The mega-rich can dabble in pretty much any business they want to. Warren Buffet owns everything from furniture stores to ice cream chains. Richard Branson started a commercial spaceflight company, for crying out loud. And yet with demand for high-speed, affordable internet access going only up, up, and up, no new business or venture capitalist seems to be stepping into the fray to provide it. People passionately hate their current cable companies — so what’s stopping an enterprising entrepreneur from making a giant wad of cash entering the telecom game?

Pretty much everything, actually.

Decades of regulatory history have allowed a few companies to become such large and entrenched players that competing against them is no longer worth the time and money it would cost. So let’s take a look at where we are, how we got here, and what we can do about it now.

Decades of regulatory history have allowed a few companies to become such large and entrenched players that competing against them is no longer worth the time and money it would cost. So let’s take a look at where we are, how we got here, and what we can do about it now.

Thirty years ago, a cable company was much easier to define than it is now. If you had cable, it was because a local-ish company ran some coaxial wire to a set-top box in your house, and that was how you watched TV instead of using rabbit ears. And that was pretty much the end of the story.

The landscape of 2014, though, is dramatically different. Sure, there are still a tiny handful of small local companies that run coax to set-top boxes in people’s houses. But then, there are also sprawling conglomerates like Comcast, companies that not only deliver cable to millions of subscribers across the country, but also have their metaphorical fingers in a thousand different pies.

For the sake of argument, let’s define a cable company as one that does two things: one, they provide home access to subscription pay-TV services. And two, they provide access to a high-speed broadband home internet connection.

All of the cable companies, big and small, provide both of these services as part of their range of offerings: Comcast, Time Warner Cable, Charter, Cox, RCN, and so on. So, too, do the fiber companies: Verizon FiOS, AT&T U-Verse, and even Google Fiber give consumers the choice of subscribing to one or both.

In addition to cable and fiber, there is of course also satellite TV: Dish and DirecTV between them have been providing over 45 million Americans with TV service since the 1980s. But both are in precarious positions as we barrel through the second decade of the 21st century. DirecTV doesn’t provide internet service — instead, for bundle discounts, it partners with cable and DSL providers. Dish does sell internet access, but satellite internet is significantly slower and less reliable than most other options, and most consumers that have a choice will not choose to use it.

So: cable and fiber can both fit our working definition of a “cable company.” From the end-user viewpoint, the couch where the consumer sits, the choice between services, when a choice is available, may be one of service quality, speed, or cost but isn’t particularly one of function. That is to say, whether a household subscribes to FiOS or to Time Warner Cable, the broad strokes of what they’re getting — internet access and Law and Order rerun marathons — is the same. One might be better than the other in some way (more reliable broadband, better channel offerings, lower monthly bills) but they’re conceptually interchangeable for subscribers.

The near total overlap of telecom and cable services is a relatively recent innovation, though. It wasn’t always so, and that history has everything to do with the state of cable competition today.

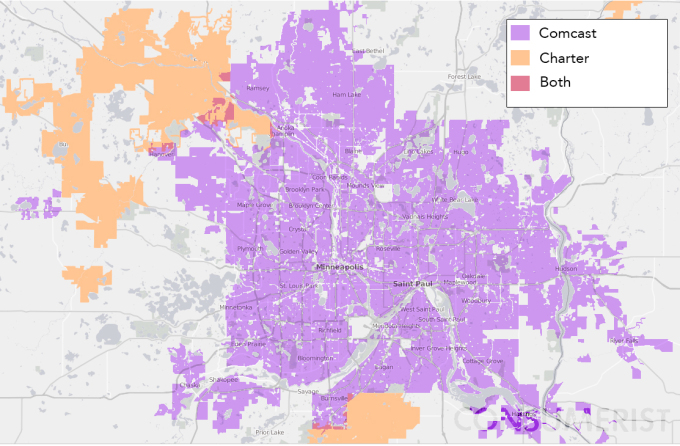

Cable companies basically don’t compete with each other at all. Remember our broadband competition maps?

Countless towns and cities around the country have similar patterns. The companies might change, but the stark borders between providers are the same. That’s no accident of fate: the competition-free pattern emerged entirely by design.

