../../../..//2008/02/29/bad-consumer-if-you-decide/

Bad Consumer: If you decide to rob a bank, then feel bad about it later, apologizing and returning the money won’t keep you from going to jail. Just ask Catherine Kaczazanowski. [NBC4]

Thanks for visiting Consumerist.com. As of October 2017, Consumerist is no longer producing new content, but feel free to browse through our archives. Here you can find 12 years worth of articles on everything from how to avoid dodgy scams to writing an effective complaint letter. Check out some of our greatest hits below, explore the categories listed on the left-hand side of the page, or head to CR.org for ratings, reviews, and consumer news.

../../../..//2008/02/29/bad-consumer-if-you-decide/

Bad Consumer: If you decide to rob a bank, then feel bad about it later, apologizing and returning the money won’t keep you from going to jail. Just ask Catherine Kaczazanowski. [NBC4]

We’ve talked about this issue a few times here on Consumerist and now the New York Times has gotten into the act with an article about people who’ve chosen use the new service “You Walk Away” to let the bank take over their mortgages after their homes turned out to be bad investments.

If you live in the New York Metro area, tune into NBC channel 4 like right now to see a followup on the widespread HSBC fraud story we broke. They interview Corey, the fiance of Emily, a Consumerist reader and HSBC fraud victim. WNBC tells us that the FBI said they they were generally aware of fraud in the area, but not this specific HSBC matter, and will be looking into the case. It’s par for the course that the bank would be more interested in avoiding bad publicity quiet than going after the scammers stealing your money. UPDATE: Just watched it, HSBC is saying that a credit card payment processor lost the customer data and so other banks could be affected too. However, when WNBC contacted other banks, Chase and Citi said they had not heard of missing money, Mastercard said they have not issued a system-wide alert, and VISA said they’re looking into it.

HSBC confirmed that thieves stole card payment data from the bank and they were reissuing 6,000 atm/debit cards to customers affected by the breach. One Consumerist reader, Keith, had $2000 stolen from him via an ATM in Bulgaria, and another, Emily, had $2,800 siphoned from her account from ATMs located clear across the country. (Emily also got interviewed on WCBS and we got a mention and a screenshot). Checking the comments section, it looks like 11 other Consumerist readers were affected by the HSBC fraud as well, with a number of the fraudulent withdrawals being made from Montreal and Canada. Sounds like the thieves stole the data, which contained both card numbers and PIN codes, and then cloned ATM/debit cards. If you’re an HSBC customer, might be a good time to change your PIN number.

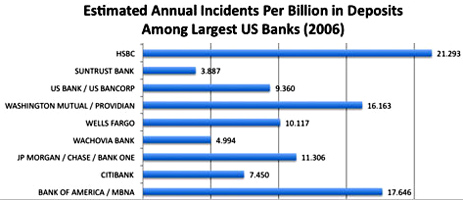

If you’re a customer with Bank of America or HSBC, you’re more likely to be a victim of identity theft, according to a new report. Chris Hoofnagle, a senior fellow at the Berkeley Center for Law and Technology at the University of California at Berkeley, compiled a list of all the banks mentioned in identity theft complaints filed with the FTC for January, March and September of 2006. Bigger banks obviously have more incidents, so Hoofnagle factored in their total number of deposits.”I’ve been working for years to try to spark a market, a true market, for competition on preventing fraud,” Hoofnagle told the NYT. “Some of these institutions have attempted to compete based on advertisements, but I’m a real believer in the idea that if you give consumers information, they can make better decisions.” This is only a fraction of the banks included, showing the worst offenders. Full graphs, inside…

Analysts estimate that 50 out of the nation’s 7,500 small and midsize banks will fail in the next 12 to 18 month, due to defaults on commercial real estate loans. The best quote in this NYT article comes from Timothy W. Long, head of supervision for midsize and community banks at the office of the comptroller, “I would tell you a lot of bankers out there have never had a loan charged off…The last time we went through this, the loan officers were in junior high.”

Rob writes:

I was the recipient of an international wire transfer into my Netbank Checking Account for $1000 EUR (about $1400 US) on 2007-08-08. After I noticed the amount didn’t post to my account, I contacted Netbank and the sending bank in Spain. The sending bank generated a multi-page “proof of transfer” document and indicated the money had been transfered. Netbank never got back to me. This began the 7 month nightmare of dealing with an inattentive bank in the middle of it’s being seized by the FDIC that continues to this day.

