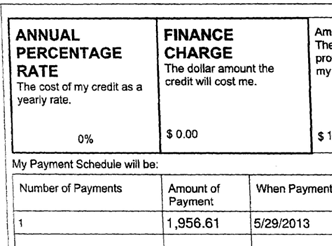

The terms and conditions for short-term, high-cost loans can often be confusing, making it difficult to decipher just how much a borrower will spend to repay an initial loan. That was apparently the case for TMX Finance, the company behind TitleMax, as federal regulators fined the company $9 million for allegedly luring consumers into costly loan renewals by presenting them with misleading information about monthly plans. [More]

titlemax

Millions In Campaign Contributions Enable The Title Loan Cycle Of Debt

Each year, thousands of consumers lose their vehicles – often their largest asset – after taking out small-dollar, high-interest auto title loans to cover expenses. Despite hundreds of attempts by lawmakers to rein in the often predatory auto title market, generous campaign donations from the industry’s leaders have created a cycle in which consumers are plunged deeper into debt, while title lenders continue lining their pocketbooks. [More]

Auto-Title Lender Skirts Law By Giving Away Cash For Free

Several cities in Texas have recently enacted laws intended to drive out or rein in short-term, high-interest lenders offering auto-title loans, in which borrowers put up their cars as collateral for short-term loans averaging around $1,500. But one lender has figured out a way to get around those laws — by giving away free cash and redirecting customers elsewhere when they need to refinance. [More]