While French President Nicolas Sarkozy has been posturing as an international leader during this time of global financial crisis, thieves have been raiding his online bank account, withdrawing small amounts over an extended period of time. Just goes to show that identity theft can happen to anyone, whether or not you’re important enough to have people Photoshop your love handles away. For best protection, install and keep up to date a good security program, like ESET. Only log into your bank from the main URL, never click on a link in an email that appears to be from your financial institutions. Use usernames and passwords that are a string of random letters and numbers. Write them down and hide it in a secure place, not inside of a fresh hot pain au chocolat.

banks

10 Things That Are Going Right For Consumers

Kiplinger’s is more optimistic than we are, so they had the cheerful idea to put together a list of 10 things that are going right for consumers — despite the financial apocalypse. Hooray!

Treasury Expected To Pump $250 Billion Into Banks In Exchange For Stocks

The Treasury Department is expected to announce that it will be pumping $250 billion into banks both large and small tomorrow… and the FDIC is expected to offer an unlimited guarantee on bank deposits in accounts that do not bear interest.

The Bailout Bill Helps Renters Keep Their Homes

Great news for renters facing eviction due to foreclosure: any mortgage owner seeking assistance under Congress’ mammoth bailout bill is required to let paying renters stay in their homes.

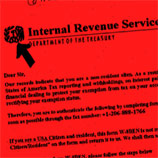

Fake IRS Fax Demands Your Bank Account And Passport

Nick has written in to warn us about a fake IRS scam that lately has been targeting nonresident aliens (e.g. teachers and researchers) working in the U.S., as well as American citizens working abroad. In the scam, which has been going on since at least 2002 (pdf), the target receives a faxed request from the IRS to provide his name, SSN, and pretty much every other bit of data you’d need to take over a person’s financial identity.

Wells Fargo Wins, Will Buy Wachovia

Wells Fargo is the winner in the battle for Wachovia, says the New York Times. Apparently, Citibank became nervous about splitting the bank when they saw the size of the “bad assets” it would have to take on, and quietly walked away. The bank will continue to seek $60 billion in damages, however.

What Are "Collateralized Debt Obligations?" Watch These Champagne Glasses.

There’s a lot of funky financial terms getting thrown as we try to explain how the money meltdown started in the first place, and one of the funkiest is a CDO or “collateralized debt obligation.” Luckily, Paddy Hirsch from Marketplace is here to explain it using just champagne glasses, a whiteboard, and a sexy British accent..

Chicago Sheriff Halts Foreclosure Evictions, Won't Toss Innocent Renters

Cook County Sheriff Tom Dart said he understood he was flouting the law in refusing to have deputies carry out the rising number of eviction requests, but mortgage holders must be accountable.

Government May Begin Buying Bank Stock Within Weeks

As it is now apparent that the credit crisis has spread to the global economy and has not been contained in any way, the Bush Administration is considering an option included in the $700 billion dollar bailout package that would allow them to invest directly in banks — buying preferred stock in exchange for a “cash injection.” White House spokesperson Dana Perino said taking partial ownership of banks and other moves associated with the financial rescue plan would not be “part of [Bush’s] natural instincts,” according to the NYT, but acknowledged that the situation has gotten sufficiently dire as to warrant a change of heart.

Don't Keep Your Money In A Shoebox, Or At Least Don't Pose For A Photo With It

Thanks to the New York Post, we know there’s a 48-year-old man named Richard Cruz somewhere in Manhattan who’s hoarding his daughter’s college fund in a shoebox. We even know what he looks like, because in the photo that accompanies the article, Cruz is posing on the sidewalk with his withdrawn cash like he just won the shoebox lottery. “‘No one hides their money under a mattress any more,’ he said. ‘That’s the first place people would look.'” Good thinking.

Iceland Is Screwed

The Icelandic government seized the nation’s largest lender, Kaupthing Bank. “Effectively the krona can’t be traded at the moment because there are no more banks to clear the trade,” a foreign-exchange trader told Bloomberg. Things have gotten so bad there that Bjork was forced to take out a second mortgage on her collection of screaming children made of glass hiding under a field of sugar.

Banks Compete For Your Deposit At Moneyaisle.com

Saw this site, moneyaisle.com, where banks compete with the best rate to get your business in a high-yield savings account or a CD. Sounded interesting, so I tried it out. I said I had $5k to deposit. The best rate they had was 3.51%. In less time it took for that rate to load, I went to Bankrate.com and found a place – yes, the banks on both sites are FDIC-insured – offering 3.91%, and only requiring a $1000 deposit. FAIL.

Financial Crisis Grips Earth

Just when you thought you were beginning to barely understand the financial cancer destroying America, it metastasized. Now it’s global.

The Economist Sums Up Financial Crisis: "Oh Fuck!"

If you feel at a loss for words to describe the now global financial cover, this spoof cover floating around the internet for September’s Economist says it all: “Oh fuck!” Download the large version, suitable for framing or desktop wallpaper, inside…

Reader Pays Off $14,330 In 20 Months With Our Tips

Stuck in a $14,300 debt hole, reader Trixare4kids was able to dig herself out using tips she learned about on Consumerist.com. Let’s learn how she attacked her personal finances and learned to live frugally, and did it all in 20 months.

A Blacker Monday

The Dow is down over 800 points, and the day isn’t even over. This beats last week’s all-time record of 777 points. A global credit crisis is in full swing, with versions of what just decimated Wall Street repeating itself across Europe as governments swoop in with bailouts of high-profile banks. Verily, blood is in the streets. Hm, what’s that old saw? Oh. Right. Buy when there’s blood in the streets.

Consumer Spending Will Shrink For The First Time In Nearly Twenty Years

Consumer spending, the engine that powers our economy, is probably going to shrink for the first time in nearly two decades, says the NYT — a move that will “all but guarantee” that the current economic crisis will deepen.