Seems like a huge burden to bear, huh? But like everything else, there are two sides to the story, as CNN Money reports :

taxes

Pay Your Taxes Or The Government Will Cut Power, Internet, Phone, Television, And Mail Service To Your Compound

You know those kooks who go around not paying their taxes and saying there’s no law to make them? Well, a pair of tax-evading renegades in New Hampshire are finding out the hard way that tax evasion can lead to an armed standoff with federal agents. Ed and Elaine Brown of New Hampshire haven’t paid income taxes since 1996, despite being convicted in January of evading taxes on almost $2 million of income generated by Elaine’s dental practice. The pair have cloistered themselves inside a 110 acre compound where they enjoy the glorified lives of tax fugitives. From the LA Times:

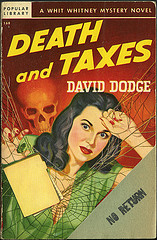

Man Dodges Taxes For 10 Years, Wins In Federal District Court

You know those kooks who go around not paying their taxes and saying there’s no law to make them? Well, one of them just won.

3 Common 401(k) Mistakes

The 401(k) is one of the best ways to maximize your retirement savings. After all, if the company matches your contribution, you start off with a 50% to 100% gain right off the bat. That said, many employees are not making the most of the potential locked in their 401(k)s. Here are some of the most common mistakes, according to Vanguard:

Cigarette Taxes Rising To $1 Per Pack

Sorry smokers, the federal cigarette tax will soon be $1 per pack, a 61 cent increase, if the Senate Finance Committee has its way. Both chambers of Congress agree that a higher tax is needed to help finance an expansion of the Children’s Health Insurance Program. From the Times-News Online:

Elderly Couple Could Lose Home Over $1.63 Tax Bill

In 1996 a property tax bill for $1.63 was mailed to Kermit and Dolores Atwood. The bill never reached its destination, according to the Times-Picayune. Now, 11 years later, the Atwoods are in danger of losing their home.

Back-To-School State Sales Tax Holidays

Just in time for back to school, Raising4Boys has posted a list of which states have state sales tax holidays. He lists when they occur, what goods are applicable, and if there’ s a maximum dollar amount. We’ve always found that state-sales-tax-free white glue is better for peeling off your hands…

../../../..//2007/07/03/starting-2008-kids-making-more/

Starting 2008, kids making more money off investments are subject to higher taxes.

IRS Fails Audit: Free File "Did Not Always Accurately Compute Taxes"

A Treasury Department audit found that Free File users with kids may have missed out on several significant tax credits. Free File allows “low-income” Americans – taxpayers making under $52,000 per year – to file their taxes for free. The audit discovered that the program’s online affiliates “could not handle simple returns,” resulting in the following failures:

Make More Money By Adjusting Your Witholdings

Why give the IRS an interest-free loan throughout the year? Instead, boost your monthly earnings by changing the amount of withholdings you claim. Kiplinger offers an easy 3-question calculator to help you figure out the right number.

How To Lower Your Property Taxes

Free Money Finance dredged a fascinating statistic from Kiplingers that suggests 60% of homes are overvalued by assessors, and that 33% of tax appeals succeed. The stat comes from a dubious source, the National Taxpayers Union, described by the San Francisco Chronicle as the “the grand-daddy of the tax revolt organizations.” Assessments guide property taxes, which are universally reviled by homeowners. Even politicians, who suckle tax revenue with the vigor of a vampire on a vein, regularly crusade against property taxes during election season.

Walmart Subsidy Watch: Why Do Public Officials Give Your Tax Money To Walmart?

Here’s something we don’t really understand. Why do public officials feel they need to give government subsidies to the nation’s largest employer? It’s sort of baffling.

IRS Investigates Jackson Hewitt Further

The IRS investigation into Jackson Hewitt’s malpractices has deepened, NYT reports:

The lawsuits filed against the Sohail-owned or controlled franchises said that employees had been pushed to crank out returns in exchange for bribes, to accept scant or false documents, like W-2 forms, and to falsify taxpayer data to receive the earned-income tax credit, a federal assistance program.

And that’s why we like accountants. Not only will a good one help you find deductions, they also know enough to not do stupid stuff. It’s you, not the tax form preparer, on the hook if you file a fraudulent return. — BEN POPKEN

Is Getting Married A Bad Investment?

As two happily single but committed persons, you’d pay $38,621.50 ($19,310.75 each); $39,392.50 if you were married, a difference of $771. As you make more and more money, the difference becomes more acute. So, either don’t get married, or don’t make a lot of money… a fair decision for someone to have to make right?

Take that, love. —MEGHANN MARCO

Mo' Money, Mo' Problems

• What Do You Look For In An Online Bank Account? [Money, Matter, and More Musings] High interest rates, easy synchronization with other bank accounts, absolutely zero fees and seven other factors you should consider when selecting an online bank account.

Beer Money In Congress

Beer manufacturers are lobbying congress in order to secure a “beer tax rollback” which would “cut the federal beer tax in half to its 1951 level,” according to the CSPI. Alcohol producers donated around $10 million to federal candidates in the last election cycle, and 70% of that was “beer money.”

Dude Busted For Running An Illegal Bank For Tax Evaders From His Suburban Home

An IRS investigator said Robert Arant had hundreds of customers, many of whom apparently used his bank, Olympic Business Systems LLC, to conceal assets for the purpose of evading taxes.

Post-Tax-Day Tips

Tax day is over but that doesn’t mean the party has to stop. WFMY has a roundup of tax tips for lingering tax issues, like setting up an installment payment plan, who to call if you have a major problem, and fixing errors.