1-In-4 Consumers Contacted By Debt Collectors Feel Threatened Image courtesy of Steven Depolo

More than 70 million Americans are contacted by a debt collector or creditor each year. While those debt collectors have a job — to get borrowers to repay on their overdue debts — some have used illegal tactics, such as threatening lawsuits, arrests, or contacting consumers’ employers or family members. Now, a new report by the Consumer Financial Protection Bureau finds that harassment by these collectors is all too common.

Under the Fair Debt Collection Practices Act, debt collectors are forbidden from using threats of violence or harm.They are also barred from claiming borrowers have committed a crime, or that the borrower may be arrested for non-payment.

Yet, according to the CFPB’s survey report [PDF], these rules are often being disregarded when it comes to collectors trying to entice borrowers to pay on their debts.

The Troubles With Debt Collection

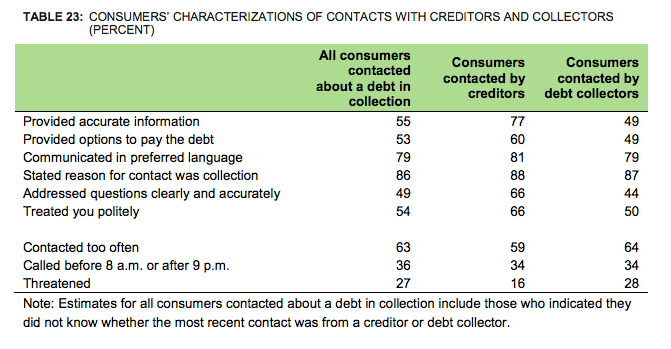

One-in-four consumers — or 27% — contacted by debt collectors for unpaid bills or loans in the last 12 months felt threatened during the interaction.

While the report does not break the threats down specifically, debt collectors in the past have been found to threaten consumers with arrests, deportation, and bogus lawsuits in order to receive payments.

Additionally, while it’s not clear how often borrowers receive threatening calls, the report found that many consumers feel the sheer frequency of debt-collection calls they received constitutes harassment.

For instance, nearly 40% of borrowers said that a debt collector has attempted to contact them four or more time per week. Of these consumers, about 20% said they were approached by debt collectors four to seven times per week, while another 17% said a creditor or debt collector tried contacting them eight or more times per week.

Additionally, under the FDCPA collectors are not allowed to contact consumers before 8 a.m. or after 9 p.m., unless the borrower asks them to.

Despite this, the CFPB survey found that 36% of borrowers in collections were contacted about their debts between 9 p.m. and 8 a.m.

About 40% of the borrowers who were contacted either during normal hours or after hours by debt collectors said they asked the collector to stop calling. However, three-in-four of these borrowers said those requests were not honored.

While it’s certainly not okay for consumers to feel threatened by collectors, another area the CFPB shined a light on with its report is the wealth of misinformation provided by debt collectors.

About 53% of borrowers said that at least one collection call they received in the past year was a mistake in some way.

Of these consumers, 28% said they had been contacted about debts they did not owe, 33% said the amount given to them was incorrect, and another 16% said the debt wasn’t their but belonged to a family member.

Another 27% of respondents said that the debt they were contacted about had previously been disputed either because they didn’t believe the debt was theirs or that the amount was incorrect.

A Bigger Problem

Although ensuring that consumers are treated fairly when it comes to repaying debts is a priority for federal regulators, the way in which debt is sold and transferred among collectors is a growing concern.

The CFPB on Thursday also released a report [PDF] on the risk of the online debt sales sale market, noting that potential risks to consumers’ personal information when debts change hands.

The sale of debts isn’t uncommon, the CFPB reports.

Typically, when an original creditor fails to collect debts on their own they will sell the debt — sometimes at a fraction of the actual cost — in order to obtain some kind of return.

Of the 298 portfolios the CFPB viewed, which were estimated to hold $2 billion in debts, 25 cost less than $1 per account, 37 portfolios were priced for between $1 and $2, and more than half were priced for below $5 per account.

The new owner, often a debt collector of some sort, can then attempt to collect the entire amount of the listed debt or to sell it again through an online marketplace.

It’s not exactly the sale of the debts that’s the concern for the CFPB, it’s the information contained in the portfolios.

According to the CFPB, these debt portfolios often contain sensitive personal and financial information of consumers such as names, Social Security numbers, account numbers, and dates of birth.

In some instances, the CFPB’s review of 298 debt portfolios found unencrypted, identified personal information had been available to any visitor to a debt marketplace website.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.