The use of cable tech for TV distribution started in the U.S. in the late 1940s, as a way to serve areas that couldn’t receive over-the-air broadcast signals. However, cable became “cable” in the way we think of it now during the 1970s and 1980s. The growth, regulation, and deregulation of the nascent industry was a bit of a mess, as these things often are.

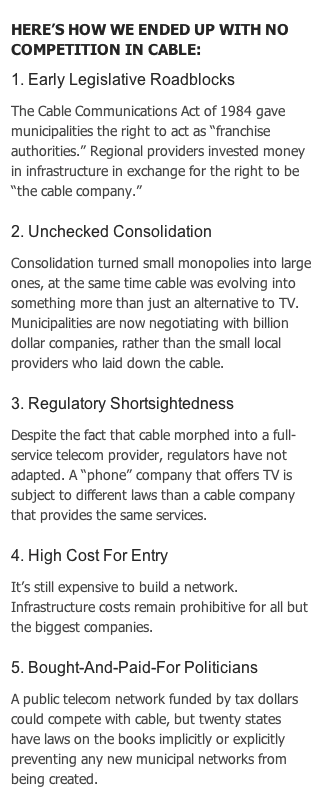

Thirty years ago, Congress tried to solve the mess with the Cable Communications Act of 1984. The full text of the act is a lot of dense legalese, but the important thing for our purposes is that it clearly delineated who has the authority to license cable operations — and that power went to the municipal level. In short, after the act was passed, cities and towns were granted the power to be “franchising authorities” that were able to grant or renew permission (a franchise agreement) for cable companies to operate under their auspices.

By the time we reached the very early 1990s, the country was full of small-scale cable providers serving small clusters of cities and towns. (This was the era when you had no idea where to find your favorite channel in the lineup when you went to grandma’s house, because she lived 30 minutes and two cable systems away.) Companies’ reach stopped at the town line because that’s where their franchise agreement stopped.

But of course, it’s not necessarily cost-effective for two small cable companies in bordering towns each to duplicate each other’s work, when they can merge together and reach twenty towns instead of ten. And then the medium-sized cable company can buy one small one, and another small one, and then it’s a biggish cable company that can just keep growing.

The Wall Street Journal published a chart in February showing just that. Over the twenty years between 1993 and 2013, over 40 regional cable companies became consolidated into just four players: Comcast, Time Warner Cable, Cox, and Charter.

While the little local cable companies were spending a decade discovering they could roll themselves up into a big cable Voltron and make more money, a bigger communications revolution was brewing over on the copper wires.

Phone lines were already strung all over every town, city, and state — all through areas that had, separately, cable franchise agreements with TV distributors. And then those phone lines started seeing a new kind of use, as families started dialing into the internet en masse. In a span of just under ten years, the familiar ear-piercing screech of a modem gave way to DSL and then to fiber.

Around 2005-2006, that fiber rollout became a way for phone companies to start selling TV subscription packages. Suddenly, Verizon and AT&T (the companies left after twenty years of the Baby Bells re-merging) became a legitimate threat to the carefully-cultivated cable monopolies.

So what functions as the same service to consumers — TV and broadband access — comes from two separate legal origins. Cable companies began from a point of being television providers, and operated under those legal obligations when later adding broadband services. Phone companies began from the point of being voice carriers, and later added broadband while operating under those legal obligations.

The “telecom” umbrella now covers both Comcast and Verizon, Time Warner Cable and AT&T. Some of their goals are mutually aligned, but the relationship between began-as-TV and began-as-phone companies has been plenty acrimonious too.

Here’s the thing about why those big companies keep getting bigger: they can afford to.

Building out an actual network — running coaxial or fiber optic cable through a city, county, or state — is an expensive and amazingly complicated endeavor. A company the size of Comcast can afford to spend a giant pile of money in one city if it’s making a larger pile of money from thirty other cities. Economies of scale, and the presence of other revenue streams, allow a company to do some big spending.

And make no mistake: it is big spending. A look at a sampling of new or current projects from around the country highlights just how much these sorts of things cost:

Seattle: Seattle already has a dark (unused) fiber optic network in place. But a now-failed plan they had in place with a third-party provider to connect that network to residences and businesses was projected to cost $25 million.

