The White House could be planning to start charging banks new fees as a way to trim the deficit, get paid back for the bailout, and teach bankers a lesson they hasn’t sunk in yet. What?! A fee on banks? You’re crazy. Only banks are allowed to make up fees. [More]

bailouts

Citi Getting Out From Under TARP

Citigroup plans to repay $20 billion that it borrowed from U.S. taxpayers through the Troubled Asset Relief Program. That’s good news for Citi execs, who will be able to pay themselves whatever they want once they’re free from TARP restrictions. And it may be good for taxpayers, as long as Citi doesn’t take any of those ultra-cheap Federal loans like BofA did. Citi shareholders? Hey, somebody’s gotta pay for this. [More]

$700 Billion Bank Bailout Extended Until 2010

The administration announced it’s extending the $700 billion financial bailout program until next fall. The Treasury said it’s important to hold onto money and have it available in case any new catasrophes slam our financial system: [More]

Is The Federal Housing Administration Going To Need A Bailout?

Earlier today a former Fannie Mae exec and the current head of the FHA gave conflicting testimonies to Congress about the health of the mortgage insurer—particularly about whether or not it’s going to require a taxpayer bailout in the next couple of years.

FDIC May Ask Banks For Bailout

Due to the record number of bank failures this year, the FDIC is low on funds. Instead of borrowing from the Treasury as they did in the early ’90s savings and loan crisis, regulators have a new idea: asking banks for a bailout.

Bailout Banks Will Keep Using Your Money For Private Jets

Under government pressure — and by “pressure” we mean asking meekly in a very soft voice — companies that have received funding from the taxpayer-funded TARP program have outlined the controls they plan to put in place to limit “luxury expenditures.” And — surprise! — the definition of “luxury” is very different for the corporate titans spending your money. While most big banks have put at least some limits on personal use of corporate jets, many seem to echo Bank of America‘s policies on official use, which state that that execs can use private planes for “safety and efficiency reasons,” no advance approval required.

Welcome To The New Gilded Age, Fueled By Your Money

Remember all of those banks that were “too big to fail” and had to be bailed out? Newsweek’s Niall Ferguson is out with a report today pointing out that a year after the collapse of Lehman Brothers signaled the start of the bailout boom, they’re still big, and thanks to the safety net you tossed them, they’re “back to making serious money and paying million-dollar bonuses. Meanwhile, every month, hundreds of thousands of ordinary Americans face foreclosure or unemployment because of a crisis caused by … a few Wall Street giants.”

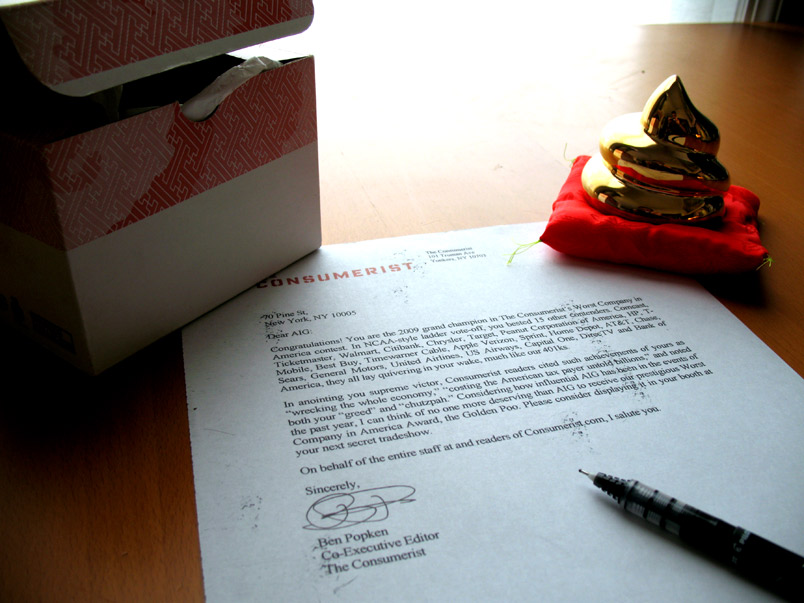

AIG's WCIA 2009 Award Mailed

We put AIG’s Worst Company in American 2009 award in the mail today. Here is the congratulatory letter that accompanied their prize:

6 Things To Know Now Before Buying A GM Or Chrysler Car

With the future uncertain, or at the very least, pretty different from normal, for Chrysler and GM, does it make sense to buy a car from one of these companies? How doe s the restructuring affect you as a potential new car owner? Consumer Reports Online Auto Crisis Center has the answers to six questions every Chrysler and GM car owner will want to know before signing on the line which is dotted.

GM Bondholders Say No To Debt-For-Stock Offer

GM’s debt-for-stock offer to its bondholders expires tonight. The company needs 90% of the bondholders to agree but has a fraction of that, notes CNN, which almost assures a bankruptcy filing in the coming days. We say “almost” because it’s possible the Treasury Department will extend talks with bondholders until June 1st, when GM’s other deadlines hit.

Chrysler/GM Car Glut: Savings Opp Or Nightmare?

To add insult to injury, Chrysler and GM will NOT be buying back vehicle inventory from dealerships that recently received closing notices. Maybe we have two new candidates for Worst Company in America next year! On the other hand, maybe this is good news for consumers. Large inventories + need for quick cash = SALE!

6 Major Banks Fail Initial Stress Tests

6 of the major 19 banks failed the Treasury’s “stress tests” and need more cash as a buffer against losses, according to leaked preliminary results.

Chrysler Financial Accused Of Turning Down Government Loan To Avoid Executive Bonus Restrictions

The Washington Post has just published a story accusing executives at Chrysler Financial of turning down a $750 million government loan because they “didn’t want to abide by new federal limits on pay,” and instead opted for more expensive private sector financing, “adding to the burdens of the already fragile automaker and its financing company.” Chrysler Financial denies the charge.

AIG Keeps Fighting Man Over Wheelchair, Glasses, And False Leg

AIG needs its money for its own problems, people, and doesn’t want to have to share with insurance claimants! That’s why they’ve fought every request from John Woodson, a man who lost a leg, an eye, and 70% of the vision in the remaining eye while working as a contractor in Iraq. He told ABC News, “You constantly are worried about who is going to pay these bills, who is going to take care of me? Because you can’t rely on AIG to come through for you. I don’t understand how a company of their size and their magnitude, with government bailouts and money and support, I don’t understand their not taking care of the individuals that were injured.”

Fannie And Freddie To Pay $210 Million In Retention Bonuses

Fannie Mae and Freddie Mac are preparing to hand out $210 million in taxpayer-funded retention bonuses to 7,600 employees. No bonus will exceed $1.5 million, but more than half of all Freddie and Fannie employees will receive an average bonus exceeding $24,000.

Why AIG Gave Your Money To Other Banks

There’s been a big stink about how AIG has given a bunch of taxpayer money to other banks. Why why why, demand the American people. Well, it’s not like they enjoy shoveling money out the door, wait, scratch that, but anyway, the real reason is because of something called “collateral calls.” Marketplace’s Paddy Hirsch explains the situation with the help of his friends Mr. Magic Marker and Mrs. White Board in this video.