After hearing about Hannaford’s giant customer data breach yesterday, Brian decided to cancel the debit card he’d used there. That’s when he found out that Key Bank really wants you to have a debit card. In fact, they’ll charge you a small monthly fee to not have one linked to your “free checking” account. We figure that this means Key Bank makes about $12 a year more off of customers who have linked debit cards—and that if you want greater security on your account, it’s going to cost you.

banks

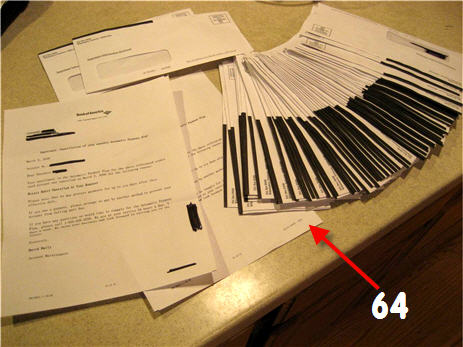

Bank of America Sends You 64 Identical Letters

Reader Ted writes:

Love your website. I’ve been a fan for quite a while. I finally have a story of my own to add. A couple of weeks ago I called BofA to cancel the Automatic Payment Plan on my BofA Visa. I was taking advantage of a 0% balance transfer offer. The autopay plan would have paid off the entire balance in full at the end of the month. Today I received 64 individual and identical letters from BofA confirming the change to my account.

Switched To Fee-Free ATM Withdrawals

I’m sick of paying ATM fees so I just finished switching to my USAA debit card for my cash money needs. They refund up to $15 of ATM fees per month and don’t charge you any fees for using other people’s ATMs. I’m still keeping my WaMu account but I took my WaMu debit card out of my wallet and just funded my USAA account with some money. Not that I have a problem but I think this will also help reduce petty cash spending. Plus, by using cash more often that means I’m getting more change, and all my coin change goes into my piggy bank (60% full at the moment, looking forward to the day I take it to the Commerce Bank “Penny Arcade” coin-counting machine). With the specter of a recession giving us all wet willies, are you making any changes to your personal finance system?

FDIC Call Center: Former Employee Says It's A Great Place For Bank & Credit Union Info

A former FDIC employee writes that the FDIC’s call center (877-275-3342) is “a tremendously helpful place to get basic referral information if you’re having trouble with your bank, lender, or finance company.” They can’t help you with complaints, but they can route you to the correct agency, provide credit union contact info, and give you the names and numbers of state agencies where your bank is located.

Bank Of America Refunds $325 In Overdraft Fees To Customer Who Was On Cruise

Don’t say we never printed anything nice about you, BoA. One of your customers just had an experience with you that—despite still having an overdraft fee of $20 to pay—has left her feeling pretty good about you.

If You Are Planning To Die Soon, Avoid Bank Of America

Because Marc B. hadn’t used his account for a few years, Bank of America decided he must have died, and froze his account. Then they started charging a maintenance fee, which eventually overdrew his account. Full email inside.

WaMu Rewrites Executive Bonus Plan To Avoid Subprime Meltdown Responsibility

The Seattle Times reports that Washington Mutual has revised its executive bonus plan so continuing fallout from the subprime meltdown won’t affect their annual bonus checks. In a regulatory filing on Monday, the bank moved to exclude the cost of bad loans and expenses arising from foreclosures when calculating net operating profit. By way of explanation, “Spokeswoman Libby Hutchinson said the bonus plan covers almost 3,000 WaMu executives, many of whom are not directly involved in lending,” writes the Seattle Times. When those subprime raping dollars were rolling in, did any of these same executives object that their bonuses was being unfairly pumped by profits not coming from their department? (Pictured: CEO Kerry Killinger, looking clever)

Check Your Credit Card For Fake Charges From "Ich Services"

Check your credit card statements for fraudulent charges from a company called “ICH Services,” reports KETV. They’re defrauding consumers across the country at $9.95 a pop with unwarranted credit card charges. If you notice it on your bill, call up your credit card company or bank and dispute the charge. And since your information is now in the hands of criminals, you may want to close down the account and get a new card while you’re at it.

"I Lost My Deposit Slip, And PNC Says There's No Record Of My Deposit"

Nicholas wrote in with a scary problem: his paycheck, which he deposited at his local branch of PNC on Saturday, never showed up in his bank account. The teller seemed to have difficulty processing the deposit, but the slip he gave to Nicholas showed the check had been processed.

../../../..//2008/03/08/heres-a-free-idea-for/

Here’s a free idea for the taking: why doesn’t a bank (cough HSBC cough) offer the option to have text message alerts sent to a registered phone number any time a withdrawal is made from a specific account via ATM? “$120 was withdrawn at 2:51pm EST in Palo Verde, CA. Reference #293005” See how easy that was? Such exception-based reporting would drastically cut down on fraud (we’re guessing) by enlisting the help of customers to report unauthorized transactions immediately.

You'd Better Know Your Balance, Because WaMu Certainly Doesn't

“Keep track of your bank balances!”—pretty much every week on Consumerist either we or our readers say something like this.

In Breach Of Federal Law, Banks Hide Fees

The Red Tape Chronicles reports bank fees are so hard to find that even the government can’t find them. A recent investigation by the Government Accountability Office released this week couldn’t find the fee schedules at 1/3 of the nation’s banks. Not only does this make comparison shopping impossible for the consumer, they’re breaking federal law, the 1991 Truth in Savings Act and Federal Reserve Regulation DD, which requires fees to be posted clearly and conspicuously. Violations are rarely punished with any severity, meaning, as Red Tape Chronicles writes, “it’s far more likely that you’ll get a parking ticket for breaking parking rules outside a bank than it is the bank will be fined for disobeying federal lending laws.”

Contact Washington Mutual CEO And Friends

Got an intractable Washington Mutual issue that regular customer service can’t solve? Try kicking it up to some of these bigwigs:

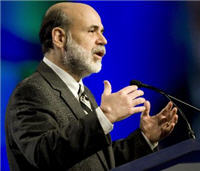

Fed Chairman Asks Banks To Forgive Mortgage Debt

Fed Chairman Ben Bernanke is urging lenders to “forgive portions of mortgage debt held by homeowners at risk of defaulting,” says Bloomberg.

Motivational Company Waterboarded Employees?

Motivational coaching company Prosper is the subject of an unusual lawsuit: “A supervisor…is accused of waterboarding an employee in front of his sales team to demonstrate that they should work as hard on sales as the employee had worked to breathe.” C’mon team, let’s Gitmo sales! [Salt Lake Tribuine]