In Spite Of Evidence To Contrary, AG Holder Claims “Too Big To Jail” Is A Myth

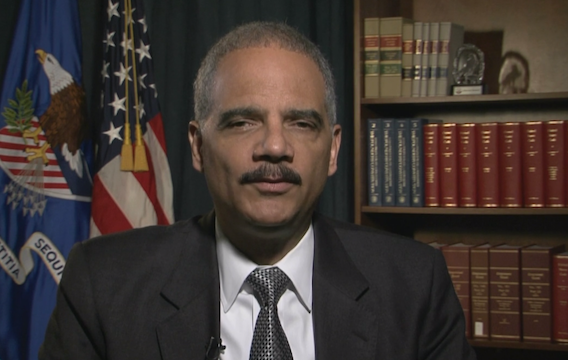

Is Attorney General Eric Holder all talk and no action? For the second time this year Holder has made it clear that the Justice Department does not believe that any corporation or executive is too big to jail. But an abundance of fines and a lack of actual prosecutions is enough to make one wonder if the declarations are just for show.

Is Attorney General Eric Holder all talk and no action? For the second time this year Holder has made it clear that the Justice Department does not believe that any corporation or executive is too big to jail. But an abundance of fines and a lack of actual prosecutions is enough to make one wonder if the declarations are just for show.

On Monday, Holder continued his message that no company is too large or important to indict in a video message on the Justice Department’s website.

“There is no such thing as too big to jail,” Holder says. “Some have used that phrase to describe a theory that certain financial institutions, even if they engage in criminal misconduct, should be immune to prosecution due their sheer size and influence on the economy. That view is mistaken and it’s a view that has been rejected by the Department of Justice.”

Holder made similar statements during an interview with MSNBC back in January. At the time Holder cited recent cases against JPMorgan Chase & Co. as an example of how prosecutors can pursue criminal charges if warranted. Yet, four months later that investigation continues.

“[We] always follow the law and facts wherever they lead,” Holder said Monday. “Sometimes a company’s conduct may be wrong, may be hard to defend, but not necessarily in violation of criminal law. When laws indeed appear to be broken and evidence supports allegations a company’s is size will never be a shield from prosecution or penalty.”

The department has continually been criticized for the lack of action in pursuing criminal charges against Wall Street banking institutions and their executives following the 2008 financial crisis.

Instead, most banks settle cases rather than head to court and admit wrongdoing. In the past two years, JPMorgan has paid out more than $33 billion to settle several investigations and findings by the federal government. Just last week, it was revealed that Bank of America received a settlement option of $20 billion to end investigations into its troubled mortgage investments. The bank has yet to respond to the offer.

Making amends without actually saying sorry might be part of the past for large companies if Securities and Exchange Commission Chairwoman Mary Jo White has anything to do with it.

Earlier this year, White told the Los Angeles Times that the agency has more power than they were perhaps using – and part of that leverage is getting wrongdoers to admit their wrongdoings.

Holder may be gearing up to tap into that power. He says he is personally monitoring the status of ongoing cases and that cooperation between the Justice Dept. and regulators has improved when it comes to conducting such investigations.

“We have made great strides in improving this type of cooperation between prosecutors and regulators,” He says. “This cooperation will be key in coming weeks and months as the Justice Dept. continues to pursue investigations.”

While Holder wouldn’t specify what entities he’s monitoring, investigations surrounding alleged criminal charges against Swiss banking giant Credit Suisse and France’s BNP Paribas have been making headlines lately.

According to the Washington Post, prosecutors and lawmakers have accused Credit Suisse of assisting wealthy Americans to hide billions of dollars from U.S. tax collectors for at least four years.

The Senate’s permanent subcommittee on investigations chastised the department for dragging their fees on pursuing charges against Credit Suisse and its executives.

Additionally, the Justice Dept. is finishing an investigation against BNP for allegedly allowing millions of dollars from countries under sanctions, including Sudan and Iran, to illegally move through the U.S. financial system.

There have been previous glimmers of hope that the DOJ was going to get serious about prosecuting bank executives. Last year, Lanny Breuer, the Asst. Attorney General tasked with investigating banks’ involvement in the financial collapse, left his position after being humiliated in an episode of Frontline that challenged his division’s failure to bring charges against bank executives.

No company is too big to jail, Holder says of Justice Dept. probes [The Washington Post]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.