Changes To TurboTax Lead To Consumer Revolt, Opportunity For Competitors Image courtesy of (rayovolks)

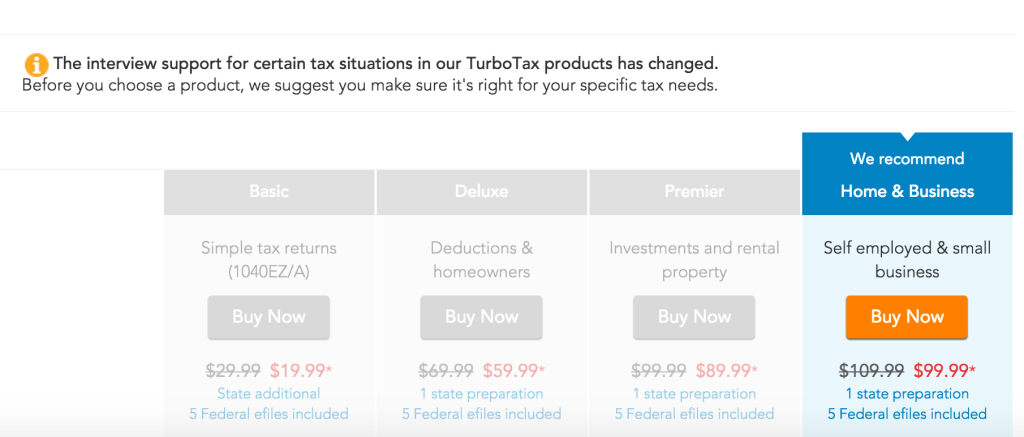

As soon as the 2014 version of TurboTax hit real-life and virtual shelves, customers noticed that something was different. There are different versions of the software for different audiences: Basic, Deluxe, Premier, and Home and Business. There are also versions for incorporated businesses and for tax preparers, but those the four consumer desktop software versions are the source of this conflict.

Customers who purchase directly from TurboTax see this polite note pointing out that they might need to check the features of what they’re getting.

What Intuit did for tax year 2014 is change which services come with each tier, shifting some of the forms to the more expensive versions. They made the same changes to the pricing tiers on their Web-based service for 2013, so the change is not entirely unexpected.

The first rumblings came as soon as the software was released last year, and some true early birds got a head start on their returns. They noticed that something was missing: some pretty common forms that had always been part of TurboTax Deluxe. These included:

Those are forms that most people don’t file. For people who do file them, though, those forms are an essential part of their tax return. When TurboTax customers discovered that forms they expected to have as part of the TurboTax “interview” interface weren’t there, the 1099-MISC hit the fan.

While some can be filled out in “forms mode,” that defeats the point of using a program like TurboTax. If people wanted to fill out forms, they would download PDFs from the IRS web site.

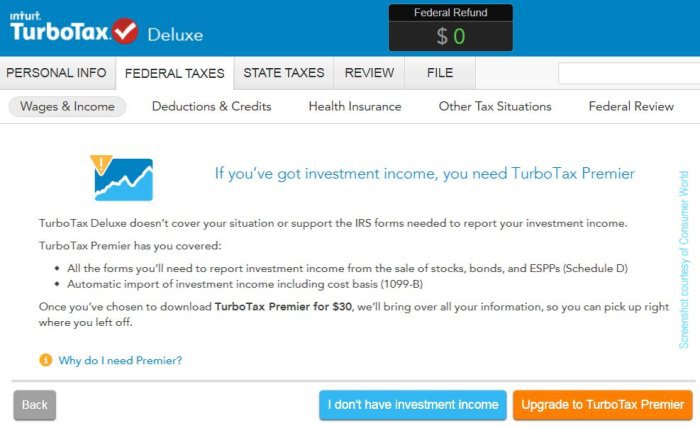

Here’s a screen grab of the in-program upsell from Mouse Print’s Edwin Dworsky:

We contacted Intuit about this situation, and in their explanations to the media of this change, they emphasize two points. First, they say, most customers don’t use the desktop version of the software anymore. That might have been the case in 1991, but most of their customers now fill out their taxes on the Web or use a mobile app. According to the company, only 20% of their customers now purchase and use the desktop versions.

