Should You Move? See How Your State Gets Its Tax Money Image courtesy of aresauburn™

Ever wonder where your state gets its tax money? Whether you’re thinking about moving or just want to know more about how your state’s government is funded, there’s a handy guide that breaks it all down.

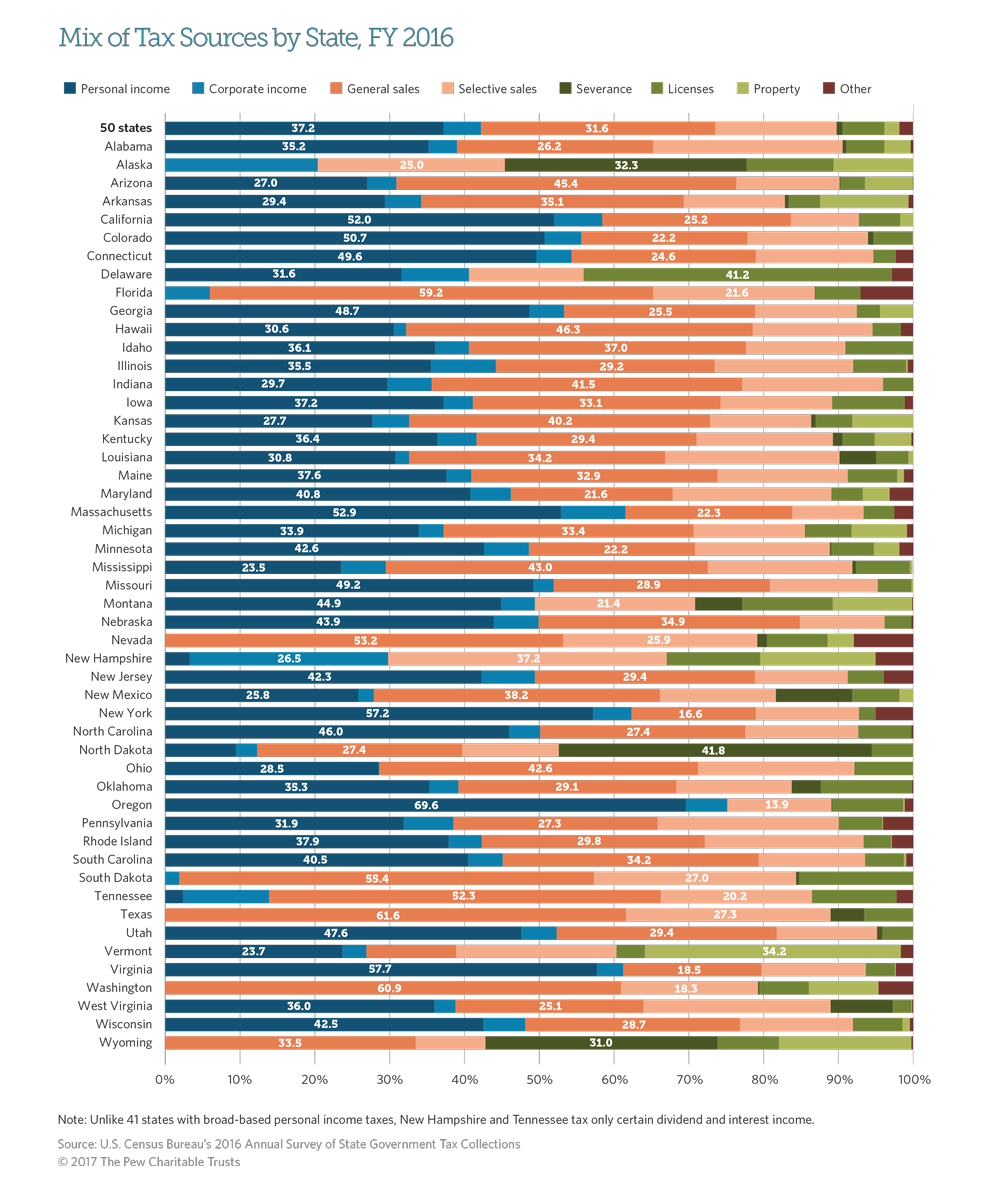

The Pew Charitable Trusts broke down the mix of tax sources by state for fiscal year 2016, showing what percentage of each state’s tax revenue is supplied by personal income taxes, corporate income taxes, general sales taxes, selective sales taxes, severance taxes, taxes for licenses, property taxes, and “other.”

In 28 of 41 states that impose them, personal income taxes were the great source of tax dollars. The highest share was in Oregon, at 69.6% of the state’s tax money. General sales taxes are the largest source in 17 of the 45 states that collect them, with Texas the most reliant on those taxes at 61.6%.

Percentages for the two largest revenue streams are included in the infographic below — click here for downloadable data for the other percentages. It’s worth noting that these are percentages so it can be a trade off. For example, Oregon, Alaska, Montana, New Hampshire, and Delaware don’t have a general sales tax at all, so the percentages for other taxes will be higher.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.