Sen. Warren Introduces Bill To Lower Rates On Student Loans To .75% For One Year

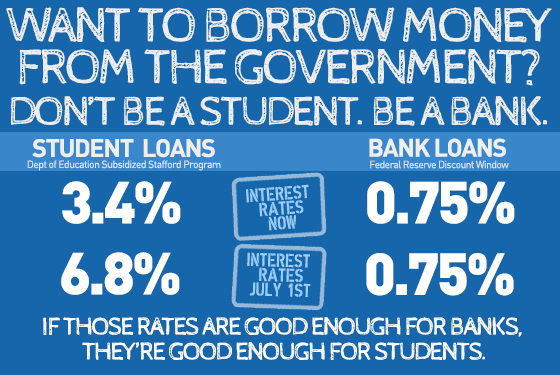

While commercial and personal borrowers are currently enjoying historically low interest-rates on loans, and big banks are able to obtain loans at less than one percent interest, student borrowers have had to fight against lawmakers looking to raise interest rates on federally subsidized student loans. With the rates on Stafford loans set to bounce back to 6.8% from 3.4% on July 1, Massachusetts Senator Elizabeth Warren has introduced legislation that would actually lower that rate for one year to only .75%.

While commercial and personal borrowers are currently enjoying historically low interest-rates on loans, and big banks are able to obtain loans at less than one percent interest, student borrowers have had to fight against lawmakers looking to raise interest rates on federally subsidized student loans. With the rates on Stafford loans set to bounce back to 6.8% from 3.4% on July 1, Massachusetts Senator Elizabeth Warren has introduced legislation that would actually lower that rate for one year to only .75%.

This is the same rate at which big banks are able to borrow money from the Federal Reserve, so Sen. Warren wants to know why banks get preferential treatment to America’s students.

“[T]he federal government is going to charge students interest rates that are nine times higher than the rates for the biggest banks,” said Sen. Warren, “the same banks that destroyed millions of jobs and nearly broke this economy. That isn’t right.”

That’s why Warren introduced the Bank On Students Loan Fairness Act [PDF], which would prevent Stafford loan rates from reverting to 6.8% on July 1 and would set the interest rates for loans disbursed until July 1, 2014, at “the primary credit rate charged by the Federal Reserve banks on July 1, 2013.”

The Senator maintains that by allowing banks to borrow at insanely low rates, taxpayers are effectively investing in those institutions.

“We should make the same kind of investment in our young people who are trying to get an education,” she explained. “Lend them the money and make them pay it back, but give our kids a break on the interest they pay. Let’s bank on students… Unlike the big banks, students don’t have armies of lobbyists and lawyers. They have only their voices. And they call on us to do what is right.”

“Senator Warren’s bill underscores the great disparity between the extremely low interest rate that big banks pay to borrow money and the higher rates that students often pay,” said Pamela Banks, Policy Counsel for Consumers Union. “Congress needs to act to find a way to help struggling students manage skyrocketing loan debt.”

Speaking of which, Consumers Union recently drafted the following list of principles it believes are the backbones of any fair student loan system:

PRIOR TO BORROWING

Transparency: Lending options should be easily comparable

Schools should be required to provide students with plain English, standardized disclosures that clearly explain their options for financing education, including grants and scholarships as well as loans. The disclosures should enable students to compare and understand the differences between private and federal loans, as well as their estimated monthly loan payments after graduation.

Borrowing Options: Schools should help students find the most affordable loan options

To prevent unnecessary borrowing, private lenders should be required to check with the borrower’s school before making a loan. Schools should provide students with pre-loan counseling to review loan costs and eligibility requirements for less costly options.

PAYING BACK THE LOAN

Flexible Repayment: Borrowers must be given reasonable options

Lenders should offer flexible, affordable and sustainable repayment options, including income-based payment plans, deferments and forbearances, regardless of the type of loan. Lenders should also permit refinancing of loans, and accept partial payments.

Reasonable Costs: Fees should be reasonable and proportional to services provided

Borrowers should not be penalized with excessive, new or hidden fees. Lenders should not be allowed to manipulate payments in a manner that harms borrowers

Accountability: Students should have access to effective and timely loan inquiries and dispute resolution

Those who administer and collect student loan payments should be required to establish clear procedures and a single point of contact for questions and complaints. Complaints handling, resolution and appeals should be centralized and monitored by regulators.

Fairness: Abusive, unfair or fraudulent practices must not be permitted

All borrowers should be protected from deceptive marketing, abusive collection and repayment practices, identity theft, school kickbacks and other fraudulent student loan practices and services.

INABILITY TO PAY

Reasonable Relief: Loans shouldn’t be a lifelong burden

All borrowers should receive opportunities to rehabilitate loans back to good standing with an affordable and sustainable repayment plan. Borrowers should also have the opportunity to obtain loan cancellations in certain circumstances, including long-term economic hardship.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.