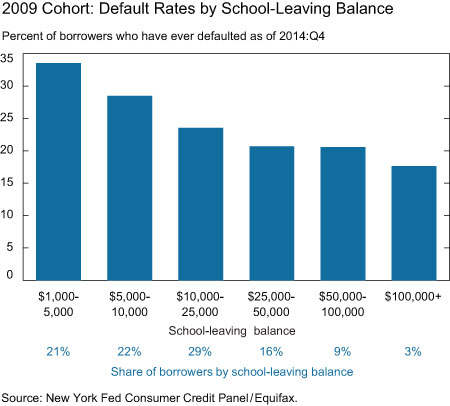

Just days after the Federal Reserve Bank of New York showed that student loan delinquency rates were once again on the rise, a new Fed report finds it’s student loan borrowers with the lowest levels of debt who typically are the most delinquent.

[More]

borrowers

Why Are Borrowers With Less Student Loan Debt More Likely To Default?

Student Loan Servicers Tricked Borrowers Into Paying More, Made Illegal Collection Calls

As if student loan borrowers needed more bad news, the Consumer Financial Protection Bureau released a report this week detailing how some student loan servicers have tricked consumers into paying higher fees and misrepresented balances due. [More]

Wells Fargo Pulls $4,000 From Checking Account To Repay Student Loan

When you borrow from a bank where you also keep your day-to-day cash, you might be opening yourself up to problems down the line. Most banks have a right of setoff, which means they can tap other accounts you hold with them to repay themselves money you owe. For a woman in Atlanta, this meant Wells Fargo legally drained her checking account without warning, leaving her and her husband with no cash and $385 in overdraft fees, due to some ongoing confusion over a student loan. [More]

Homeowners With Good Credit Are More Likely To Strategically Default

Here’s an interesting discovery about mortgage defaults from the LA Times:

Lender Makes Borrowers Pledge Their Souls

Mirosiichenko said his company would not employ debt collectors to get its money back if people refused to repay, and promised no physical violence. Signatories only have to give their first name and do not show any documents. “If they don’t give it back, what can you do? They won’t have a soul, that’s all.”

How Credit Bureaus Correct, Or Fail To Correct, Errors On Your Report

SmartMoney’s Anne Kadet looked into the process by which the three major credit bureaus—Experian, TransUnion, and Equifax—investigate and correct errors on credit reports. What she found was that the process is “almost entirely automated,” and that “many lenders respond by simply rereporting the erroneous data.” Here’s how it works, and your meager options when something goes wrong.

Citibank, Senate Agree On "Cramdown" Bill To Prevent Foreclosures

Ever heard of a cramdown? It’s when a bankrupcty court splits a home loan into two parts: a secured loan that’s equal to the current value of the home, and an unsecured loan that covers the rest of the outstanding debt. The secured loan is paid, and the unsecured isn’t. It can result in lower monthly payments (if the new loan amount is amortized over the course of the loan), but the important part is that it helps guarantee that a significant part of the loan will still be paid off.

Sallie Mae Stops Student Loan Consolidation, Will No Longer Pay Origination Fees On Stafford Loans

Consolidation loans are no longer profitable for Sallie Mae, so it’s saying goodbye to them. SmartMoney points out that ultimately this shouldn’t matter for students taking out new loans, since the original point of consolidation—converting lots of variable rate loans into a nice predictable fixed rate loan—is no longer relevant (all federal student loans are now disbursed with fixed interest rates.) SmartMoney says if you still have variable rate loans you need/want to consolidate, check out the government’s consolidation offering—”You’re likely to pay the same consolidation rates you’d pay if you did so with Sallie Mae,” they write.