If you’re married and the two of you own your house, is your legal title recorded as “joint tenants” or “community property”? If you bought it recently, odds are good it’s “community property” (and it should also include “with right of survivorship”).

taxes

Failure: H&R Block Shuts Down Subprime Lending Operation

H&R Block has decided to admit defeat after a plan to sell its troubled subprime lending operation to Cerberus Capital Management LP finally unraveled.

Find Out What Your IRS Refund Will Be

What’s your tax refund for 2007 going to look like? Go to this withholding calculator at the IRS website with your paycheck at your side, answer the questions, and they’ll give you a good estimate of what your refund will be. They will also give you suggestions for changing your withholdings.

10 Tips For Lowering Your Taxes

This list of ten tips to reduce taxes was published nearly a year ago, but they’re still relevant, and we thought now would be a good time to share them before Kiplinger releases its new “10 Ways” list later this month. Among the tips: make sure you load up your retirement accounts and flexible spending accounts, and remember that the government gives you a 2 ½ month grace period on reimbursing yourself from an over-funded flex account.

Is Express Taxing Tax-Exempt Items?

An Express in New York City charged a sharp-eyed reader tax on a belt that cost $34.50. Neither the city nor state levy tax on items costing less than $110.

Kmart Loses Toilet Paper Tax Lawsuit

Mary Bach, the woman who sued Kmart for charging tax on toilet paper, has won her lawsuit and $100. Kmart offered to settle with Bach, but she declined.

The IRS Has $110 Million In Refund Checks For You

If you’ve moved recently and did not get your refund check, you might want to contact the IRS and see if it was returned as undeliverable.

../../../..//2007/11/26/4-ways-for-small-business-owners/

4 ways for small-business owners to save on next year’s taxes. [WSJ]

../../../..//2007/11/15/are-companies-that-offer-free/

Are companies that offer free e-filing of IRS tax returns, linked from the IRS website, actually charging customers? [6abc]

House Passes AMT Fix

The House voted 216-193 on Friday to keep 21 million middle-class taxpayers from paying the alternative minimum tax (AMT) next year. Republicans opposed the measure because the bill is funded by raising the tax on carried interest, paid exclusively by investment bankers, from 15% to 35%.

Friday’s bill would extend AMT relief for one year, at a cost of about $51 billion. It includes another $30 billion in largely popular tax relief measures, including expanding the child tax credit, providing a property tax deduction to some 30 million families and extending a tax exemption for the combat pay of military personnel.

IRS Grants Tax Relief To California Wildfire Victims

The IRS is extending deadlines for those of you within the Presidental Disaster Area caused by the wildfires.

Taxpayers in the Presidential Disaster Area — consisting of Los Angeles, Orange, Riverside, San Bernardino, San Diego, Santa Barbara and Ventura counties — will have until Jan. 31, 2008, to file returns, pay taxes and perform other time-sensitive acts.

IRS: Report Your Poker Winnings, Or Else

The IRS is clarifying the fact that yes, you do have to report your poker winnings as income, because apparently there has been some “confusion.” Ahem.

Today Is The Deadline For Late Tax Filing

Today is the deadline to file your taxes if you got an extension back in April. File them.

13,000 People Are Getting A Surprise Audit!

13,000 lucky Americans will soon receive letters from the IRS explaining that they’ve been selected for a random audit. The hapless participants are rounded up as part of the IRS’ National Research Program, which seeks to explain why the Treasury receives $300 billion less than we Americans collectively owe. A random audit is nothing to fear unless you are a tax cheating yutz.

../../../..//2007/10/14/remember-ed-and-elaine-brown/

Remember Ed and Elaine Brown? The federal government cut power, internet, phone, television and mail service to the couple’s 110-acre compound after they failed to pay taxes on $2 million of income. Well folks, the Brown’s four-month standoff is over. U.S. Marshalls seized the Browns last week without incident. Please remember, pay your taxes before federal agents seize you and your compound. [WMUR]

IRS Struggles To Give Away $8 Billion

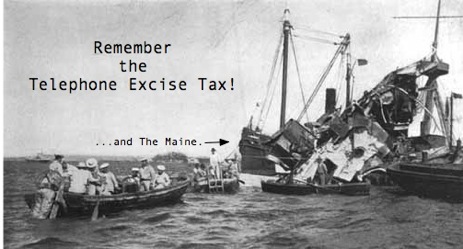

Free money! Free money! We shouted, begged, implored you to take the free money that was rightfully yours, but no, you would have none of it. The free money was too good for you. Too much effort, you said, to fill out a simple line on your tax return to celebrate phone ownership and our victory in the Spanish-American War. And now, $8 billion beautiful bucks lie cluttering our treasury, taking up valuable space needed for Social Security IOUs.

K-Mart Illegally Taxes Toilet Paper

A Pennsylvania K-Mart levied an illegal $0.28 tax on Mary Bach’s $3.99 12-pack of Angel Soft toilet paper. Pennsylvania’s sales tax guide clearly states that toilet paper is a non-taxable item. Mary first spoke with a cashier after noticing the illegal charge. When K-Mart again charged her the tax on a second visit, she decided to sue.