State, Federal Agencies Crack Down On Companies That Allegedly Facilitate Mail Fraud Of Elderly Image courtesy of (Juan Cabanillas)

Each year, millions of elderly consumers are lured into mail fraud schemes by all-too-attractive claims that they have won unimaginable prizes, like millions of dollars or trips around the world. Today, the U.S. Department of Justice took unprecedented steps to ensure these scammers no longer victimize older Americans by announcing action against companies that they allege are some of the little-known perpetrators of the alleged schemes: the payment processor, mailer printers, and lead generators.

The U.S. Attorney General’s Office, along with U.S. Postal Inspection Service (USPIS), U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC), the Federal Trade Commission, and other law enforcement agencies, announced Thursday sweeping action involving mass-mail fraud that resulted in criminal charges, seizure of allegedly criminal proceeds, and civil injunction lawsuits against several companies and individuals.

The sweep targeted a global network of mass mailing schemes that have allegedly defrauded millions of elderly and vulnerable victims across the U.S. out of hundreds of millions of dollars, according to the AG’s office.

“Today’s actions send a clear message that the Department of Justice is determined to hold the perpetrators of these harmful schemes accountable,” U.S. Attorney General Loretta Lynch said. “And they make unmistakably clear that we are committed to protecting our people from exploitation – especially our older citizens, who are so often the focus of these shameful ruses.”

The alleged mail schemes involved a complicated web of organizations that created “direct mailers” that falsely claimed a recipient had won, or would soon win, cash or valuable prizes, as well as the companies that printed the mailers, processed payments, and provided lists of potential victims.

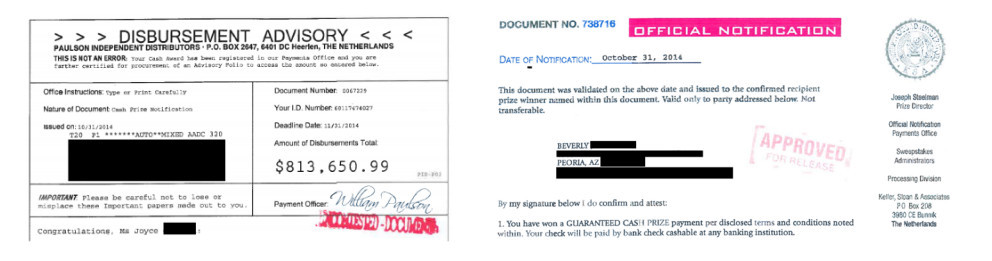

Mail fraud generally works in the same way despite being operated by different companies. The fliers — which often appear to come from legitimate sources using official-looking letterheads but are, in reality, identical form letters personalized to the addressee — claim that a victim has been chosen as the winner for a large prize. In other cases, a clairvoyant or psychic claims in a mailer to have information about a large sum of money or another good fortune event that will soon happen for the victim.

In most cases, in order to collect these prizes described in the letters, the victims were directed to send in a small amount of money for a processing fee or taxes.

As part of the regulator and law enforcement crackdown announced Thursday, several companies that did work on behalf of these direct mailer organizations were sued, shut down, or otherwise penalized for their part in the schemes.

This includes payment processors, the printer that manufactures the solicitations and arranges for bulk shipment to U.S. victims, and list brokers who buy, sell, or rent lists of victims from one mailer to another so that once a victim has fallen prey to one scheme, others are able to target this victim.

The Payment Processor

PacNet, a Canadian-based payment processor, cashes the checks for dozens of allegedly unethical and scheme-y mail fraud organizations that target the elderly, according to the Dept. of Justice.

For more than 20 years, the DOJ claims, the payment processor has helped dozens of international fraud organizations gain access to U.S. banks and take money from victims.

As part of the action, PacNet has been designed as a “significant transnational criminal organization.”

The DOJ, U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC), and U.S. Postal Inspection Service (USPIS) claim in court filings that PacNet has a long history of engaging in money laundering and mail fraud, by knowingly processing payments on behalf of a wide range of mail fraud schemes that target victims in the United States and throughout the world.

The agencies claim that in 2016 alone, PacNet has processed payments for more than 100 mail fraud campaigns involving tens of millions of dollars.

“PacNet has knowingly facilitated the fraudulent activities of its customers for many years, and today’s designations are aimed at shielding Americans and the nation’s financial system from the large-scale, illicit money flows that are generated by these scams against vulnerable individuals,” said OFAC Acting Director John E. Smith.

An investigation by CNN found that PacNet worked with dozens of organizations dealing in mail fraud against the elderly.

The company would allegedly receive the checks, cash them, take a cut, and then send the remaining funds to the direct mailing company that had promised victims million-dollar prizes in exchange for a $20 check.

In one case, CNN found an 91-year-old Iowa woman had sent more than 749 checks, totaling more than $29,000, in response to phony prize notifications and personalized letters from so-called psychics promising financial fortune.

