It’s a day of the week ending in “y,” which can only mean one thing: Another national company’s payment system has been compromised. This time, it’s the Sonic Drive-In fast food chain, where potentially millions of credit card numbers may have been stolen. [More]

Data & Privacy

Tinder Has Loads Of Data On You; Says You Shouldn’t Expect It To Remain Secure

Human beings say and do a lot of stupid things when trying to connect romantically. Before the internet, there was no record of all the idiotic pick-up lines you used or that others used on you, no permanent file of all the people you randomly dismissed as unattractive (or inexplicably found attractive at the moment). Dating sites like Tinder now have vast amounts of data on their users’ preferences, peculiarities, and peccadilloes, but are they concerned about keeping it safe? [More]

Equifax CEO Resigns Following Massive Data Breach

Among the items on that list of “Things a CEO Doesn’t Want on Their Resumé” is “Being the one in charge at the time of one of the biggest data breaches in U.S. history.” So perhaps it’s not a shock that Equifax CEO Richard Smith is stepping down only weeks after admitting that his credit bureau failed to secure the personal information of about half the U.S. adult population. [More]

Accounting Giant Deloitte Hit By Data Breach

Following on the heels the massive theft of some 143 million consumers’ information from Equifax, one of the world’s largest accounting firms has confirmed that is the victim of cyber hack. [More]

Is Experian Letting Anyone Access Your Credit Freeze PIN?

UPDATE: Experian tells Consumerist that its authentication processes go farther than previously identified steps. The company regularly reviews its security practices and adjusts as needed.

Placing a credit freeze on your accounts following a hack or issue with identity theft is only effective if the credit reporting agency you’re working with doesn’t give ne’er-do-wells the ability to unfreeze the accounts by providing the same information that any good ID thief already knows about you. This is a lesson some victims of Equifax’s recent data breach are learning after freezing their accounts with fellow credit reporting agency Experian. [More]

So, The Equifax Hack Actually Started Back In March

Two weeks ago, credit agency Equifax announced an unprecedented breach of consumer personal data where records for 143 million customers in the United States alone were stolen. Equifax told the world that it discovered the breach in July, and it began in May. Turns out that the second half of that statement isn’t quite true. [More]

Don’t Be Fooled By Fake Equifax Data Breach Information Sites

The Equifax breach, as we now all know, is completely terrible: Roughly 143 million customers in the U.S. had their personal data compromised. Concerned consumers are, naturally, looking for information — but fake sites or scams are everywhere. [More]

Baltimore Ravens Postpone DNA Test Giveaway After Public Health Officials Get Involved

If you showed up to the Baltimore Raven’s home opener on Sunday expecting to receive a free DNA test, you were likely sorely disappointed. The NFL team’s planned promotion with Orig3n was canceled at the last-minute following increased scrutiny from federal and state health officials. [More]

In Wake Of Equifax Hack, New York Wants Assurances From Experian, TransUnion

The Equifax data breach compromised personal information for some 143 million Americans, but there are still two other major credit bureaus — Experian and TransUnion — whose digital vaults are filled with the same sensitive info. New York’s top prosecutor is now asking these companies to explain how they won’t be the next source of a massive consumer data leak. [More]

California ISP Privacy Bill Stalls Out After Heavy Pushback From Industry

There is no federal-level law protecting your private web data from your internet-providing company anymore, and there likely won’t be a replacement anytime soon. So some states are trying to take matters into their own hands. But the latest, last-ditch effort in the tech capital of the U.S. has failed, after strong pushback from the very companies it would regulate. [More]

After Hack, Registry-Cleaning App CCleaner Infected Users With Malware

When you download an app meant to clean your computer, you assume that it’s supposed to remove junk from your machine, not add more. Yet for about a month, downloads of the popular program CCleaner came with a free bonus dose of malware, installed on millions of PCs around the world. [More]

Two Equifax Execs Exit Company Following Massive Data Breach

The full extent of Equifax’s recently revealed, massive data breach isn’t known yet — although 143 million US customers and tens of millions of others globally are thought to be affected — but top executives are already having to answer for the debacle, with two Equifax officers making a sudden exit. [More]

Uber Also Used ‘Greyball’ Software To Evade City Transportation Officials

Uber has already been accused of using a software tool dubbed “Greyball” to avoid sidestep law enforcement officers in cities where the service wasn’t yet authorized to operate. A new investigation has concluded that Greyball was also being used in at least one city to evade detection by more than a dozen local government officials. [More]

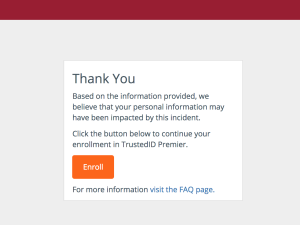

States Call On Equifax To Halt Marketing Of Its Paid Credit Monitoring Service

If you’re one of the 140 million or so people affected by Equifax’s failure to keep its data secure, the credit bureau is offering free access to its TrustedID credit monitoring service (though we don’t recommend you enroll in it). At the same time, the company is continuing to charge everyone else for access to TrustedID, and some consumers affected by the breach are inadvertently paying for a service they can get for free. That’s why dozens of state attorneys general are asking Equifax to stop trying to sell TrustedID for the time-being. [More]

Would You Take A DNA Test At An NFL Game? The Baltimore Ravens Want You To

Fans attending the Baltimore Ravens’ home opener on Sunday will be leaving more than empty cups, nacho tins, and possibly their team spirit when they exit M&T Bank Stadium: Guests can leave their DNA to be tested if they take part in the team’s latest promotion. [More]

Motel 6 Admits Some Locations Were Sharing Lists Of Guests With Immigration Officers On Daily Basis

When you check into a hotel and provide a photo ID, your expectation is that the hotel will be holding this info for its records in case you mess up the room or try to skip out on your bill. What you don’t expect is that the hotel management is taking its daily guest logs and turning them over to federal immigration officials. [More]

Equifax Says Site Vulnerability Behind Massive Breach; FTC Confirms Investigation

It’s been a week since credit reporting agency Equifax admitted it had lost sensitive personal data for 143 million American consumers — one of the worst data breaches yet. Now, the company says it knows how the intruders got in… and it’s through a bug that was first identified six months ago. [More]

It’s Not Just The U.S. — Equifax Security Issues Causing Headaches Around The World

We already know that more than 143 million Americans’ personal identify information was compromised as part of Equinox’s two-month-long data breach. If you thought that was bad enough, it gets worse: The credit reporting agency’s lax data security may have affected tens of millions more consumers across the world. [More]