In recent years, we’ve written a number of stories about laws aimed at protecting active-duty servicemembers and their families from predatory loans and the businesses that try to take advantage of loopholes in these rules. Some readers have asked why members of our armed forces merit protections not available to civilians. But this isn’t about just doing something nice for our soldiers; it’s about removing a threat to national security. [More]

servicemembers

22 States Ask Defense Dept. To Do More To Protect Servicemembers From Predatory Lenders

When the Military Lending Act was introduced in 2007, it aimed to prevent predatory lenders from gouging military personnel with exorbitant interest rates and mountains of fees. While those protections have proven to be successful in many ways, lenders have since learned how to work around specific limits of the law. Now, attorneys general from 22 states are asking the Department of Defense to do more to shield servicemembers from unscrupulous lenders. [More]

CFPB: Retailer Allegedly Using Illegal Debt Collection Practices Against Servicemembers Must Refund $2.5M

The Consumer Financial Protection Bureau continues its fight against companies that continuously take advantage of members of the military, despite protections afforded to them under federal laws. Regulators’ latest victory? A settlement demanding over $2.5 million in consumer relief from three companies that allegedly used illegal tactics to pilfer money from servicemembers and their families. [More]

New DoD Protections Aim To Keep Shady Businesses From Taking Advantage of Military Members

Members of the military — particularly younger members from lower-income backgrounds — are too often the target of shady, predatory businesses looking to take advantage of their youth and inexperience with finances. The Military Lending Act offers some protections, but these operators find ways to get around the law. On Friday, the U.S. Dept. of Defense took steps to eliminate some of those exploitations by creating reforms to the current military discretionary allotment system. [More]

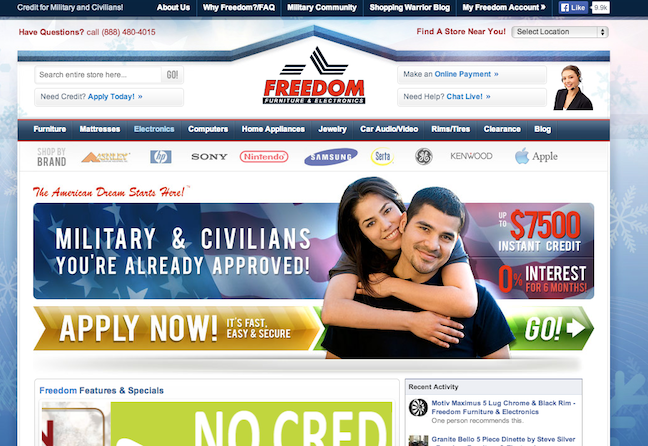

Sketchy Retailer Caught Scamming Servicemembers With Pointless Fees

A discount retailer that came under fire last month for its questionable lending and marketing practices received a slap on the wrist from federal regulators for allegedly tricking thousands of servicemembers into paying fees for legal protections they already had and for certain services that the company failed to provide. [More]

Sallie Mae, Navient To Pay $97M To Settle Servicemember Student Loan Violations

Taking advantage of members of the military isn’t looked upon lightly by federal regulators. This idea was driven home today by the Depts. of Education and Justice, and the Federal Deposit Insurance Corp., who jointly announced a sizable settlement against student loan servicers Sallie Mae and Navient for overcharging and imposing excessive fees to military members.

[More]

New System Addresses Military Members’ Complaints Of Higher Education Abuse

It’s hard to believe some higher education institutions deceptively target veterans and servicemembers, but it does happen. To better ensure veterans’ and servicemembers’ input is being heard the federal government has launched a new reporting system to streamline consumer complaint investigations. [More]