Costco may be very generous with the free food samples and might have a very forgiving return policy, but when it comes to paying with a credit card at the warehouse club, customers have only one option: American Express. But a new report claims that we could be seeing the end of Costco customers being forced to use their AmEx when buying 872 lbs. of steak and enough toilet paper to keep a small nation clean. [More]

american express

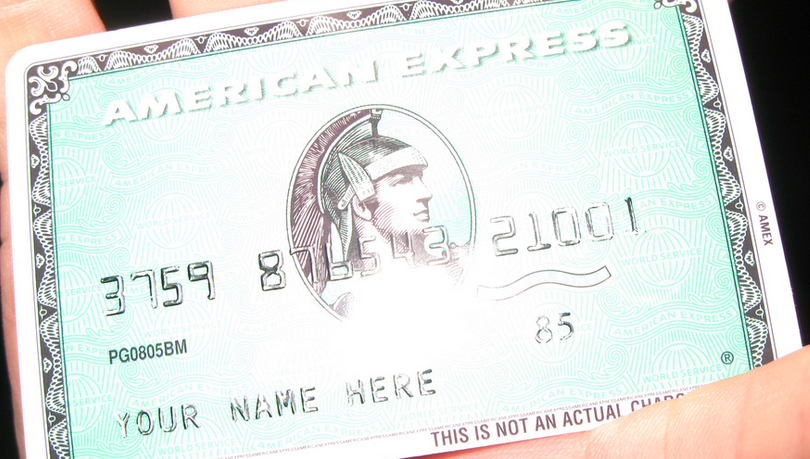

What The Numbers On Your Credit Card Indicate

Over the years, countless people have looked at 16-digit credit card numbers and said things like “Why do they need so many numbers? It’s not like there are 9.999 quadrillion bank accounts out there.” Well, that’s true. But the numbers on your card aren’t just about how many accounts or cardholders exist. They also indicate information about your card issuer, its network and tells processors whether or not the number is valid. [More]

Study: Credit Card Applications Becoming More User Friendly, But Still Lack Valuable Informaton

Credit card companies love to advertise all the perks of being a cardholder — rewards points, cash back, airline miles, etc. — but card issuers have historically hidden the not-as-good stuff in the fine print of card applications. A new study finds that banks are doing a better job of making things more transparent — but not about everything. [More]

10 Answers To Credit Card Questions We Get Asked All The Time

Credit cards come with a lot of fine print. But the scene isn’t just complicated for cardholders; it’s complicated for the retailers that accept them, too. What needs signing, and what doesn’t? When can a store ask for ID? Are they allowed to charge different prices for cash and credit? [More]

Legal Battle Between American Express & DOJ Could Change Credit Card Purchases As We Know Them

A four-year battle between American Express and the Justice Department comes to a head today in court, and the outcome could bring significant changes to the credit card industry. [More]

Capital One Is The Most Complained-About Credit Card Company

Since the Consumer Financial Protection Bureau opened its credit card complaint portal in Sept. 2010, more than 25,000 complaints have been filed with the CFPB. And while the 10 largest credit card issuers account for 93% of all those complaints, one company is responsible for more than 1-in-5 of all complaints filed with the Bureau: Capital One. [More]

American Express To Refund $59.5 Million Over Bad Billing & Deceptive Marketing

About 15 months after getting slapped around by the Consumer Financial Protection Bureau to the tune of $112.5 million for a variety of bad business practices, the CFPB put another huge lump of coal in American Express’s Christmas stocking, spanking the credit card company for nearly $70 million, including $59.5 million in refunds to customers. [More]

Hackers Steal Info About LeBron James, Donald Trump, Lawmakers From Car Service Site

A company that handles car service and limo reservations for the rich and famous has found itself the victim of a massive hack that exposed information, including some high-limit and no-limit credit card numbers, for 850,000 clients, including some of the world’s wealthiest athletes, business executives, and influential lawmakers. [More]

Supreme Court Deals Another Blow To Consumers, Lets Companies Use Forced Arbitration To Skirt The Law

The Supreme Court has once again ruled that forced arbitration clauses in contracts are enforceable, and that they can be used to preempt class-action lawsuits, even in cases where class-action suits are the only economically feasible way for the plaintiff to make its case. [More]

