CFPB Looking Into “Confusing Rules” Of Credit Card Rewards Programs

In an e-mail to Bloomberg News, CFPB Director Richard Cordray wrote of the “detailed and confusing rules” for credit card rewards programs and said the Bureau “will be reviewing whether rewards disclosures are being made in a clear and transparent manner, and we will consider whether additional protections are needed.”

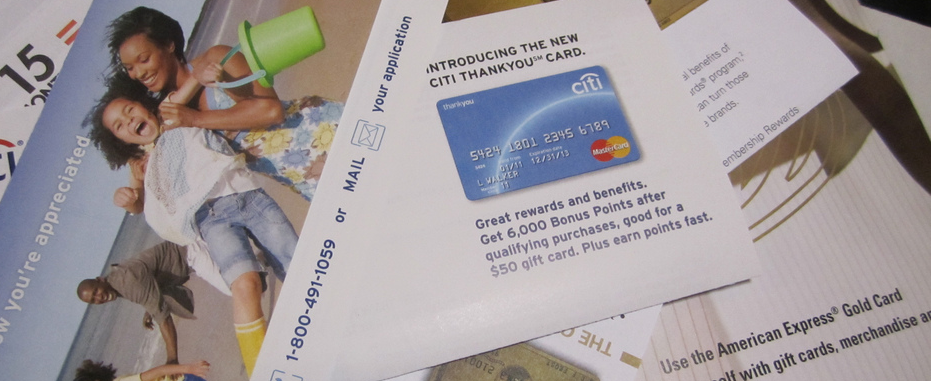

At issue is whether consumers understand what it actually costs to earn the rewards — whether its airline miles, retail discounts, cash back, or some other benefit — that are advertised by the card issuers, and whether these companies are being transparent about the limits on using these rewards.

While many banks ditched debit card rewards programs after new legislation limited the amount of money the card issuer received for each retail transaction, the programs have remained on credit cards as a way to entice consumers into charging more, thus earning more rewards while also making it more likely that the cardholder will carry a higher balance.

“To what degree does something have to be a problem before we take a look at it?” asks Pamela Banks, senior policy counsel at Consumers Union. “We should identify trends early.”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.