Airbnb To Start Collecting Taxes In Portland, San Francisco, Maybe New York City

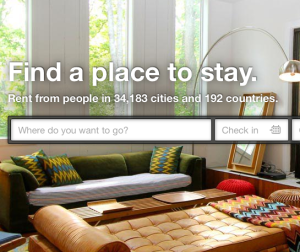

Airbnb is a site that lets people rent rooms or entire apartments or houses, directly from the homeowner or renter. It has proven popular with travelers, but less popular with landlords, the hotel industry, and local governments. Why do local governments care? Airbnb rentals aren’t subject to sales and hotel changes. In some cities, that’s about to change.

Airbnb is a site that lets people rent rooms or entire apartments or houses, directly from the homeowner or renter. It has proven popular with travelers, but less popular with landlords, the hotel industry, and local governments. Why do local governments care? Airbnb rentals aren’t subject to sales and hotel changes. In some cities, that’s about to change.

In the past week, Airbnb announced that it would begin collecting and remitting taxes on behalf of its “hosts” in a few cities. First was Portland, in a deal that legalizes short-term sublets in that city and that the company swears has absolutely nothing to do with the company’s decision to open an office there that will create 160 new jobs. Guests will pay 11.5% in lodging and sales taxes on their Portland rentals.

The site is also negotiating with New York City. They’d really like for short-term rentals to become explicitly legal there, you see, and have promised to collect and remit $21 million in local and state taxes if that happens.

Good citizenship begins at home, of course, and the company announced earlier this week that it will also collect taxes on short-term rentals in its home city of San Francisco. Part of the problem is that the tax system simply isn’t set up for transactions like this. “We know from countless discussions with our hosts that they want to pay taxes, but some of these rules are arcane and difficult to follow,” Airbnb explained in a post on their public policy blog. Some hosts have even tried to pay taxes in San Francisco and been turned away.”

Airbnb Tries to Grow Up, Finally Agrees to Collect Taxes in Two Cities [Wired]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.