Getting into debt is easy. Winding up in default is easier yet; all you have to do is not pay your bills for several months! So how do you deal when the lender doesn’t want to wait around for you any longer and has moved on to more drastic action? Here’s three ways, only two of which are advisable.

bankruptcy

Chrysler Will Enter Bankruptcy, Partner With Fiat, Warranties Backed By US Government

President Obama announced today that Chrysler would seek bankruptcy protection and enter into an alliance with Fiat. The president told reporters that a “small group of speculators” made up of hedge funds and other investors held out in the hopes that the US government would bail them out. That didn’t happen.

../../../..//2009/04/30/president-obama-is-expected-to/

President Obama is expected to speak at noon to announce the fate of Chrysler. The New York Times says, “Last-minute efforts by the Treasury Department to win over recalcitrant Chrysler debtholders failed Wednesday night, according to people briefed on the talks. Barring a last-minute agreement, Chrysler was expected to seek Chapter 11 protection, most likely in New York, these people said.” [NYT]

Time Is Running Out For Chrysler! Bankruptcy "95% Certain"

With a week to go before the deadline runs out on Chrysler’s bailout — it’s looking less and less likely that the automaker will be saved from liquidation.

General Motors Defaults, Idles Plants

General Motors is projected to default on its next bond payment—the last before the June 1st government-imposed restructuring deadline. Next freeway exit: bankruptcy.

Chrysler Financial Accused Of Turning Down Government Loan To Avoid Executive Bonus Restrictions

The Washington Post has just published a story accusing executives at Chrysler Financial of turning down a $750 million government loan because they “didn’t want to abide by new federal limits on pay,” and instead opted for more expensive private sector financing, “adding to the burdens of the already fragile automaker and its financing company.” Chrysler Financial denies the charge.

Leave Off The Last "S" For Bankruptcy

Dial-a-Mattress, known for its “leave off the last ‘s’ for ‘savings'” jingles, has filed for bankruptcy and intends to sell itself to Sleepy’s, says the NYT.

Is Borders About To Go Under?

Yesterday’s post about Borders closing down its unprofitable CD and DVD sections prompted a tip from the owner of a small music label. He says his distributor has already cut off shipments to Borders once for nonpayment (in November 2008), and on Monday the distributor warned labels that they’ll have to agree not to hold him “liable on any future shipments to Borders in case they file for bankruptcy.” Borders’ CFO left in January, which is rarely a good sign for a troubled company. And this morning, the Detroit Free Press notes that the bookseller is facing being delisted from the New York Stock Exchange. We may not have to wait long to find out; CEO Ron Marshall is hosting a conference call with analysts and investors next week.

GM To Taxpayers: Bail Us Out Or We'll Liquidate

With two weeks to go before the government deadline to approve GM’s restructuring plan, the AP says that GM’s CEO Rick “The Station” Wagoner told the press that if GM is allowed to go into bankruptcy, it will simply be liquidated.

The Photograph That Pretty Much Sums Up Circuit City

Reader Adrian emailed this photo of the Circuit City in St. Peters, MO.

Blockbuster's Stock Nosedives On News It Is Investigating Bankruptcy

Blockbuster’s stock just dropped 79% this afternoon after Bloomberg published a story that said the company hired the firm Kirkland & Ellis “to evaluate restructuring options, including a possible pre-packaged bankruptcy.” Blockbuster says they’ve only hired the firm for “refinancing and capital raising initiatives,” and that they do not intend to file for bankruptcy.

DirecTV Owner Swoops In To Save Sirius From Bankruptcy

Liberty Media, the owner of DirecTV, has swooped in at the last minute to save Sirius from certain bankruptcy. Liberty will invest a $530 million in the form of loans to the satellite radio company, $175 million of which will go to paying debt that comes due for Sirius today.

Peanut Corp Has Gone Out Of Business

It was bound to happen, and it looks like it just did: Peanut Corporation of America has filed for Chapter 7 bankruptcy, and will liquidate its assets to pay off creditors.

Sirius XM May Be Preparing for Bankruptcy

According to the NYT, Sirius XM owes $175 Million by the end of February and it may not be able to pay up. Bankruptcy may very well be in the cards for the Satellite Radio super-organism. The article cites a failure to “to win over many younger listeners” and the general economic downturn.

Bankruptcy Is A Last Resort

Bankruptcy is not a get out of jail free card for your debts, it’s a nuclear weapon. If you use it, expect to be considered credit unworthy for a decade.

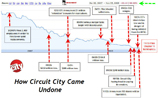

GRAPH: The Decline And Fall Of Circuit City

Liquidation is a time for reflection, we guess, so we put together a nice little time line of Circuit City’s precipitous decline over the past 2 years. We begin our journey in March of 2007, when Circuit City announced that it was firing everyone who knew what 1080p meant so that they could hire cheaper labor…

Liquidators Are Bidding On Circuit City, Including Gordon Brothers

Although they are accepting offers from buyers who intend to keep the retail operation going — Bloomberg reports that Circuit City is taking bids from liquidators — including the notorious Gordon Brothers (of CompUSA fame.)

Two More Retail Bankruptcies, Goody's And Gottschalks

Gottschalks, a regional department store chain with 61 stores (most of them in California) has filed for Chapter 11 bankruptcy, but will continue to operate as usual. Goody’s a clothing retailer that emerged from bankruptcy in October, however, has failed and will be liquidated.