Sallie Mae Wants Me To Pay Down Debt By Opening Up A Credit Card

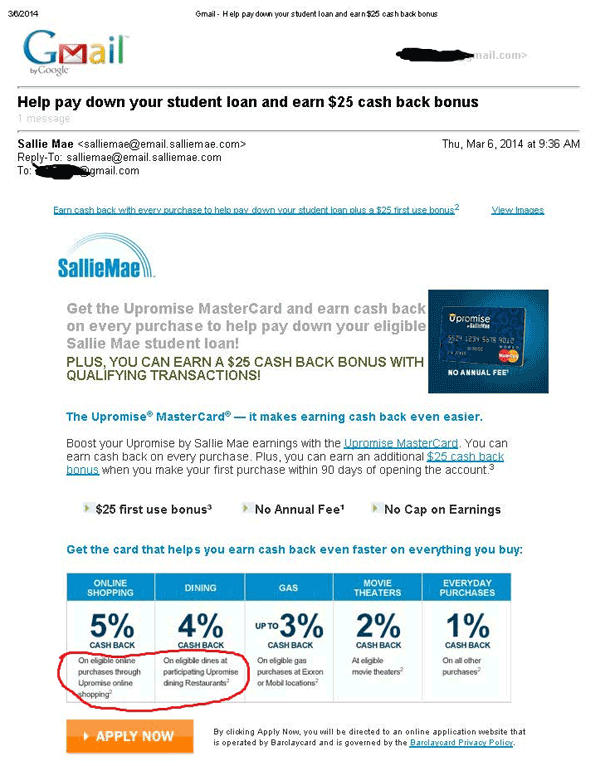

On the surface, this e-mail that reader S. received from Sallie Mae doesn’t seem like a bad idea. It’s offering a new credit card, which maybe you were going to get anyway. You can use the card’s cash-back rewards to save for a loved one’s college education, or to pay off your own student loans. Yet it doesn’t sit right with S.

On the surface, this e-mail that reader S. received from Sallie Mae doesn’t seem like a bad idea. It’s offering a new credit card, which maybe you were going to get anyway. You can use the card’s cash-back rewards to save for a loved one’s college education, or to pay off your own student loans. Yet it doesn’t sit right with S.

We’re not saying that credit cards are bad. Indeed, we encourage judicious use of them instead of debit cards to extend the warranty on major purchases, and to protect yourself from card skimmers or payment information breaches. Protecting yourself from fraud: good. Losing track of your monthly spending by flashing plastic: bad. Racking up huge amounts of debt: really bad.

“Apparently opening a credit card and spending money through online shopping and dining out at restaurants is a great way to pay down student loans,” S. wrote to Consumerist. “I get the idea that there is a whole cash back thing happening here, but someone didn’t think this campaign all the way through.”

It doesn’t send a very good message to borrowers, but someone definitely thought this all the way through. Sallie Mae, as you may recall, is splitting itself up, dividing into two companies: Navient, which will originate and administer federally-backed student loans, and Sallie Mae, a consumer bank that will offer private student loans and consumer banking services. Like credit cards. Sallie Mae happens to own UPromise, as well.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.