Feds Tell Nissan Dealer To Stop Saying Buyers Can Get Out Of Current Lease For Only $1

Have you been looking to get a new car but you’re stuck in the lease on your current vehicle? A Nissan dealership in Texas has been advertising that it will get you out of your present lease for only one dollar, but the Federal Trade Commission says the fine print tells a very different story.

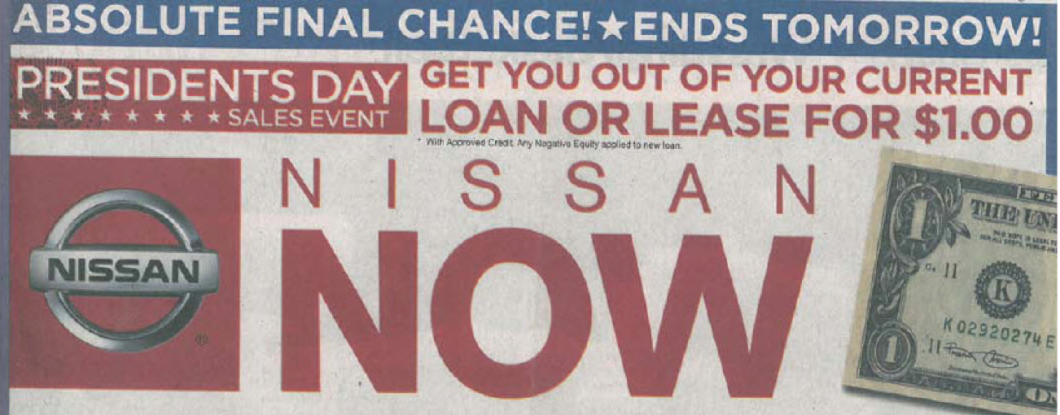

According to the FTC, Trophy Nissan in suburban Dallas started running this $1 marketing campaign in Feb. 2014, with ads like this one that appeared in a local newspaper:

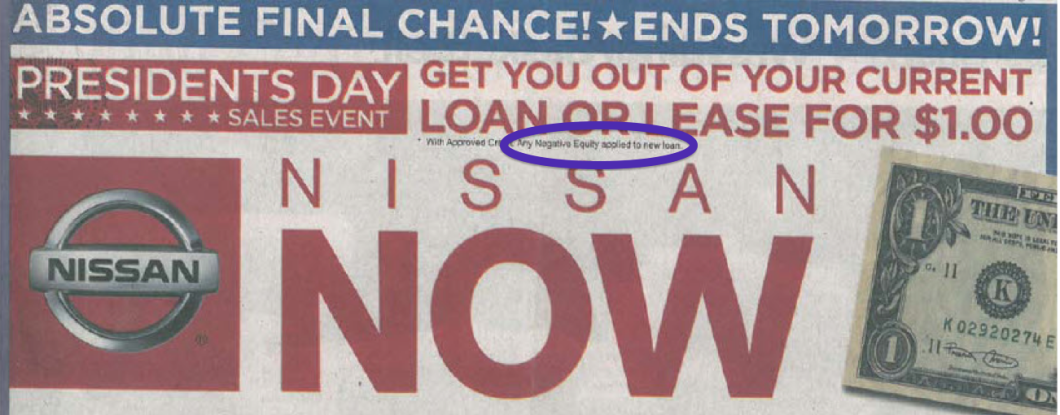

Given that many car owners might still owe several thousands of dollars on their current lease, there has to be a catch, right? Yup, and it’s there in the microprint below the marketing pitch:

Can’t read it? We’ll help you. It states that “Any Negative Equity applied to new loan.” So you’re really just rolling over the balance of your current lease to another form of financing. You haven’t actually gotten out of any obligation to repay the money owed on that leased vehicle.

The same tiny print can be found if you squint really hard at the video at the top of this story.

Regardless of whether or not you noticed these conditions, the disclosure omits important details like the fact that people with auto leases would probably need to pay a lease termination fee that would certainly be higher than one dollar.

And according to a complaint [PDF] filed by the FTC, when the dealership touted the $1 offer on Facebook and Twitter, there was no fine print or further information about the conditions anywhere to be found.

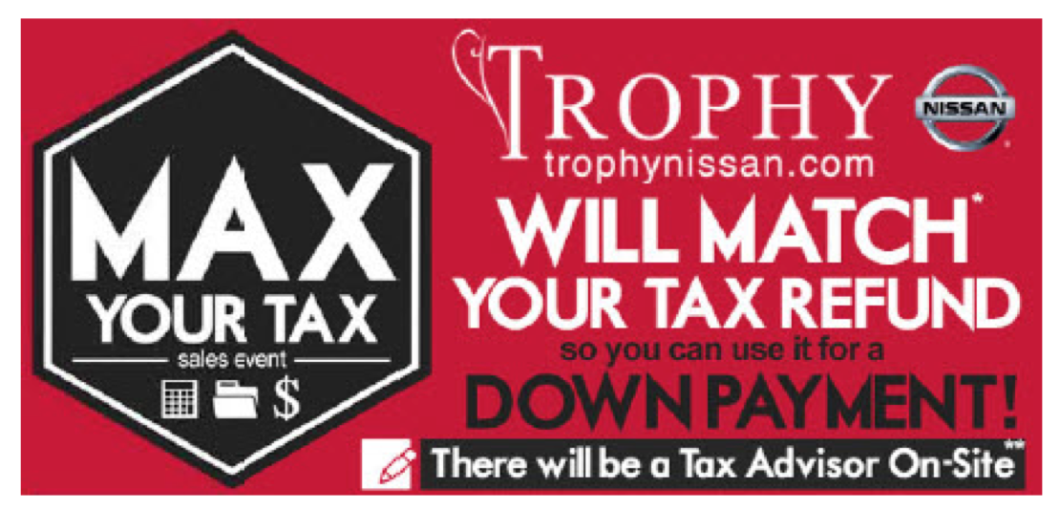

It wasn’t just this marketing campaign that drew the attention of the FTC. The dealership also ran a “Max Your Tax” promotion that promises to match a customer’s tax refund so that it could be used as a down-payment and declares that “There will be a tax advisor on-site.”

But the fine print clarifies that the refund match maxes out at $1,000 and that, in spite of the presence of a tax advisor, no tax advice will be provided.

These misrepresentations are violations of the FTC Act, according to the complaint.

In addition to the allegations of deception, the FTC further claimed that the dealership violated the Consumer Leasing Act and the Truth in Lending Act for failing to properly disclose information about leasing plans in other ads it ran.

Trophy has agreed to a proposed consent order [PDF] in which the dealership promises to stop misrepresenting it will pay off a consumers’ trade-in; misrepresenting material terms of any promotion or other incentive; misrepresenting the cost of leasing or purchasing a vehicle; and failing to clearly and conspicuously disclose material terms of a promotion or other incentive.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.