Los Angeles: LA is hoping to build a citywide gigabit fiber network. No contract has yet been awarded, but the city projects that the cost to the vendor that ultimately takes the project will run in the $3 to $5 billion range.

New Jersey: When Verizon was trying to get out of their 1993 agreement with the state of New Jersey to provide 100% broadband coverage, they said in a filing to the state that they had spent “more than $13 billion” on the wired infrastructure — and still hadn’t reached the whole, not-that-big state.

Kansas City: Kansas City, KS granted Google significant incentives to become the first Google Fiber town, but even so, expanding is a costly venture. The total estimated cost to Google for building out a fiber network in both Kansas Cities? $94 million. And of course Google’s expanding Fiber access to a handful of other cities. Analyst estimates project that in order to reach about the same number of subscribers as Cox or Charter have, Google will have to spend $8 to $10 billion over roughly a decade.

There’s also a large secondary cost to building out any kind of infrastructure project anywhere, and it’s not measured in dollars. (Although it sure does take plenty of them.) It’s political clout.

The cable and phone providers, as discussed above, have had a decades-long opportunity to become thoroughly entrenched in their areas. And if there’s one thing a big, powerful monopoly hates, it’s upstart challengers.

A local monopoly has power: not just over the consumers who are stuck with it, but also over the officials who would attempt to regulate it. Back in February, when Comcast announced its intention to buy Time Warner Cable, the Washington Post observed just how much power Comcast already has over municipalities, using the case of Seattle:

The acquisition will also make Comcast less accountable to state and local regulators. Consider the comments of Seattle Mayor Ed Murray. Murray notes that the city’s franchise agreement with Comcast—the agreement that gives the cable company permission to operate its network below public streets and other city-owned infrastructure—expires in January 2016. Murray vows to use the renewal process to ensure that Comcast is doing a good job of serving Seattle consumers. “If we determine Comcast has not lived up to their obligations, the City of Seattle will not renew the franchise agreement,” Murray warns.

But the reality is that Murray won’t have much leverage. If Comcast were a small company that only provided service in the Seattle area, then Murray would hold the power of life or death over it. Comcast would have to work hard to address the mayor’s concerns or have its business shut down. But Comcast is a huge company. If the mayor demands major concessions in exchange for a renewal, Comcast can afford to call Mayor Murray’s bluff. Cancelling Comcast’s franchise would hurt Murray more than Comcast.

Comcast is spending $45 billion to buy Time Warner Cable — and it’s spending additional millions on political donations and philanthropic donations in order to grease the wheels of regulatory approval for that deal.

The existing industry doesn’t just use their clout to make things easier for themselves; they use it to make things harder for anyone else, too.

Any other infrastructure project — a road, a bridge, a tunnel, a dam — would face many of the same sort of hurdles that a new cable or fiber company would face. Digging and building are always expensive, and every place in the country is subject to some set of competing or complex regulations.

Except that most other infrastructure projects in the U.S. aren’t a matter of private companies deciding where to work, and for how much profit. They’re public projects, bringing together local, state, and/or federal governments and resources and private contractors to make a necessary project happen, for the shared public good.

There are a few hundred, cities, towns, and counties in the U.S. where broadband access is taking just that path. Bigger cities and smaller towns alike are maintaining or building out municipal fiber networks, both to local businesses and to residents.

In face of all the very real barriers to increased business competition — the financial and political costs — these municipal networks are the most likely route to increased competition and better broadband service around the country.

But this is where that “entrenched power making things harder for everyone else” bit comes in: thanks to the tireless work of cable and telecom lobbyists and political donations, twenty states have laws on the books implicitly or explicitly preventing any new municipal networks from being created.

There is a ray of hope, though. Just this month, FCC chair Tom Wheeler indicated that the agency might be willing to step in and help do away with all the state-level laws blocking municipal broadband projects.

Without those laws in place, maybe you can start that cable company, after all… with your tax dollars. And if the existing companies keep getting ever-larger, and facing even less competition, you might very well want to.

photo credits, top to bottom: Tom Simpson; Scott W. Vincent; Molly; MissConduct; So Cal Metro; The Joy of the Mundane; Sten