And The Survey Says: ATM, Checking Account Overdraft Fees Aren’t Getting Any Cheaper

The Associated Press reports that a new Bankrate.com checking survey found the average fee for using out-of-network ATMs climbed 5% in the last year to a high of $4.35 per transaction, while average overdraft fees now sit at more than $32.

Generally, using an out-of-network ATM results in consumers being charged two fees: one from the customer’s bank and one from the owner of the ATM.

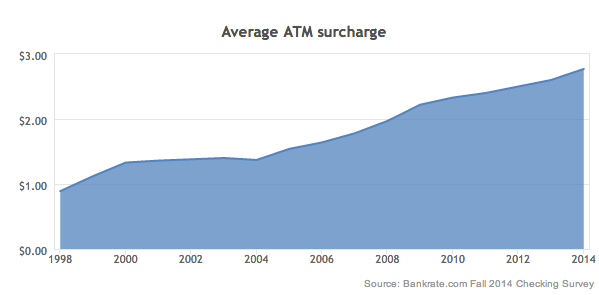

According to Bankrate.com, the average fee banks charge their own customers for going to an outside ATM rose to a new high of $1.58, while the average surcharge that banks charge non-customers at the ATM climbed to $2.77.

In all the average fee for using out-of-network ATMs increased by 23% in the past five years; marking 2014 the eighth year in a row with a new high.

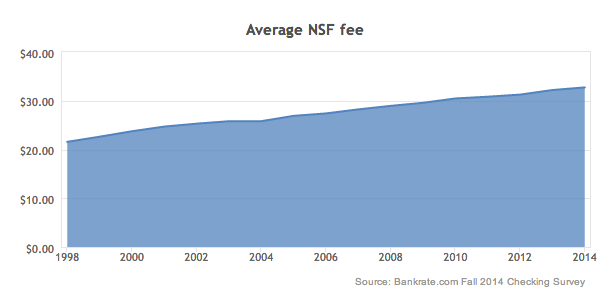

As for overdrafts, Bankrate.com found fees increasing by 1.7% to an average of $32.74. The rate marks the 16th consecutive record high.

The increased fees are just one way the banking world has responded to tougher federal banking laws that included limits on when overdraft fees on ATM and debit transactions can be charged.

Bankrate surveyed 10 of the largest banks in 25 large U.S. markets to determine fee increases.

Phoenix recorded the highest average ATM fee, charging $4.96 on average per transaction. On the flip side, Cincinnati had the lowest average fee at $3.75.

Philadelphia had the highest average overdraft fee of $35.80, while San Francisco had the lowest fee with $26.74.

In addition to having a difficult time avoiding rising fees for overdrafts and out-of-network ATM visits, consumers have fewer options when it comes to no-strings checking accounts.

Only 38% of banks in the Bankrate.com survey offer free checking. However, many of those banks often waive monthly fees if account holders have their paychecks deposited directly into the account.

Additionally, Bankrate found that the average monthly service fee for a non-interest checking account feel 5% to $5.26 over the last 12 months.

To avoid costly fees, Bankrate suggests consumers use their bank’s websites to find fee-free ATMs or get cash back while using a debit card at the register.

Survey: ATM, Checking Account Overdraft Fees Surge [The Associated Press]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.