Servicemembers Twice As Likely To Submit Complaints About Unsavory Debt Collection Practices Image courtesy of Hammerin Man

While millions of Americans are no strangers to questionable debt-collection practices, a new report from the Consumer Financial Protection Bureau shows that the men and women in the armed forces are twice as likely than their civilian counterparts to file a complaint when a collector crosses the line.

From continued attempts to collect a debt that was not owed to improperly contacting a servicemembers’ superior, complaints submitted by servicemembers to the Bureau — and highlighted in its annual report — covered nearly all the hallmarks of unsavory debt collection operations.

The CFPB Office of Servicemember Affairs annual report [PDF], released today, highlighted those complaints, and others levied against mortgage providers, loan issuers, student loan providers and servicers, payday loan providers, credit reporting companies and other financial providers that directly impact the military community.

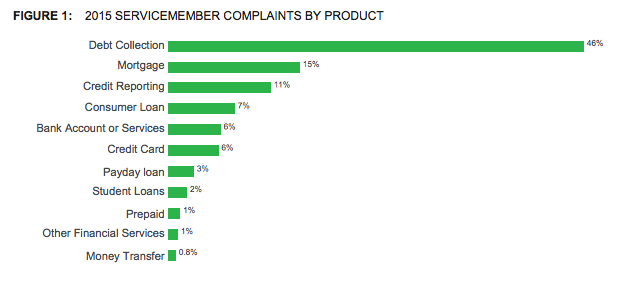

In all, the CFPB received over 19,000 complaints from members of the military last year. Of those complaints, nearly half — about 8,900 — were related to debt collection.

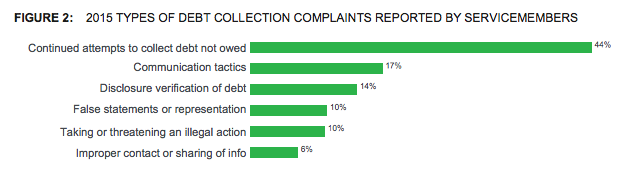

Roughly 44% of the debt collection complaints submitted by servicemembers involved companies’ attempts to collect debt that the servicemember believes is not owed.

In many of these cases, the attempt to collect the debt is not itself the problem, the CFPB states. Instead, servicemembers report that the calculation of the amount of underlying debt is inaccurate or unfair.

Another 17% of complaints submitted about debt collectors related to their chosen method of communication. For example, servicemembers say the contact, usually via telephone, occurs too often or at inconvenient times of the day.

Additionally, servicemembers often complained that debt collectors would contact their commanding officers and threaten their security clearance over a debt issue.

Medical debt accounted for about 13% of the types of debt that military personnel say they are contacted about by collectors.

The majority of medical debt complaints came from veterans, the CFPB report states.

“We routinely hear from veterans who are struggling with debt collectors attempting to collect debts stemming from medical bills that should have been paid for by insurance,” according to the report.

In many cases, veterans leave the hospital believing their services were covered by their VA health insurance or Medicare/Medicaid. The later report being contacted by debt collectors requesting payments.

“These veterans are often left stressed and worried about their credit report due to potentially erroneous collections,” the report states.

Other than complaints specifically levied against debt collectors, the CFPB found that servicemmbers also submitted collection complaints related to payday and student loans.

As for servicemebers’ other complaints, the CFPB says it received 2,800 related to mortgages, 2,200 for credit reporting, 1,400 about consumer loans, 1,100 on about bank account and services, 1,100 related to credit cards, 500 for payday loans, 400 on student loans, 300 related to prepaid cards, and 200 each for other financial services and money transfer services.

In addition to highlighting complaints received from servicemembers, the CFPB also detailed several enforcement actions that returned $5 million to those consumers.

Those cases included a $2 million order against Security National Automotive Acceptance Company (SNAAC), an Ohio-based auto lender, that illegally engaged in abusive debt collection practices against servicemembers and their families.

Another noteworthy action involved military allotment processor Fort Knox National Company and Military Assistance Company. The Bureau alleged that the company charged fees without providing proper disclosures. In the end, the company was ordered to repay $3 million.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.