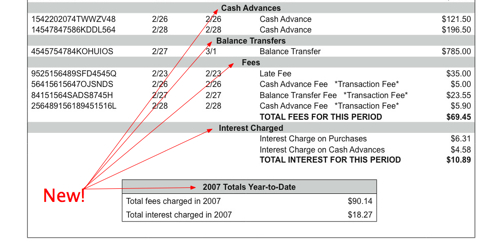

The Federal Reserve Board wants credit card companies to clean up their act, and the credit card companies couldn’t be happier. The Fed’s proposed regulation would give customers 45 days notice before a change to their card’s terms, require fees and interest to be shown separately on each bill, and would transform default APR into the more menacing-sounding penalty APR. None of this is objectionable to the credit card companies:

“We strongly agree that improved disclosures empower consumers to make better choices in our competitive marketplace,” said Edward Yingling, head of the American Bankers Association, a lobbying group that represents the biggest credit-card issuers.

We tell you why creditors are grinning, after the jump…