AIG has been repeatedly called on the carpet over the past week or so for indefensible “business as usual” expenditures—a lavish corporate retreat, an executive hunting trip, and severance packages costing tens of millions of dollars. Now, after a meeting with NY Attorney General Andrew Cuomo, they’ve announced they’ll start trying harder to monitor and stomp out unnecessary expenses.

aig

AIG Says It Will Try Harder To Cut Costs, Begins By Canceling $10 Million Severance Package

AIG Executives Help Themselves To $86,000 Hunting Trip

The AP is reporting that AIG executives aren’t done partying yet — they took an $86,000 hunting trip even as the company was requesting an additional $37.8 billion loan from the Federal Reserve. Meanwhile, New York attorney general Andrew Cuomo has said that as long as the company continues to be propped up by the taxpayer — he has the power under state business law to review and possibly rescind any inappropriate AIG spending.

What Are "Collateralized Debt Obligations?" Watch These Champagne Glasses.

There’s a lot of funky financial terms getting thrown as we try to explain how the money meltdown started in the first place, and one of the funkiest is a CDO or “collateralized debt obligation.” Luckily, Paddy Hirsch from Marketplace is here to explain it using just champagne glasses, a whiteboard, and a sexy British accent..

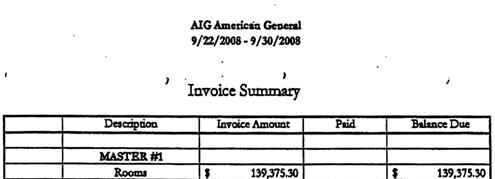

Backlash: Outrage Forces AIG To Cancel Second Pricey Hotel Party

AIG has decided to cancel a second pricey hotel party for their brokers after receiving another loan from the Federal Reserve for $37.8 billion dollars. AIG defended throwing a $400,000 week long bash for its top independent insurance agents and some AIG employees immediately after the bailout — claiming that these events were “standard industry practice” and that they must continue. They announced that they would go ahead with another event at the Half Moon Bay Ritz-Carlton in northern California. 50 AIG employees were expected to attend.

Confronted With Hotel Bills, AIG Says, "This Is Totally Normal!" And "We're Having Another One!"

AIG says that the “retreat” that ABC News reported on the other day was really just an event for AIG’s top independent agents — and that only 10 employees were present out of 100 attendees. Here’s how they explain in a press release:

After The Bailout AIG Bought Themselves A $440,000 "Retreat" At A California Resort

Now that AIG has been nationalized, some folks are wondering just how their tax dollars are being spent. If you’re among them, we have some bad news for you from ABC. They are reporting that papers uncovered by congressional investigators show that “less than a week after the federal government committed $85 billion to bail out AIG, executives of the giant AIG insurance company headed for a week-long retreat at a luxury resort and spa, the St. Regis Resort in Monarch Beach, California.” Ouch.

FBI Investigating Failed, Bailed, Financial Firms

The FBI has launched a fraud probe into Fannie Mae, Freddie Mac, Lehman Brothers and AIG. Sounds kinda like a move to placate the masses. “We’re on it.” No doubt in response to the seething outrage sweeping the nation over the size and audacity of the bailouts, however needed they might be. Sounds like an easy job. Sorta like dipping your hand in a barrel of ink and trying to pull up black stuff.

Two Economists From The University Of Chicago Explain What The Hell Just Happened

It’s one thing to understand what just happened to the financial markets, and yet another to actually be able to explain what just happened. Thankfully, Steven Levitt from Freakonomics walked down the hall and found two economists from the University of Chicago (Doug Diamond and Anil Kashyap,) who gave him the best explanation I’ve been able to find about what the hell just happened.

Nobody Gave A Crap About The FDIC Until Fairly Recently

Spend a little time looking at Google trends and you’ll notice that no one really gave a crap about the FDIC until fairly recently.

Signs Of The Apocalypse: Even Money Market Funds Are Losing Money

In the history of money market funds, says the NYT, only one had ever “broken the buck” or actually lost money… before yesterday. On Tuesday, the managers of a multi-billion dollar money market fund announced that their customers might lose money in the fund– a type of investment that is considered as safe as a savings account.

AIG's "Strength To Be There" Commercials Are Suddenly Hilarious

When Treasure Secretary Henry M. Paulson Jr. and the Fed chairman, Ben S. Bernanke, convened a meeting with House and Senate leaders on Capitol Hill last night to discuss giving AIG an unprecedented $85 billion loan, do you think they had a laugh about AIG’s commercials? We picture Paulson saying something like, “Ha, ha, ha… ‘strength to be there.’ That’s rich! Rich! Ha! I’m on a roll!”

Feds Loan AIG $85 Billion

The Federal Reserve Bank of New York will lend AIG $85 billion. Explaining the breathtaking move the Fed said, “a disorderly failure of A.I.G. could add to already significant levels of financial market fragility and lead to substantially higher borrowing costs, reduced household wealth and materially weaker economic performance.” They’re not just dumping out the public purse on the counter, though. FBNY will take a 79.9% stake in the company, the collateralized loan is for two years, and is expected to be paid off by selling off assets. NYT writes, “the bailout is likely to prove controversial, because it effectively puts taxpayer money at risk while protecting bad investments made by A.I.G. and other institutions does business with.” You can say that again.

What Merrill, Lehman, And AIG Customers Need To Know

NYT’s Ron Leiber breaks down what you need to know and do if you are or were a customer of Merrill Lynch, Lehman, or AIG…