Meet The Card Skimmer That Might Make You Think Twice About Ever Using An ATM Again

Once upon a time, identity thieves hoping to capture victims’ debit and credit card information had to resort to clunky, sometimes obvious skimming devices. But as consumers have grown more savvy about how to identify a possible skimmer, the devices have evolved to a point where some are all but impossible to detect by the naked eye.

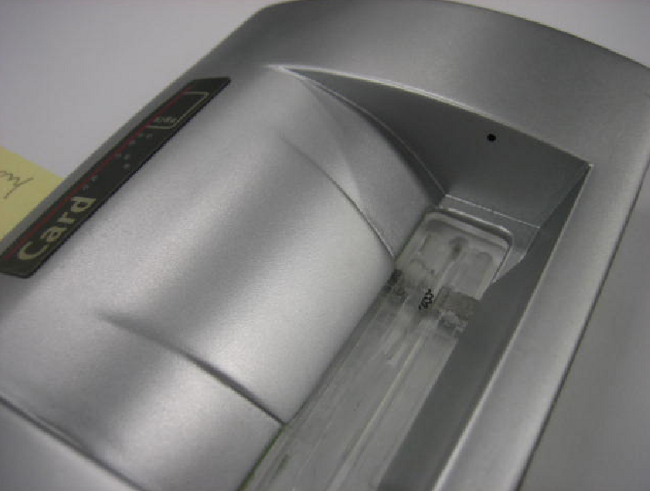

Security expert Brian Krebs recently posted some photos and info about a skimmer that looks exactly like the card slot on an ATM machine, but will give the ID thief both your card number and your PIN.

The device is powered by a cell phone battery and contains technology to skim your card and the guts of a digital video camera that peeks out through a tiny pinhole in the plastic shell and records time-stamped footage of victims punching in their pin so that the scammers can match up the information later on.

As Krebs points out, the best way to defeat the PIN-recording aspect of the skimmer is to simply cover your hand when entering the information.

Check out KresbsOnSecurity.com for more photos of this skimmer and more information on how to protect yourself.

PREVIOUSLY:

Shield Yourself From Credit Card Skimmers

Check Out This Nearly Undetectable ATM Skimmer

Customer Discovers Card Skimmer On Bank ATM

Those Anti-Skimming Gas Pump Stickers Don’t Work If You Do It Like This

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.