9-In-10 Big Banks Strip Customers Of Their Right To Jury Trial Image courtesy of Adam Fagen

If you ask someone on the street if they should have the right to sue their bank over something like an illegal overdraft fee, nearly everyone you speak to will invariably say yes. But a new report confirms that nearly all big banks are forcing customers to give up their right to a jury trial.

This is according to researchers at the Pew Charitable Trusts, who looked at the customer contracts for checking accounts at 44 of the nation’s largest banks and found that 91% of them include jury trial waivers.

At the very least, that means that any legal dispute would be heard solely by a judge and not by a jury of the customer’s peers. However a further look at these contracts shows that customers are — often unwittingly — signing away their ability to even enter a courtroom in the first place.

According to the Pew data, 70% of these same banks have forced arbitration clauses, meaning you can’t have your case heard in a courtroom but must instead enter into binding arbitration before a third-party private arbitrator.

We’ve run down the problems with forced arbitration before, but the main concerns for consumers include:

• Potential Bias: Some of arbitration’s biggest defenders have admitted the process can be tilted in favor of the businesses that frequently use arbitrators.

• Secrecy: Arbitration often happens behind closed doors with all parties bound by confidentiality agreements. Thus, even if a company is found to have violated the law, the public may never know. This is one of the reasons that opponents of forced arbitration, like NYU Law professor Samuel Issacharoff have dubbed it a “get out of jail free card.”

• Limited Damages: As opposed to jury trials, where successful plaintiffs can be awarded substantial damages, arbitration awards are often very limited. This restriction makes it difficult for plaintiffs to find or afford quality legal representation. Similarly, some cases that are expensive to mount are rendered pointless because it would cost more to prove your case than you could possibly hope to win.

Go It Alone

This brings us to the biggest sticking point with most forced arbitration clauses: The ban on class actions. As we showed in this list of nearly 90 major companies that use arbitration agreements, all of them include a prohibition on class actions — even through arbitration.

So take the above concerns about the arbitration process and then add the problem of being forced to go it alone, even if there are thousands — maybe millions — of customers who were similarly wronged.

Take, for example, the $203 million verdict against Wells Fargo for its practice of unfairly re-ordering debit transactions to maximize overdraft fees.

That lawsuit pre-dates the Supreme Court’s ruling in AT&T Mobility v. Concepcion, which vindicated companies’ use of forced arbitration to block class actions.

After the 2011 Concepcion ruling, banks, retailers, manufacturers, websites, and countless other businesses raced to add arbitration clauses to their user agreements and contracts — including Wells Fargo. So if a customer tried to sue Wells over that same issue now, not only would they be shunted off immediately into arbitration, each individual customer would have to make their case… for damages that might not even reach triple digits.

Only A Lunatic Sues for $30

If you’ve ever received a payment as part of a large class action, you know that the individual payouts are often quite small; sometimes no more than a few dollars per class member.

Defenders of forced arbitration point to these small individual rewards as evidence that class actions provide minimal benefit, but should companies avoid liability just because their lawbreaking only hurts each customer a little bit?

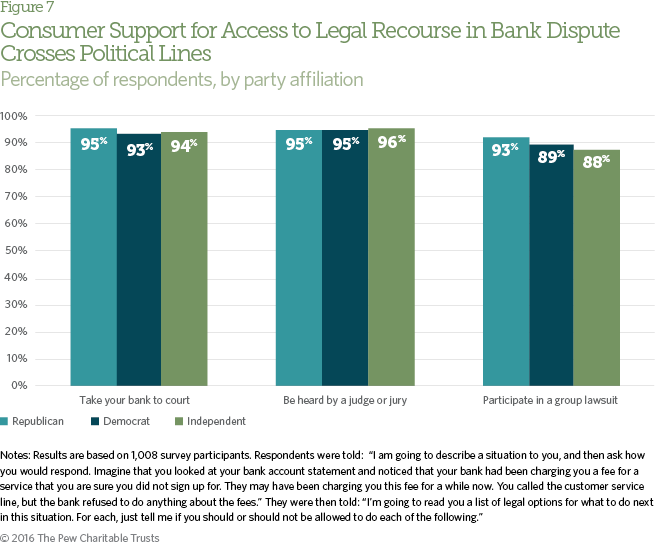

The Pew folks surveyed 1,000 people about what they would do if they found out their bank had been charging them a fee for a service they didn’t sign up for, and which the bank’s customer service department could do nothing about.

The large majority (75%) of respondents said they would speak to a bank manager, but fewer than a quarter of people (23%) said they would consider taking legal action against the bank.

