Every year, as way to make itself feel important and useful, the federal government makes modifications to the tax code. Here’s a detailed breakdown of all the changes for 2007 and how they affect your wallet, from AMT exemption amounts, to deductions for business-related mileage.

taxes

../../../..//2008/01/30/the-house-yesterday-passed-hr/

The House yesterday passed H.R. 5140, the Recovery Rebates and Economic Stimulus for the American People Act of 2008, by a vote of 385-35. The $146 billion economic stimulus plan funds $600 rebates for most taxpayers making less than $75,000. The Senate is preparing a competing $161 billion package that would extend unemployment insurance and give most Americans, including billionaires, a $500 rebate check. Speaker of the House Nancy Pelosi begged the Senate to shut up and play nice, saying: “I hope the Senate will take heed. It’s not unprecedented that one chamber has yielded to another.” [THOMAS]

6 Tax Credits That You Shouldn't Overlook

Here are 6 tax credits that can help you with the cost of education, child care, and improving your home.

Low Income? You May Qualify For Tax Saver's Credit

If you’re single and earned less than 26,000 last year, or married and together made less than $52,000, then you can qualify for a tax credit of up to $1000 if you contributed to a retirement savings account during the year. To get the maximum credit, you’ll need to have socked away $2,000 and earned less than $15,500 as a single tax filer ($31,000 if married). And yes, this is a credit, not a deduction (something this writer has confused in the past), so it can make a significant difference on your final tax bill.

../../../..//2008/01/29/the-irs-aint-so-evil/

The IRS ain’t so evil, they sponsor free tax prep help program to give you assistance with your taxes. [IRS]

Poll Results: How Will You Spend Your Tax Rebates?

Last Thursday we polled our readers for what they plan on doing with their money when they get their tax rebate checks. The result is that Consumerist readers mainly plan on using their money in precisely the opposite way that the politicians want them to, paying off debt (46.3%) and saving it in the bank (30%). All the other options combined, which would have a supposedly more directly stimulating effect on the economy, add up to only 23.8%. Food came in at 1.5%, depreciating assets 8.2%, discretionary spending 4.5% and stimulating the critical beer and cigarette industries 9.6%. It seems our readers are more concerned about their personal finances than the national economy. Good. Maybe if more people were like them we wouldn’t be in this mess in the first place.

../../../..//2008/01/28/president-bush-is-expected-to/

President Bush is expected to use his State of the Union address to tell the Senate to STFU and pass the stimulus package already. [Associated Press]

Worst Tax Product Ever: The Refund Anticipation Loan Debit Card

Refund anticipation loans are bad enough, but H&R Block and Jackson Hewitt want you to get a RAL, and then put it on a fee-riddled pre-paid debit card. What a great idea!

Senate To Scuttle Timely Economic Stimulus Plan

Smarting from its continued failure to check the expansive growth of the unitary executive, the Senate has decided to assert itself by derailing an agreed upon economic stimulus plan. Senate leaders are now insisting that the stimulus plan contain an extra $25 billion to fund road work, tax cuts, and extend unemployment insurance.

../../../..//2008/01/24/the-first-tax-rebate-checks/

The first tax rebate checks will be sent out in May and just about everyone should have them by July. [AP]

How Will You Spend Your Tax Rebates?

Gawker Media polls require Javascript; if you’re viewing this in an RSS reader, click through to view in your Javascript-enabled web browser.

Economic Stimulus Plan Passes

Accord was reached and the economic stimulus plan has passed. Here’s a brass tacks breakdown:

Tentative Economic Stimulus Deal Reached

The Administration and Congress have negotiated the outline of how the proposed economic stimulus plan will play out. Here’s how much in rebates you could be getting back, depending on your situation:

Coach CEO Says Proposed Stimulus Package Necessary So Consumers Will Buy His Purses

Whether the U.S. is technically in a recession or not, Coach’s CEO Lew Frankfort says consumers are already pretending that it’s here. That’s why he’s in favor of the President’s proposed stimulus package—it will “restore confidence in consumers that they will have some additional discretionary money that they would otherwise not expect.” That’s right: we need a nation-wide tax credit this year so that we can buy more Coach purses.

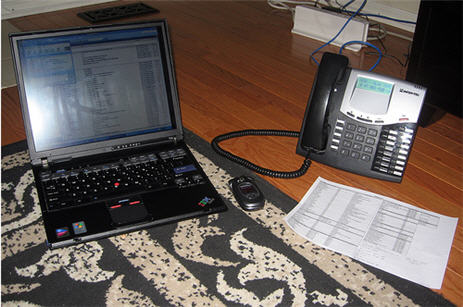

Get Tax Advice Over The Phone With FreeTaxQuestion.com

If you’re uncertain about something on your taxes, you can get free tax advice over the phone until Jan. 31, thanks to a special TurboTax promotion at FreeTaxQuestion.com. Just enter your question and name, phone, email, and best time to reach you, and an IRS enrolled tax pro will call you and help you out. If you’re worried that this is just a lead generation ploy, use a disposable email address and disposable phone number. The FiLife blog tried it and had to submit their question twice, but they got it answered and answered good. They said that TurboTax was casually mentioned among the array of options one could use to finish filing, but there was otherwise no overt product pushing.

Tax Tip: Home Offices Are Worth The Deductions If You Qualify

The first question that must be asked about any home office in order for it’s expenses to be deductible is, is the workspace used exclusively and regularly for business? The answer to both of these questions must be yes before any deduction can be taken. If the workspace is used for both business and personal use, then it is not deductible. Furthermore, the space must be used on a regular basis for business purposes; a space that is used only a few times a year will not be considered a home office by the IRS, even if the space is not used for anything else. These criteria will effectively disqualify many filers who try to claim this deduction but are unable to substantiate regular and exclusive home office use. It should be noted that it is not necessary to partition off the workspace in order to deduct it (although this may be helpful in the event you are audited.) A simple desk in the corner of a room can qualify as a workspace, provided you count only a reasonable amount of space around the desk when computing square footage.

../../../..//2008/01/21/as-of-january-11th-you/

As of January 11th, you can now start e-filing your taxes. Let the fun begin! [Bankrate]

Self-Employed? Here's How To Do Your Taxes

Being self-employed can be a source of personal satisfaction, but also headache, especially when it comes to doing one’s taxes. Fortunately, there’s an extremely lucid step-by-step guide posted over at E-How. They’ll walk you through everything you need to do, from determining your status, to your expenses and deductions. The guide points out important things to remember, like the extreme importance of using exact numbers when claiming deductions. Rounded numbers might be easier to add, but they’re also a red flag to IRS auditors (if you learn nothing else from Girls Gone Wild, let it be this).