Of the checks that were sent, 566 were deposited by PacNet on behalf of nearly 50 different mail fraud schemes.

Connecticut Direct Mailer

The AG’s office, along with the Iowa Attorney General, FTC, and other agencies took separate action Thursday against a number of direct mailers that allegedly sent hundreds of thousands of cash prize notifications from fictitious companies to elderly Americans.

They took action to shut down a California mailer, Florida printer, and Florida list broker that they claim perpetrated a scheme against these victims.

According to the FTC complaint [PDF], the company sent letters to mostly elderly consumers informing them that they won a substantial cash prize of nearly $1 million or more.

The notifications instruct consumers to pay a fee of approximately $25 to collect their prizes, but those who paid received nothing in return.

According to the complaint, operators Terry Somenzi and David Raff, directly and through third-parties, provided the cash prize notifications and mailing lists of consumers’ names and addresses to Ian Gamberg, who then arranged to have the notifications printed and mailed.

This process, the regulator believes, created a cycle of fraud that continuously targeted the same victims.

Many consumers who paid the “fees” later received numerous other deceptive personalized cash prize notifications from the defendants and other companies who purchased lists containing the consumers’ personal information, the FTC alleges.

The Iowa Attorney General’s Office and federal authorities took separate action against Connecticut-based list broker Macromark that marketed lead lists to third-party direct mailers.

According to the DOJ’s complaint, Macromark rented lead lists to direct mailing companies that used the lists to personalize and address hundreds of thousands of solicitation packets to potential victims across the United States.

Macromark marketed the lead lists as containing the demographic information of individuals likely to send money in response to the solicitations. The lists collectively contained approximately 750,000 potential victim names and addresses, according to the complaint.

The Iowa AG announced that it had reached an Assurance of Voluntary Compliance with the broker resolving claims it facilitated fraudulent activities.

The AVC with Macromark requires it to refrain from any further facilitation of such fraudulent activities affecting Iowa residents and to pay $30,000 into a fund that protects elderly Iowans against consumer fraud.

The state brought separate action against Waverly Direct Inc. a direct mailer, and Nicholas Valenti, an individual accuse of sending deceptive mailings to elderly residents.

Nevada Mass Mailer

The U.S. AG’s Office announced the arrest of Glen Burke, of Las Vegas, for his alleged involvement in operating fraudulent schemes including a mass-mailing prize campaign that violated a federal court order.

According to the complaint, Burke’s business mailed solicitations — using fictitious names and, in many cases, created to look as if they were from law firms or financial institutions — claiming a recipient had won thousands or millions of dollars.

The indictment alleges that the solicitations advised consumers to pay a fee – usually $20 to $30 – in order to claim their winnings. Once consumers paid, however, Burke allegedly failed to send anyone their promised winnings of thousands or millions of dollars.

In addition to his direct mailing business, the AG’s office accused Burke and another man, Michael Rossi, of creating and operating a telemarketing company that mirrored the mass-mailing campaign.

The complaint alleges that Burke hired telemarketers to contact consumers claiming they had been selected for a valuable prize, and that they would receive the funds if they purchased certain products.

New York Direct Mailer

In another civil injunction action, the DOJ seeks to stop a collection of businesses and individuals who it says have operated a direct mailing scheme based out of Long Island, NY, since at least 2012.

The complaint [PDF] alleges that DMCS Inc., Direct Marketing Consulting Services Inc., Horizon Marketing Services Inc., Quantum Marketing Inc., and their owners committed mail fraud in connection with their scheme that included sending fraudulent solicitations styled as notifications that the recipient has won a large cash prize, typically worth more than $1 million.

In all, the complaint alleges that the defendants mailed hundreds of thousands of solicitations to potential victims throughout the United States every year and have grossed roughly $30.4 million since 2012.

Dutch “Caging” Companies

The U.S. District Court for the Eastern District of New York entered a consent decree [PDF] of permanent injunction against two Dutch caging businesses — known as Trends — and their principal, to prevent them from assisting mass-mailing fraud schemes.

According to the original complaint [PDF], filed in June, since at least 2012 two companies based in Utrecht, Netherlands, operated “caging” services for multiple international mail fraud scams, meaning the companies receive and open responses from victims, and process payments for the scammers.

Trends and its operator agreed to settle the litigation and be bound by a consent decree of permanent injunction that prohibits them from performing caging services for prize or psychic mailing campaigns, or any other mailing campaign that misrepresents itself to consumers. The injunction also allows USPIS to intercept U.S. mail headed to the defendants, and to return that mail – along with any money being sent to the defendants – to U.S. victims.

As part of the settlement, the companies and operators did not admit wrongdoing or liability.

Swiss/Singaporean Direct Mailer

The United States brought a suit to shut down BDK Mailing GmbH, Mailing Force, and Only Three, known collectively as BDK, that allegedly collected approximately $50 to $60 million from victims annually.