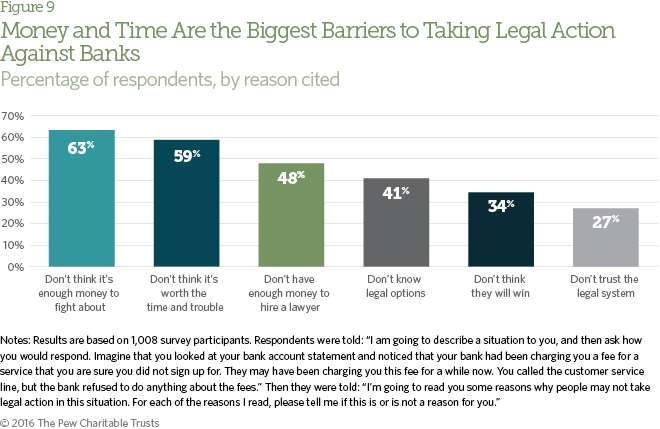

When asked why someone might not pursue legal action against their bank in this situation, the three most popular choices indicated that consumers feel like suing a bank is probably going to be an expensive fruitless endeavor, with a majority of people saying it may not be worth the time and effort:

As federal appeals court Judge Richard Posner opined in Carnegie v. Household Int’l, “only a lunatic or a fanatic sues for $30.”

All it takes for a successful class action is for one person willing to represent all similarly wronged customers, which is why banks and other companies want to preempt potentially massive lawsuits by requiring that customers sign away their rights as early as possible.

What The People Want

AT&T and other companies have argued that forced arbitration is really a benefit to consumers by expediting the dispute resolution process.

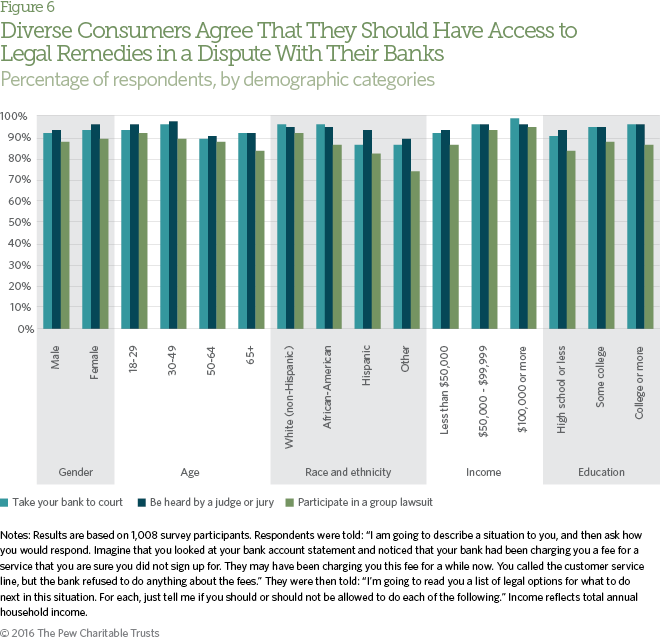

However, data from the Pew report indicates that Americans are decidedly not in favor of having their rights taken away from them, with 95% percent of respondents saying that disputes should at least be heard in a court of law, and 89% of people agreeing that consumers should be able to join their legal actions together in a class action.

Something We Can All Agree On

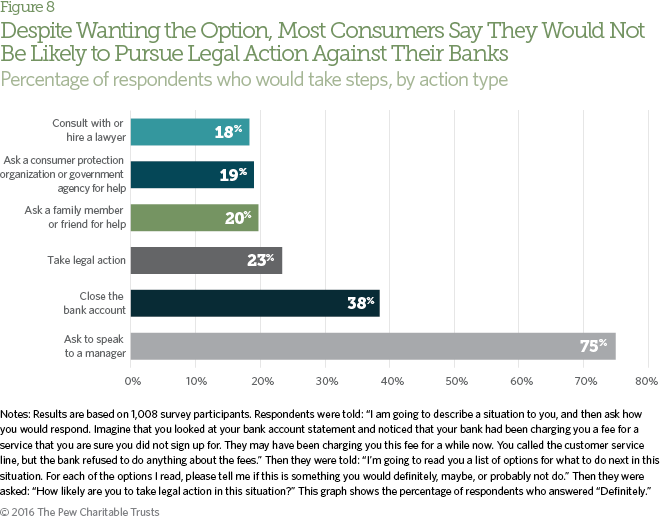

Additionally, support for retaining these legal options is nearly universal, with no significant statistical difference based on age, gender, race, income, education, or even political affiliation:

Change May Be Coming

In May, the Consumer Financial Protection Bureau completed its Congressionally mandated, multi-year investigation into forced arbitration clauses and released a draft of new rules that would not forbid arbitration agreements in financial contracts, but would bar them from being used to prohibit class actions.

The rules have received support from consumer advocates, law professors, and more than 100 members of Congress.

Yet some in Congress are attempting to scuttle the rules, with the House recently passing an appropriations bill that would effectively force the CFPB to redo all of its work on arbitration before it can enforce any new rules on the issue.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.