An Intuit representative told Consumerist that the basic versions of the software (the ones that mostly compete with the IRS’s free e-filing program) are cheaper than in previous years, and that customers who pay for the upgrade will find it super easy to file. “We recognize change isn’t always welcome,” she explained. But we think believe our customers will find that if they do need to use a different product this year, they’ll be truly delighted with the extra guidance, additional insights into deductions and credits for which they may qualify and the increased confidence from knowing they left nothing on the table.”

It’s true that the upgraded versions offer access to TurboTax support staff, which you may or may not need, but encountering an upsell in the middle of typing in their information. Angry customers are fighting back in the way people do in 2015: well, they’re also burning up the TurboTax brand Facebook page, but there’s a campaign of negative Amazon reviews meant to attract the attention of potential buyers before they spend $40 on the Deluxe version.

Intuit is taking this campaign very seriously. TurboTax representatives, including the brand’s vice-president, have stepped in on Amazon to comment on some of the poor reviews.

One reviewer who says that he has used TurboTax since 1995 explains why he thinks it’s time to move on:

I have no interest at all in experimenting with the various “flavors” of TurboTax to make sure I’m buying the right one. I have a couple of shares of stock purchased from “OneShare.com” that were given to me as gag gifts that occasionally report dividend income. Will “Deluxe” handle this? I’m selling a home for which I may or may not need to report capital gains income. Will this require a $30 upgrade? I have no idea, and I’m not interested in taking a chance and finding out I was wrong the hard way.

I’m off to a competitor, most likely H&R Block, because it’s cheaper, and quite clear what it will allow me to do. Farewell, old friend TurboTax. It was great while it lasted, but it’s time to move on.

Another customer explained the options for people who need to file a full Schedule C or who put anything on Schedule D.

I hate what Intuit has done with Turbotax. I especially hate the disingenuous comment added by the Turbotax VP. Sure, you can manually file the Schedule D, but what the heck did I pay for? The Deluxe version clearly says you can file your Fed return electronically–except the actual software says you can’t.

So, the real answer is if you need to file Schedule D you’ll have to pay $30 more as stated in other comments. Alternatively, you can do what I did–which was uninstalled the software, submitted a request for a refund (6-8 weeks!), and started using other software….after using Turbotax for over 20 years. Good job Intuit–you just lost another loyal customer–for life.

Intuit has offered $25 rebates to returning TurboTax customers who bought the wrong product. Competitor H&R Block has also joined the party. They sell tax preparation software in addition to preparation services, and are offering free copies of their program to disgruntled TurboTax customers.

Intuit finally sent an e-mail to customers today along with that $25 rebate offer, apologizing for the confusion and explaining why the company thought that this was a good idea. That $25 doesn’t cover the entire upgrade fee, but at least the letter apologizes in plain language rather than corporatese.

We messed up. We made a change this year to TurboTax desktop software and we didn’t do enough to communicate this change to you as proactively and broadly as we could or should have. I am very sorry for the anger and frustration we may have caused you.

Intuit has a long history of doing right by our customers, and in this instance, we did not live up to the standards of excellence you have come to expect from us. We did not handle this change in a manner that respected our loyal customers and we owe you an explanation of what we are doing to make it right.

The letter concludes:

I deeply regret the anger and distress we have caused those of you affected by this change. Our customers are the heartbeat of every TurboTax employee. Our hope is that we can regain your trust and demonstrate that our commitment to you has never been stronger.

It’s important to step back and look at the big picture, too. Intuit has spent millions of dollars ($2.8 million in 2014) lobbying the federal government to make sure that American taxpayers still have to file tax returns, and even running fake grassroots campaigns against proposals, even though for most people the IRS could simply pre-populate the form with the information they have and cut us a refund check or send us a bill. The state of California already does this for state income tax returns, and other countries, including Denmark, Sweden, and Spain, do this. People would be welcome to do their own math and file a return, but they wouldn’t have to.

In its ads and sales materials, TurboTax brands itself as an “interview,” like dealing with a tax preparer but without the human interaction. Intuit doesn’t want the federal government to make filing our tax returns easier, because they want us to buy TurboTax to make filing taxes easier for us.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.