Nearly 80% Of Americans Hold Some Form Of Debt, But It Isn’t Always Bad

When most people think of debt, they probably conjure up a vision of consumers struggling to make ends meet after making unwise financial decisions. But that actually isn’t the case for most Americans. In fact, like other things, debt in moderation is actually a good thing.

That’s according to a new report [PDF] from Pew Charitable Trusts that found debt is a routine but complicated aspect of U.S. households’ with nearly 80% of Americans holding at least some form of debt.

The report, titled “The Complex Story of American Debt,” examines how four generations of consumers’ hold debt and their views toward it.

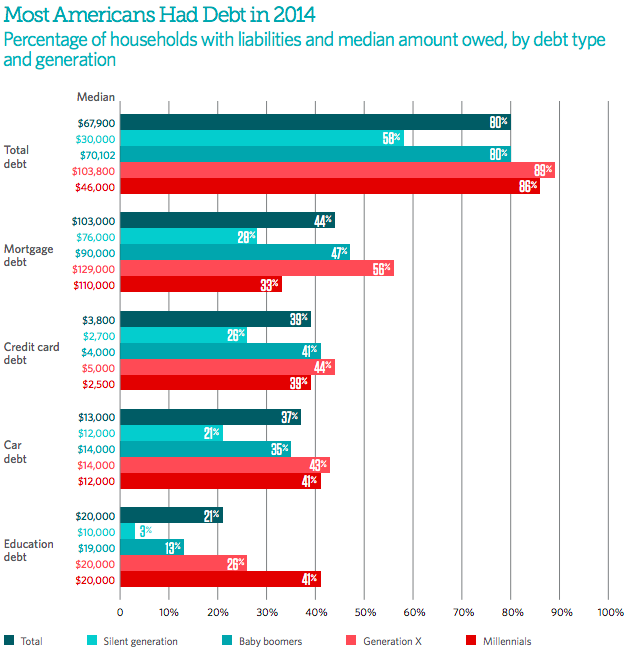

Of the 80% of consumers holding debt, most is connected to mortgages. The median amount of debt for consumers across all generations was $67,900.

Unsurprisingly, the divide in the amount of debt held by consumers finds that middle-aged consumers have the most, while those entering the later stages of life and those just entering adulthood have the least.

Members of the silent generation – those born between 1928 and 1945 – hold just $30,000 in total debt, while Gen Xers – those born between 1965 and 1980 – have an average of $103,800 in debt.

Members of the silent generation – those born between 1928 and 1945 – hold just $30,000 in total debt, while Gen Xers – those born between 1965 and 1980 – have an average of $103,800 in debt.

Much like consumers indebtedness varies by generation, so do their feelings about debt.

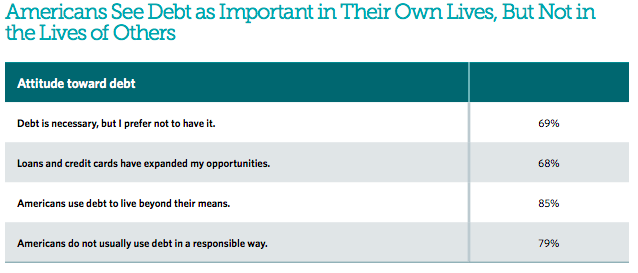

For the most part, a majority of Americans — seven in 10 — view debt as a necessity in their lives, even though they would prefer not to have it.

Similarly, most consumers, about 68%, believe that loans and credit cards have expanded their opportunities by allowing them to make purchases or investments that their income and savings alone could not support.

Still, the report found that debt is more often than not seen as a negative mark in consumers’ lives, with 79% of consumers believing that other people use debt irresponsibly.

Consumers’ attitudes on debt varied significantly depending on their stage in life. For example, members of the silent generation say that the availability of credit cards and loans afforded them more opportunities, while members of the Millennial generation – those born between 1981 and 1997 – see those products as a potentially harmful to their finances.

Consumers’ attitudes on debt varied significantly depending on their stage in life. For example, members of the silent generation say that the availability of credit cards and loans afforded them more opportunities, while members of the Millennial generation – those born between 1981 and 1997 – see those products as a potentially harmful to their finances.

“Overall, Gen Xers’ and Millennials’ aversion to debt may reflect their greater debt burdens at an earlier stage in life than previous generations, as well as having experienced the Great Recession when they were just beginning school, entering the workforce, and purchasing their first homes,” the report states.

The report found that each new generation is significantly influenced by the generation before them.

That trend can certainly be seen when it comes to consumers’ debt related to education. It appears that while many consumers say they would change the way they paid for college, they haven’t exactly passed that knowledge to younger generations.

Many Gen Xers that are still paying off their student loans are now gearing up to send their own children to college.

Nearly 93% of Gen X parents say their oldest child will go to college, with about 83% saying they plan to help pay for the costs. However, a majority of parents of teenagers also paying off their own student loans have only set aside $4,000 in dedicated college savings accounts, believing that their child will receive grants and scholarships to pay for a majority of their college expenses.

“In reality, far fewer students receive grants or scholarships, and more depend on loans,” the report states. “The college-bound teenagers of Gen Xers are poised to take on as much or more debt than their parents.”

Consumers’ financial health and sense of security related to debt also varies depending on age.

For older Americans, lower levels of debt indicate greater financial security, while consumers of working age who have higher amounts of debt have healthier balance sheets, according to the report.

When comparing low- and high-debt retirees, the report found those who paid off their debts earlier in life were more likely to have accumulated more assets and net worth.

As for the younger Americans accumulating more debt – for homes or education purposes – their current financial situation is similar to those of the silent generation who now feel more secure.

Overall, the report suggests that while the long-term effects of debt for young Americans is still to be determined, their financial futures may be on the same path as older generations.

“Sustainable debt can be a positive force for the economic mobility and financial security of young Americans and their families,” the report states.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.