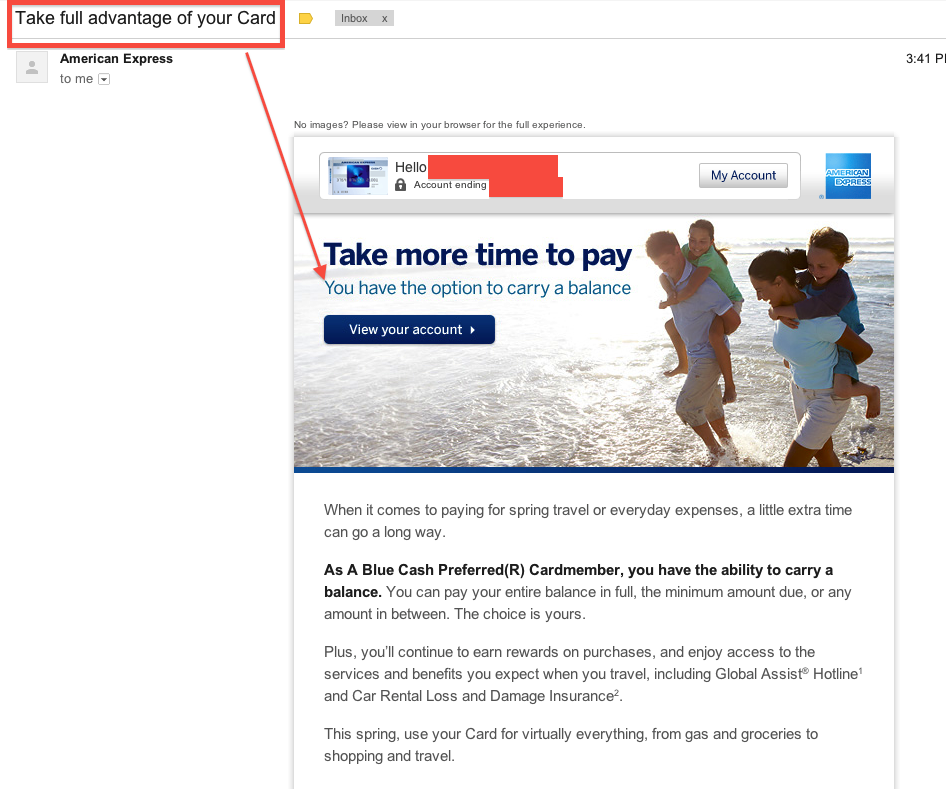

American Express, Where Carrying A Balance With An 18% APR Is A Perk

Forget airline miles, cash back, rewards points, or any of that rubbish. American Express wants you to remember that the best way to take full advantage of your card is to carry a balance. [More]

Supreme Court To Decide Whether Companies Can Use Forced Arbitration To Skirt Federal Laws

It’s been nearly two years since the Supreme Court slapped U.S. consumers across the face, ruling in AT&T Mobility v. Concepcion that companies could take away customers’ rights to class-action lawsuits by including a tiny arbitration clause in user agreements. Today, SCOTUS hears another arbitration case that could shift the balance even further in favor of corporations. [More]

Now You Can Buy Stuff With A Tweet: Amex’s Twitter Sync Turns Hashtags Into Cashtags

Last year American Express launched its “Amex Sync” integration, where customers could link up their credit cards to Twitter and get discounts on certain items by way of special offers sent out on the social network. And now the two companies are turning hashtags into dollar signs with a joint venture that allows users to buy certain items simply by hashtagging tweets. [More]

How Do Different Credit & Debit Cards Stack Up In Terms Of Consumer Protection?

We’ve mentioned any number of times how federal laws offer more protection to consumers who make purchases with credit cards because $50 is the most you can be held responsible for a fraudulent purchase, while the sky could be the limit with debit cards. But how do the various networks compare? [More]

Watch Your Credit Card Statement: Refunds Arriving Soon From AmEx, Capital One, Discover

Getting money back from a credit card issuer doesn’t happen every day, so plenty of Discover, American Express and Capital One customers are in for a treat in the form of refunds hitting their accounts soon. Those three companies were ordered to pay up a total of $435 million to almost six million customers after the Consumer Financial Protection Bureau took action against deceptive credit card practices. [More]

American Express Tries To Sneak Forced Arbitration Clause On Users, Gives Until Feb. 15 To Opt Out

It’s the hot new trend in business: Forcing customers into binding arbitration that take away their rights to sue as a group. The latest to latch onto this trend is American Express, which did its best to hide the clause on the final pages of their statements, but which is also giving them until Feb. 15, 2013 to opt out. [More]