Between the rise of e-commerce, credit/debit card use, and mobile payment platforms, the days of “running to the ATM” for enough cash to get through the day are gone for many people. That’s one of the reasons why, according to a new survey of banks, out-of-network ATM fees and overdraft charges are hitting new highs. [More]

bankrate

1-In-4 Families Don’t Seek Medical Attention Because Of Financial Worries

With the latest reports suggesting that the American Health Care Act — a budget resolution intended to repeal and replace much of the Affordable Care Act — would leave more than 23 million consumers without insurance and facing higher out-of-pocket costs, it’s no surprise that consumers are a bit uneasy when it comes to their healthcare. In fact, a new survey suggests that in the face of rising costs, some families are foregoing medical care to save a few — or a few thousand — bucks. [More]

Survey: 4-In-5 Consumers Say They Won’t Be Spending More This Holiday Season

Consumer spending this holiday season got off to a rather slow start last month when fewer people hit up retailers over Black Friday weekend. And that trend of spending less likely won’t change in the final few weeks of 2014 if a new holiday spending survey is to be believed. [More]

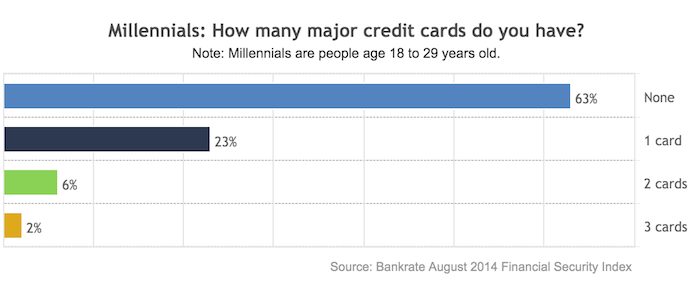

Nearly 2 Of 3 Millennials Don’t Have Credit Cards

Millennials — those Americans currently between 18 and 29 years of age — never really lived in a world without debit cards, when the only way to make a non-cash purchase was to use a credit card or hope the store accepted personal checks. So it may come as little surprise to some that nearly two-thirds of the consumers in this age group don’t have a single credit card to their names. [More]

Despite Lessons From Great Recession, Few Consumers Save For Emergencies

Did consumers learn nothing from the Great Recession? Okay, they learned several things, but putting away for a rainy day doesn’t appear to be one of them. [More]

Study Confirms That Most Of Us Carry Less Than $50 Cash

Sometimes the effort needed to fumble inside my wallet for cash and change just seems too much of a burden. So I rarely use the tender and instead go straight for the debit card. And it appears I’m not alone in my preference for not carrying cash. [More]

Is In-Person Banking Going The Way Of The Dodo?

When I was a child, I remember going to the bank every Friday with my mom. She’d run inside to deposit her paycheck, or pull up to the drive-thru window where the teller would sometimes put a candy in the cash envelope if he or she saw me or my siblings sitting in the car. It’s all very quaint and rose-colored now, but that notion of going to the bank on a regular basis appears to be a thing of the past. [More]

24% APR Crushes Reader To Death

I have a card with one bank (that I am trying my hardest to pay off ASAP) that is 24% APR. It is killing me. A week or two ago, you had an article about a woman who paid off all her credit card debt over the course of 20 months or so. Good for her and it was a good story. One thing about it had me wondering though. She said that she negotiated with her lenders to get lower interest rates on her cards. How do you suggest I do that?

Watch Out For Fees With Gift Cards

Like candy canes and drunken family dinners, gift cards have become a Christmas staple. Bankrate has reviewed a wide number of them and published the results to help you pick the best one for your needs. To avoid fees, you should stick with “closed-loop” cards—that is, a card issued by a specific retailer for use only with that retailer. Almost all retailers now offer cards that don’t expire and don’t charge maintenance fees, with the notable exceptions of Macy’s and Bloomingdales, whose cards both expire two years after purchase. However, several retailers—CVS, for example—still charge “dormancy” fees on cards that have been inactive for anywhere from 6 to 24 months, so be sure to check the fine print to see how this is addressed.

Estimate Your FICO Score For Free

To creditors, you are a walking, talking, three digit number. Creditors use that number, your FICO score, to judge your credit worthiness. A good FICO score can lead to favorable terms, but unless you pay a fee or sign up for a free trial, your score is cloaked in a shroud of secrecy. Until now.