Unfortunately, we don’t all carry little elves on our person who can administer a hefty poke when we need to snap to attention. State Farm is working on a way to solve that issue with a patent for a wearable device system that can alert drivers who might be nodding off, distracted, or intoxicated behind the wheel. [More]

state farm

Some Drivers Don’t Want Insurance Companies Tracking Them, Even If It Means Discounts

A longstanding complaint against auto insurance is that it sometimes lumps in drivers based on things — like location, type of car, and age — that may have little-to-nothing to do with a particular driver’s behavior or history. In recent years, some insurers have begun offering drivers a way to get more personalized rates by allowing the insurance company to track their vehicular movements, but many American consumers simply aren’t willing to share that information. [More]

3 Things We’ve Learned About How Demographics, Credit Scores & Marital Status Affect Your Car Insurance Rates

When you get a quote for car insurance, you might think that only a few things matter — your driving record, the cost and use of your vehicle, the type of coverage you need, and other factors directly related to operating an automobile. But the fact is that many insurers are basing your insurance quotes on data points that have nothing to do with driving, like your credit score, marital status, and ZIP code. New research shows that determining price using these types of demographic and financial factors (rather than driving record alone) can have a serious impact on the affordability of car insurance. [More]

What Happens If You Find Your Stolen Car After The Insurance Company Has Paid You For It?

We’ve heard stories in the past of stolen cars turning up years after they go missing, and joyfully reunited with the owners who thought they had lost their beloved rides forever. But what happens if your insurance company has already paid you for that stolen car — is there any way to keep it if you find it again? [More]

NBA To L.A. Clippers Sponsors: We’ve Banned Donald Sterling… Please Come Back

Yesterday, a number of high-profile sponsors cut ties with the NBA’s L.A. Clippers pending a decision from the league on how to handle the pretty awful things team owner Donald Sterling is accused of saying. Now that it’s issued a lifetime ban against Sterling’s involvement in the league, the NBA is asking those advertisers to return to the fold. [More]

CarMax, Virgin America, Others Ditching L.A. Clippers Over Owner’s Alleged Racist Comments

If we learned anything from Deengate last year, it’s that if people don’t like what you’re allegedly saying, big companies will no doubt cut ties and run in order to avoid as much of the fallout as possible. Joining Paula Deen and others before her in the rejected corporate sponsorships arena is the L.A. Clippers, whose owner Don Sterling has been accused of making racist comments. [More]

As The Auto Insurance Industry Spends Billions, Fewer Drivers Switching Insurers

All those ads trying to wheedle, cajole, convince and otherwise get drivers to switch car insurers add up to billions of dollars for insurance companies. But a new study says that even with all that financial heft, fewer drivers are deciding to take the plunge and go elsewhere. That sound you hear is money sliding down the drain. [More]

Consumer Group: The Rich May Pay Less For Car Insurance Even If They’re Not Safe Drivers

Driving safely and avoiding accidents isn’t just common sense — injuries hurt, car wrecks are bad — but also a way to make sure drivers keep their auto insurance premiums down. But according to figures released by a consumer group recently, insurance companies are in the habit of charging higher premium to safe, low- or moderate-income drivers than to richer people who were at fault for an accident. [More]

State Farm Pulls My Homeowner’s Policy Because I Was Robbed As A Renter

Just a few weeks ago, Consumerist reader Ben went to close on his new home, complete with documentation from State Farm saying he had a homeowner’s insurance policy for the property. Then the other day, he gets a call from the insurer telling him, sorry, he’s not actually covered because his previous apartment had been robbed a couple years earlier while he had a State Farm renter’s policy. [More]

State Farm Will Believe You Hit A Deer When You Serve Them Venison Steaks

Sean hit a deer with his car a few weeks ago. We believe him, but his insurer, State Farm, doesn’t. It’s not like the deer, which disappeared into the woods, is going to stop by his agent’s office and testify. So they were going to use his collision coverage, which would result in an increase in his premiums or even cancellation for daring to use the comprehensive policy that he was paying for. But Sean is a lawyer, and he fought back. [More]

Learn Thanksgiving Turkey Fryer Safety With William Shatner

It’s still a little early to start talking about turkey fryer safety. There’s still a week before most families’ birds even come out of the freezer. But this is no ordinary video: most frying guides don’t feature William Shatner being consumed by a massive computer-generated fireball.

[More]

State Farm Ordered To Pay $350 Million To Overcharged Customers

A judge in Texas has sided with the Lone Star State’s insurance commissioner, upholding an order for State Farm Insurance to pay out $350 million to over one million overcharged customers. [More]

State Farm Uses Mutilated Monkeys To Sell Insurance To College Kids

State Farm didn’t win too many people over with its Worst Ad In America-nominated spokesman, so now the company is trying a very different approach by courting college students with mutilated monkey keychains. [More]

State Farm To Toyota: Pay Us Back For Unintended Acceleration Accidents

As if the mass of class-action lawsuits against Toyota weren’t enough for the Japanese car maker, it now faces an immediate challenge from another side — the insurance companies. State Farm announced over the weekend that they want Toyota to reimburse them for claims they’ve had to pay out for incidents related to sudden unintended acceleration. [More]

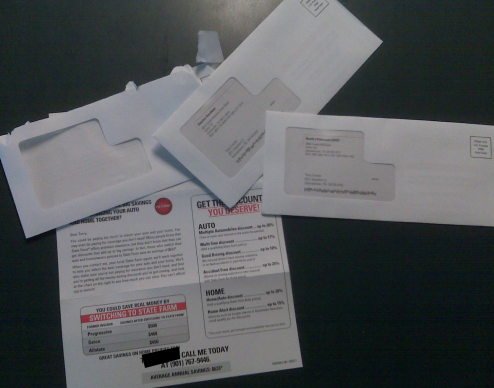

Man Receives 16 State Farm Junk Mailings In One Month

State Farm is powerless to stop its representatives from filling up your mailbox with unwanted solicitations! Terry has contacted one of the agents listed in the 16 mailings he’s received over the past month and was told, “Sorry, it’s from corporate.” He then lodged a complaint with the corporate office and received a response from their “Internet Support Representative” who basically told him he’s out of luck. We’re not sure what State Farm’s sales strategy is here; maybe they’re just betting on wearing him down through sheer volume?

State Farm: This 1963 Chrysler Newport Is Not An Antique, Unless You Give It A Fresh Coat Of Paint. What?

Humphrmi’s 1963 Chrysler Newport has antique license plates, meaning he can’t drive to or from anywhere other than car shows, shops and parades; but State Farm won’t insure the car as an antique unless it gets a new coat of paint. “You have to paint the car,” they said, to avoid a 33% higher premium. Does this strike anyone else as insane?

../..//2008/02/08/state-farm-customers-get-to/

State Farm customers get to file their taxes for free with Turbo Tax. [State Farm]

Yes, You Can Insure Your iPhone Against Accidental Damage And Theft

AppleCare’s iPhone coverage is limited to hardware issues and technical support; if you drop your iPhone on the sidewalk, you may be out $600, unless you have insurance against accidental damage and theft.