Report: Billing Errors, Varying Procedure Costs Create Environment For Excessive Medical Debt

A new report from financial-advice company NerdWallet found that about 63% of Americans have received a medical bill that was more than they expected, The Atlantic reports.

While for the most part the increased costs were a result of billing errors, other issues such as inconsistent costs for procedures and surprise add-ons wreak havoc on consumer’s financials.

Peter told the Atlantic that he was prepared for a majority of the costs associated with a procedure to fix a herniated disk. However, when the final bill came, he was shocked to find an additional charge of $117,000 for an “assistant surgeon,” an out-of-network doctor added at the last-minute.

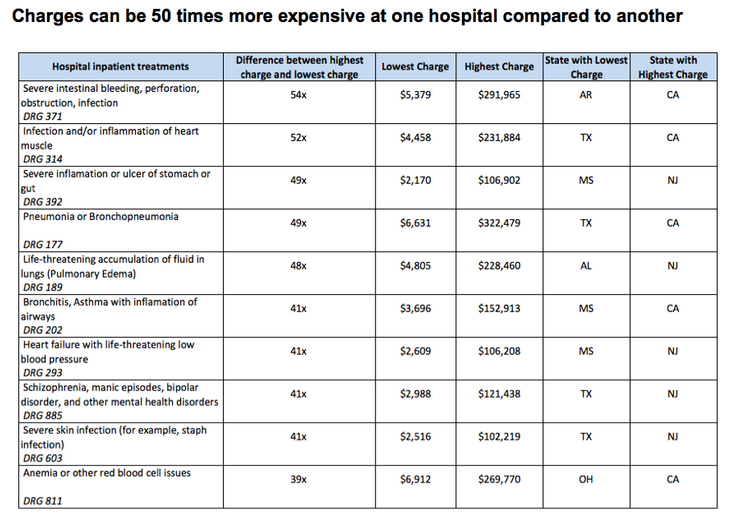

As for varying procedures, they tend to cost a pretty penny. NerdWallet found that some procedures vary by as much as 54 times the lowest cost in other places in the U.S., which reflects a lack of standards to protect patients.

For example, Californians pay nearly $300,000 for an inpatient stay for severe intestinal bleeding, while the same stay would cost a patient in Arkansas just $5,400.

Billing errors, unexpected additions and varying procedure costs are just a few reasons why 1-in-5 – or about 51 million – consumers find themselves being contacted by a debt collection agency about medical debt, NerdWallet reports.

While it can be tough to plan ahead for accidents, NerdWallet advises consumers to educate themselves on their health insurance coverage and to audit their own bills to avoid falling into medical debt purgatory.

“The system that Americans trust for their medical care is not very trustworthy when it comes to their finances,” says Christina LaMontagne, general manager of health for NerdWallet and author of the recent study. “Many Americans think they are getting the greatest care in the world, and yet the American household is more indebted to the medical system than ever before.”

Why Americans Are Drowning in Medical Debt [The Atlantic]

NerdWallet Health Study: Medical Debt Crisis Worsening Despite Policy Advances [NerdWallet]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.