Pictured: CEO Arkadi Kuhlmann perched atop his Harley-Davidson in the ING-Direct company lobby.

Donald writes:

First and foremost i would like to thank you for the wonderful site. The information found here has been extremely useful. With that said i just want to share with you a success story i had with getting Bank Of America to lower the interest rate on my Apple GoldReserve Line of Credit. This story does not start out so nicely though.

There was a NYT op-ed last week, “Go On A Savings Spree,” suggesting that, as opposed to the tax-rebate stimulus, the best way to heal the economy is for the government to create universal mutual funds for every tax-payer. At one point, author Dalton Conley writes, “Some research suggests that asset-holders behave more responsibly and are more civic-minded than those without wealth. After all, they have a stake in the future of the economy and their community…Investing motivates people of all income levels to defer gratification and become knowledgeable about the economy and society.”

Reader W writes in in response to the so-called “retail manager” who said that credit card companies require video proof of cashiers checking ID.

../../../..//2008/02/19/bank-of-america-still-isnt/

Bank of America still isn’t giving customers, and now, reporters, a straight answer when asked why they’ve been jacking up people’s interest rates to 23, 29%. [Star-Telegram]

../../../..//2008/02/19/banks-are-quietly-borrowing-massive/

Banks are quietly borrowing massive amounts of money from the Federal Reserve. Some people find this worrisome. [Reuters]

Everyone with an ATM card is used to paying withdrawal fees when using another bank’s ATM and it’s no big deal, it’s only a buck or so, and the ATMs are so convenient. If that screen said, “This ATM will charge you $4.75 to withdraw money,” you might look around to make sure you hadn’t accidentally stepped into a casino or strip club. But since many banks charge you an extra per-transaction punishment fee for using another bank’s ATM, that’s exactly what’s happening. You just don’t notice because it gets lumped together into one ATM fee on your bank statement. Not only that, but these fees are slowly and steadily on the rise, as seen in this NYT graph. Average ATM surcharges by “other banks” have gone up from $.75 to $1.75 from 1999 to 2007. Average punishment fee for cheating with another bank’s ATM has gone from $2.00 to $3.00 in the same period. Obviously, one way to beat the fees is to only visit your bank’s ATMs. Another is to bank with a place like USAA, which refunds other bank’s ATM surcharges. Any other solutions out there for ending the fee spree?

– About the WaMu Free Checking, yes it is a different “free” checking account. We just came out with the “WaMu” part about a couple of years ago, so if you have any “free” checking account older than that I suggest you change it to the newer one.

Keith writes:

On Friday February 15th I called HSBC customer service. I explained that there was a $1,000 difference between my “Bank Balance” and I was concerned because I hadn’t used my ATM card. They said that the money was “on hold.” They could give no further explanation. I pressed them and said “How is it possible that $1,000 of my money is out in space” They had no reply. I asked to speak to a supervisor to which the person I was speaking to refused and said “They have the same information I do and they are not available.” I was talking to outsourced “customer service reps” from the Philippines so I hung up and dialed 716.841.7212 again. I kindly explained my store from scratch to Helga REP # 6124, also in the Philippines, not Buffalo, NY. She said the same thing as the guy before (at least they were consistent), and refused to let me speak to a supervisor.

Just because we posted the internal US Bank memo saying that customers could turn off courtesy overdraft protection doesn’t mean that the rest of the US Bank employees got it, or read it. Here’s what happened to Jason when he tried to get it turned off:

More about Bank of America’s inexplicable rate hikes against good customers who never pay late: the Charlotte Observer talks to some recent recipients of BoA’s infamous rate-increase letters from the past few weeks. The first person they talk to is a 60-year-old woman who “had never been late on a credit card payment, just refinanced her home at a lower interest rate, and just been rewarded by her credit union with a lower rate on her credit card there.” Bank of America just raised her card from 13% to 24.99%.

![]()

Part of ![]()

Founded in 2005, Consumerist® is an independent source of consumer news and information published by Consumer Reports.