You can’t blame companies that run advertisements on Facebook for being a bit suspicious after the social media platform has acknowledged problems with over-estimating how long users interact with videos and how much time users spend reading Instant Articles and interacting with brand pages. Now the company will submit to an outside audit of that advertising data. [More]

audits

Regulators Investigating Honda Over Inaccuracies In Reporting Injury And Death Claims

Less than two weeks after Honda announced it would begin a third-party audit of potential inaccuracies in providing valuable information regarding death and injury claims to U.S. regulators, the National Highway Traffic Safety Administration has opened its own investigation into the car company’s reporting procedures. [More]

5 Things People Do On Tax Returns That Can Lead To IRS Audits

Can you smell it in the air? That’s the distinct scent of Tax Season approaching. So in these days leading up to everyone’s favorite time of year, here are some reminders about the red flags the IRS looks for when deciding whether to audit a taxpayer. [More]

Ask Tax Dad: Old Clothes, An Audit Dispute, And IRA Rollovers

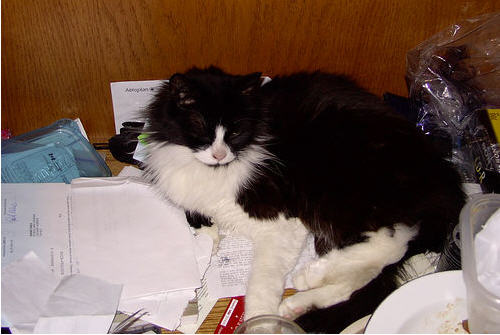

Usually, our staff Certified Tax Cat handles readers’ questions about taxes, but he’s also a cat, and cats occasionally just do whatever the hell they want. Filling in for him is Laura’s dad, a retired accountant and real live independent tax preparer. Exclusively on Consumerist this spring, Tax Dad answers your questions. [More]

Trimmed-Down IRS Staff Means Fewer Audits This Year

We certainly don’t want to give comfort to tax cheats — and we’re not trying to imply that any of our beloved readers are anything less than honest when filing their tax returns — but for those who dread a random audit, there’s some good news: Budget and staff cuts at the IRS will likely mean fewer audits. [More]

Tax Nuances That Could Get You Audited

By most accounts, Internal Revenue Service auditors aren’t much fun to meet with. Even if you’ve filed your taxes with impeccable precision, facing an audit can be nerve-wracking, so you’re best off making sure you aren’t tossing up any signs that draw attention to yourself. [More]

BP Faces Audit Over Spill Compensation

The prizes keep flowing for reigning Worst Company in America champ BP, which not only received the Golden Poo for its spilleriffic efforts, but now gets the pleasure of an independent audit to verify it’s on the up-and-up in terms of distributing the $20 billion oil spill victim compensation fund. [More]

Avoid The Dread Eye Of The IRS Auditor

After The Reaper, second in the line of “those to fear” is the IRS tax auditor. What with his scales and poison fangs and all. But you can dodge his fell gaze if you know the red flags he’s looking for. [More]

Prepaid Funeral Trust Money Used For Conventions And Lobbying, Say Auditors

We’ve said repeatedly that prepaid funeral plans are bunk–the industry is too unregulated to be trustworthy, and it’s far too easy to lose money when you could just as easily set up a savings plan for a funeral on your own. Now there’s news from California that the state’s second-largest prepaid funeral trust was spending money “improperly” on everything from political lobbying to conventions, blowing $12.6 million from the $70 million paid in advance by customers. [More]

Amazon Sues North Carolina, Says It Won't Divulge Customer Names

North Carolina’s tax collectors want to find out which of the state’s residents have bought untaxed goods from Amazon over the past seven years, so they visited Amazon’s HQ in Seattle and demanded the retailer turn over its records. When Amazon said no, the state threatened to sue. What it got instead was a preemptive lawsuit from Amazon that “says the demand violates the privacy and First Amendment rights of Amazon’s customers.” [More]

The IRS Isn't Sure Who They Hired Or Why Your Sensitive Tax Documents Are Filed In Dumpsters

Here are three things you didn’t want to know: 1) The IRS doesn’t always conduct background checks on the employees contracted to handle your sensitive tax documents; 2) Those contracted employees regularly toss your sensitive tax documents into dumpsters without first shedding them; 3) The IRS doesn’t really know who’s in charge of conducting background checks on contracted employees, or who’s responsible for keeping your sensitive tax documents shredded and out of dumpsters. At least that’s what the Treasury Inspector General‘s office uncovered when it audited everyone’s favorite auditors.

Private Food Safety Inspectors Routinely Give Seal Of Approval To Dangerous Food

Large companies routinely rely on private audits to prove that their food is safe even though private auditors are dangerously incompetent, according to a New York Times investigation. The private auditor who inspected the Peanut Corporation of America plant responsible for unleashing the massive salmonella contamination was trained to audit bakeries and repeatedly gave the plant a “SUPERIOR” rating, partly because he “never thought that [salmonella] would survive in the peanut butter type environment.”

TurboTax Doesn't See Anything Unusual About Your $1,635,335 In Moving Expenses

Reader Elijah is glad he gave his taxes a manual check before sending them off. Despite accidentally inflating his cross-country moving expenses from $1,635 to $1,635,335, TurboTax’s audit check said Elijah’s return was “green” — meaning that he was at low risk for an audit. Now, Elijah’s wondering: If $2,000 error on his tax return wouldn’t put him at risk of an audit, what would?

../..//2008/01/19/more-audits-for-all-says/

More audits for all, says the IRS! Especially the rich. 1 out of every 11 millionaires was audited in 2007. The rest of us earning less than $100,000 had only a 1 in 100 chance of receiving the Torquemada treatment. [Mercury News]

13,000 People Are Getting A Surprise Audit!

13,000 lucky Americans will soon receive letters from the IRS explaining that they’ve been selected for a random audit. The hapless participants are rounded up as part of the IRS’ National Research Program, which seeks to explain why the Treasury receives $300 billion less than we Americans collectively owe. A random audit is nothing to fear unless you are a tax cheating yutz.

Middle Class? Get Ready For Your Audit!

If you make from $25,000 to $100,000 dollars, the IRS is much more likely to audit you this year, and those caught cheating can expect to pay about $4,100 more in taxes.

Avoid IRS Audits

WSJ says the IRS is ramping up its audits this year, especially for high-earners. Here’s some ways to duck the ax.

How To: Attract An IRS Audit

Sometimes the best way to avoid something is to know what attracts it. Thankfully, J.D. at Get Rich Slowly has put together a list of suspicious items that will set off an audit flag on your return. Here are a few: