n+1: What’s a paradigm shift in finance?

subprime meltdown

../../../..//2008/01/22/wachovias-4q-earnings-get-hammered/

Wachovia’s 4Q earnings get hammered by the subprime meltdown. [Bloomberg]

Buyers Sue Agent For Inflating Real Estate Appraisal

The New York Times has an interesting article about a couple in California who are suing their real estate agent (who is conveniently also a mortgage broker) for allegedly artificially inflating the appraisal on their home by $100,000. A few days after moving in to their new home, says the NYT, “they got a flier on their door from another realty agent. It showed a house up the street had just sold for $105,000 less than theirs, even though it was the same size.”

U.S. Markets Down Sharply Despite Emergency Rate Cut

Despite the fact that the Fed cut the federal funds rate on overnight loans between banks to 3.5 percent from 4.25 percent in an attempt to prevent a sell-off in U.S. markets, the Dow Jones Industrial average opened down by more than 460 points.

World Economy Feels The Mortgage Meltdown

On a day when United States markets were closed in observance of Martin Luther King’s Birthday, the world’s eyes were trained nervously on the United States. Investors reacted with what many analysts described as panic to the multiplying signs of weakness in the American economy.

../../../..//2008/01/21/some-libertarian-flavored-analysis-of-the/

Some libertarian-flavored analysis of the mortgage crisis, from Credit Slips:

If my lugubrious predictions prove true, there will be a measurable–possibly quite large–impact on the market. Such rules will make mortgage lending less profitable to everyone in the system-so the number of mortgages written will decline and those that are written will be marginally more expensive. It will winnow the number of mortgage brokers and so remove some who have committed fraud in writing mortgages. It will make investors upstream think twice about buying a debt that carries not only a fraud claim but also the possibility of tort liability for too generous lending, and even a lasting stain (for debt liability) that cannot be removed by assignment to another.

Bankrupt Mortgage Executive Kills Wife, Self

Walter Buczynski jumped from the Delaware Memorial Bridge on Friday after killing his wife, Marci. Buczynski was the Vice President of Fieldstone Mortgage, a Maryland lender with $5.5 billion in subprime loans. The company recently filed for bankruptcy.

Prosecutor Robert Bernardi said Evesham Township police went to the couple’s home in the Marlton section of the township around noon after a male caller asked them to check on Marci Buczynski’s welfare. Her body was found in a bedroom.

Who Wasn't Investing In Subprime Mortgages?

The money transfer services provider’s stock lost half its value Jan. 15 after the company disclosed a plan to recapitalize its balance sheet that depends on its ability to shed its risky loan portfolio.

../../../..//2008/01/15/citigroup-writes-down-181-billion/

Citigroup writes down $18.1 billion due to investments related to subprime debt. Observers and analysts unanimously agree that that is a lot of billions. [Reuters]

../../../..//2008/01/15/home-prices-may-bottom-out/

Home prices may bottom out in 2008, says the Mortgage Bankers Association.

Need A 2-Liter Bottle Of Pepsi? Just Apply For A Walmart Credit Card!

This is not funny. This is sad. Very, very sad. They should at least offer Coke.

BREAKING: Bank Of America Buys Countrywide, CEO Gets Up To $115 Million Parachute

Hey there, sports fans: Bank of America will buy everyone’s favorite evidence-forging subprime lender, Countrywide for a cool $4 billion dollars.

Bank Of America May Buy Countrywide

Marketwatch says that Bank of America is in “advanced” talks to acquire Countrywide. No word on if said talks took place on Vader’s Star Destoyer or on Captain Hook’s pirate ship. Bank of America already bailed out Countrywide last year, chucking $2 billion into the troubled mortgage lender in exchange for preferred securities that could be converted into stock at $18. Countrywide is currently trading at around $7.75.

Will The Foreclosure Tsunami Lead To An Arson Boom?

Faced with foreclosure on her Russellville, Indiana home, Christina Snyder allegedly concocted the kind of plan that now has insurance executives on edge.

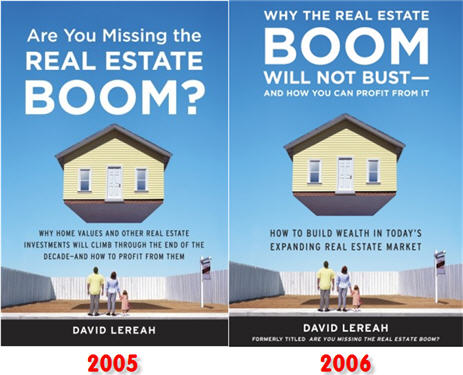

"Economist" Publishes "Why The Real Estate Boom Will Not Bust" Shortly Before Real Estate Boom Busts

David Lereah was the chief economist for that National Association of Realtors before he left to become an Executive Vice President of Move, INC. During his tenure as chief economist, he published several books. One of them, released in 2005, was titled Are You Missing The Real Estate Boom? Why Home Values And Other Real Estate Investments Will Climb Through The End Of The Decade—And How To Profit From Them. The cover depicted a nice enough looking family staring up at tiny little house that was hovering in the sky above their heads, out of reach, but still tantalizingly close. If only, if only they’d just read Mr. Lereah’s book!

Countrywide Says It's So, Like, Totally Not Going To Go Bankrupt, OK?

Reacting to the bankruptcy rumors, Countrywide spokesman Rick Simon said, “There is no substance” to them “and we are not aware of any basis for the rumor that any of the major rating agencies are contemplating negative action relative to the company.”

So, if you’re seeking better interest rates, and are morally flexible about who you give your money too, look for companies that are in dire need of an infusion of cash. Who’s the predatory lender now? Don’t you feel cool?

86,000 Mortgage Related Jobs Cut In 2007

A new study says that 86,000 mortgage related jobs were cut due to the weakening housing market, says CNNMoney. Diabolical mustache-twirling evidence-forging lender Countrywide unburdened itself of the most workers, cutting 11,665.