According to the complaint, BDK acts as a “direct mailer” responsible for mailing millions of multipiece solicitations to potential victims throughout the U.S. that profess to come from financial entities, scholars, and world-renowned psychics, with contrived names like “Harrison Institute,” “Dr. Grant,” “Finkelstein & Partner,” and “Marie de Fortune,” among others.

The solicitations are written to give the impression that they are personalized and inform recipients that they will receive large sums of money, guaranteed money-making methods and/or powerful talismans in return for payment of a fee of $50 to $55, the complaint alleges.

Indian Printer

The U.S. filed suit [PDF] against Mail Order Solutions India, an Indian-based printer and distributor, that allegedly serves as one of the printer/distributors used by mail fraud organizations, including BDK, since at least 2005.

MOSI designs, edits and proofreads BDK’s solicitations, then “lettershops” them for delivery to the U.S. The complaint alleges that since 2013, MOSI has shipped at least 24.5 million solicitation packets to the U.S.

Turkish Direct Mailer

In a criminal complaint [PDF] filed in the U.S. District Court for the Eastern District of New York, the government charged Ercan Barka, 34, a resident of Turkey, with conspiracy to commit mail fraud.

According to the criminal complaint, Barka arranged for fraudulent solicitations to be mass-mailed to victims across the United States.

The mailers allegedly informed recipients — again mostly the elderly — that they had won cash awards or lavish prize items and needed to pay a “fee” to claim their winnings.

The DOJ also brought civil action [PDF] against Barka’s company, Delaware-based True Vision, under the Anti-Fraud Injunction Statute. The complaint, which claims Barka sends millions of notifications resulting in pilfering more than $29 million from victims since 2012, seeks to permanently ban Barka from participating in mail fraud schemes.

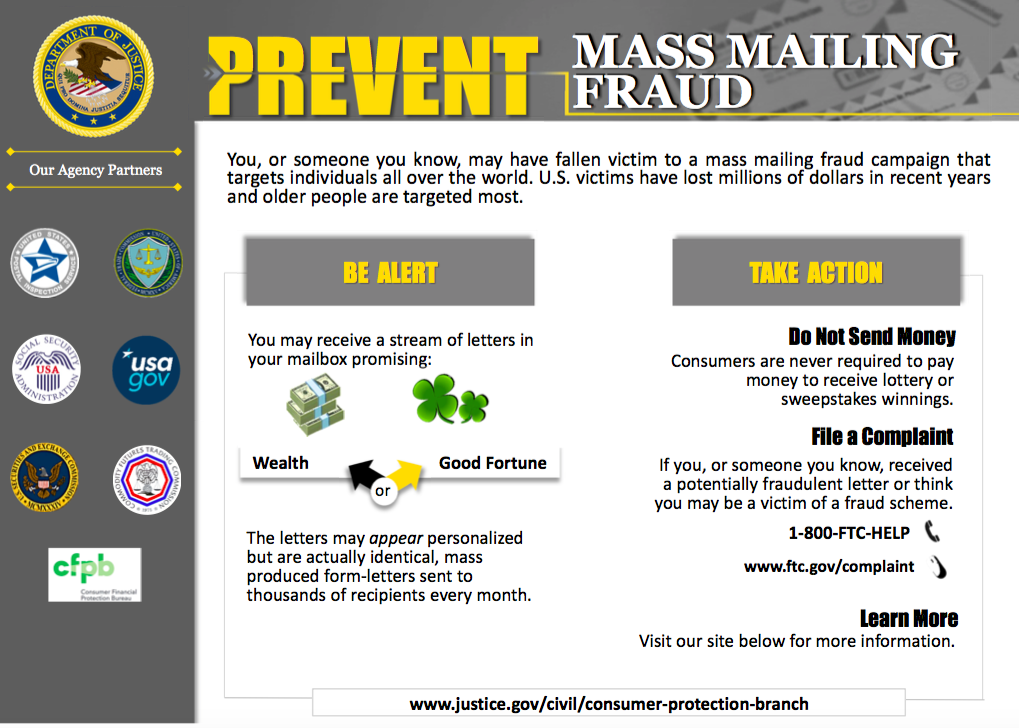

Preventing The Schemes

As part of Thursday’s crackdown, the government is working with several non-profit organizations — including our colleagues at Consumers Union – to create education tools that aim to protect vulnerable citizens.

The tools include websites, newsletters, social media channels, training, and outreach events.

The material provides information on how potential victims can spot mail fraud and prevent being lured into the schemes.

The outreach also includes messages to caregivers – such as friends, relatives, social workers and others in contact with older individuals – about the need to be vigilant against prize or psychic letters being sent to those under their care.

“This new campaign shines a spotlight on mass-mail fraud, where we see some of the most outrageous and sophisticated crimes aimed at the elderly,” Laura MacCleery, Vice President of Policy and Mobilization, Consumer Reports, tells Consumerist. “We are committed to helping educate and empower people so they can spot these schemes and avoid becoming the next victim.”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.