonymous brokers out to sabotage the competition.

The Case Of The Man Who Should Have Known Better

Back in 2005, my wife and I bought our first condo. We live in the Central Coast of California, in San Luis Obispo, where the property values were skyrocketing, and were not supported by the wage base, similar to Monterey and Santa Barbara. It was the top of the market and I knew it, but we had a very slick mortgage broker who got us qualified (it wasn’t a no-doc loan, but it was a 100% finance, 80/20 with a first and a second, the first was a 6.5% 2/28 ARM, the second a 9% fixed.) We were assured at the time and up to as recently as this Summer, that we would have no problem re-fi-ing that loan (and even paying off our lower-interest student loans by taking some cash out in the process=wtf???) by the same broker. Of course that didn’t happen…

Mortgage Industry Lays Off More Workers

The mortgage industry isn’t just hemorrhaging money anymore, it’s hemorrhaging jobs. Two more mortgage lenders (Lehman Brothers Holdings and the National City Corporation) announced that they would be laying off 2,000 employees.