A nationwide study by non-prof group Consumer Action found rising trends for credit card rates and fees. Compared to 2005

banks

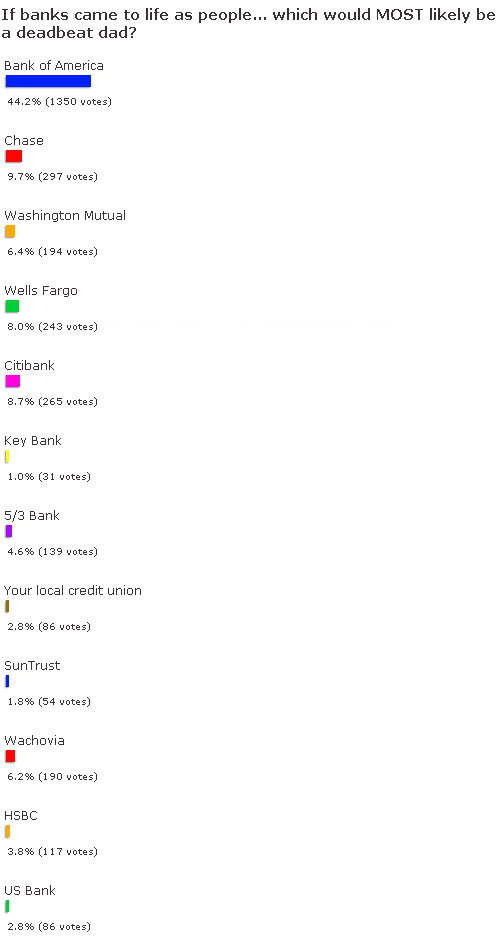

If Banks Came To Life, 42% Of Our Readers Say Bank Of America Would Be A Deadbeat Dad

3052 people voted and it’s clear. If banks came to life as people, 42% of Consumerist readers vote Bank of America would most likely be a deadbeat dad. Props to commenter nerodiavolo, whose comment helped prompt a survey so incisive, Gallup rose from the dead and baked us a cake last night.

Don't Let Crunch Gym Crunch Your Bank Account

The following is reader David’s consumerist report on how Crunch Gym stole from his bank account and how he made the bastards pay, a process akin to squeezing sweat from a stone.

If Banks Came To Life…

Gawker Media polls require Javascript; if you’re viewing this in an RSS reader, click through to view in your Javascript-enabled web browser.

Run Away, Banks Are Coming To Life As People

If one of these brands came alive, which would duck out of helping you move? Which one would take your last beer? Which would get your girlfriend to cheat on you? Which would point you out as a kulak to the Red Army?

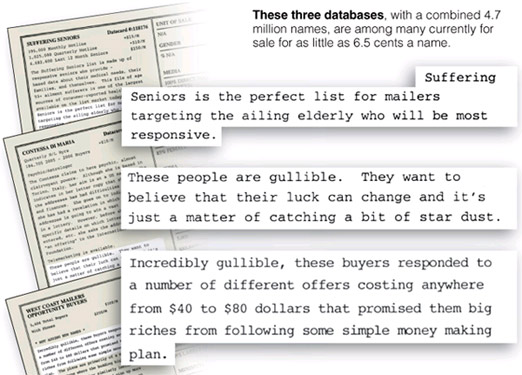

infoUSA Calls "Unfair" NYT Article About How It Marketed Lists Of "Gullible" Seniors To Known Scammers,

Instead of atoning for their sins and begging for forgiveness, infoUSA, the firm that knowingly marketed lists of “gullible” seniors to known scammers, opted for a path of childish and defensive rebuttals:

Banks Make $50 Billion A Year From Fees

Things seems to have gotten out of hand when banks are raking in $50 billion a year just from service charges, MSN reports. Consider how banks maximize over-draft charges:

In recent years, changes in federal laws have all but eliminated “float” — the time it takes for a check to clear from the writer’s bank account. What used to take days now often takes hours or less. What hasn’t been speeded up is the time it takes for deposits to clear and be available for your withdrawal.

In other words, your money goes out faster than ever, but comes in as slow as ever. Which leads to… overdrawn checks. Which leads to… nice, juicy bank fees.

infoUSA Marketed Lists Of "Gullible" Seniors To Known Scammers, Wachvoia Processed The Unsigned Checks

Global rings of crooks are stealing the bank accounts of thousands of the elderly, using lists of names and phone numbers sold to them by corporate America, NYT reports.

Bank of America Randomly Gives You $400, Takes It Away, Then Charges You For 9 Overdrafts

Oh, Your Mom Might Know Your PIN? Then You're Not Getting Your $300 Back

Samantha, pictured holding a log more customer friendly than Capital One, had $300 stolen from her Capital One account, even though her debit card was still in her pocket. When she filed a claim with CapOne, not only did it take numerous contradictory phone calls with employees not knowing their ass from their elbow, her claim was denied. Why? Because she said on her claim form that her mother might know her PIN. Oops.

Support The Credit Card Act Of 2007

The Credit CARD Act Of 2007 is a bill currently before Congress aiming to end some of the credit card industry’s anti-consumer practices. Among H. R. 1461’s proposals:

Chase Switches Me To Paperless Billing, Without My Consent, Then Charges Late Fees

Is Chase enrolling customers in paperless billing without their consent and then charging them late fees when they fail to pay? That’s what seems to have happened to Jack, who writes:

Contact Keybank Executive Relations

If you have an issue with Key Bank that you’re trying to get traction on, and you’ve exhausted normal customer service routes, try calling their executive relations line:

Beware Address Fraud

Identity thieves can take over your accounts, just by swapping their address for yours with your financial institutions. Banknet360 elucidates how this works:

Oh, You Use Quicken Or Microsoft Money? That'll be $5.95 Per Month

Wachovia is charging customers a $5.95 monthly fee to access their accounts through Quicken or Microsoft Money. The fee, which took effect April 1, aligns Wachovia with the 27% of banks that penalize consumers who access their accounts through money management software.

Never Try To Game The Float. Ever.

Used to be with check that you could count on there being at least 3 days between someone cashing your check and the charge being run on your account. The delay is called “float” and writing a check before you have the money but think you’re going to deposit enough is called “gaming the float.”

3 Bank Laws You Need To Know

My Mint has three important banking regulations every banking customer should know about.