What Is Digit, And Why Are Users Upset That It’s Charging A Fee? Image courtesy of frankieleon

Maybe you’re familiar with Digit, an app that analyzes your bank account and tucks away money that you won’t miss. The app has a lot of fans, who credit it with helping them build more savings than they would have on their own. This week, though, the company announced that it will start charging a $2.99/month fee.

Digit is great for people who simply don’t remember to stick money in savings. It’s a more sophisticated version of what you can do yourself by having a certain percentage or amount of your pay diverted to a savings account every week, but the service is phone-based and fun, and gained lots of fans. When it didn’t cost anything.

In an announcement this week, which was also emailed to customers, Digit explained that in looking for a way to make money, it didn’t want to go the way of what we traditionally think of in “free” web and mobile apps. That would include selling user data, “recommending” bank accounts or credit cards, or serving up ads within the app.

Those are all ways that services that most of us use every day make money, but Digit went for a straightforward option of charging a monthly fee. Instead of interest, Digit pays users a quarterly Savings Bonus. That’s currently .25% annually, and will go up to 1% when it becomes a paid app. For the bonus to offset the entire fee, users would need to keep a balance of at least $3,600 in their accounts.

“As Digit becomes a more important part of our customers’ financial lives, we’ve decided to make a conscious decision about how we want to make money: We work for you, and you pay us. It should be that straightforward,” the company wrote in an email that some users complained that they found unprofessional.

Forbes recounts that in an interview a year ago, the CEO of Digit said that the company hadn’t really considered yet how it was going to make money, and that it had enough money from investors that it was able to take “a long-term mentality around monetizing.”

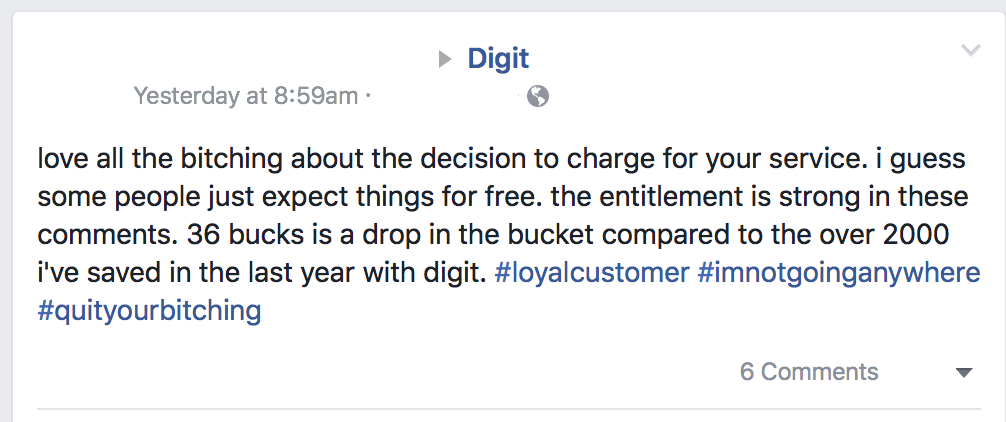

Users were pretty transparent about their reasons for leaving on the company’s social media channels, explaining that they didn’t find the service worth $3 per month, or simply that there are too many competitors out there whose services are free.

There really are a lot of competing apps. Lifehacker encouraged readers to try Digit in the past, and now offers a list of alternatives that function in similar ways and don’t charge fees. Instead, they earn money from the interest on users’ accounts, which was Digit’s sole revenue source before this change. The problem is that interest rates depend on factors outside of the company’s control, and interest rates aren’t great right now.

“Relying on interest income is difficult in the current interest rate environment,” a Digit spokesperson told Consumerist. “By charging a monthly fee, we’re no longer motivated by interest.”

Instead, the company chose a “transparent monthly fee” so customers would understand what they were paying for the service and getting in return.

Web and mobile apps that help users save or manage their finances (fintech, or financial technology) are a growing market, and also a market that has to grow up eventually. While some users will simply migrate to whatever app is offering the most services for free, others may find that Digit is working for them.

“Fintech companies aiming to disrupt big banks must figure out how to monetize in a way that continues to deliver value for their customers,” the Digit spokesperson told Consumerist. “Digit chose a monthly fee instead of selling customer data or unnecessary products so we can continue building only for the benefit of our customers.”

Current users have 100 days to decide whether they want to pay for the service, while new users will have 100 days from the time they sign up before the fee kicks in. They’ll receive a reminder that it’s happening before the app starts to charge the fee.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.