After you’ve spent more than $100 billion to acquire your biggest competitor, what’s left? Sure, you can buy up that smaller business here and sell off this subsidiary there, but how does a company regain the adrenaline rush of pulling off a transaction so big people need to stop and count the zeros? [More]

sabmiller

Mega-Beer Merger Could Cost SABMiller, Anheuser-Busch Employees Thousands Of Jobs

It’s not just brands of beer that Anheuser-Busch InBev and SABMiller have had to discard in order to make their $107 billion merger dreams a reality: it could also cost thousands of people their jobs. [More]

China Okays Merger Of Former U.S. Beer Giants

The final country that needed to weigh in on the mega-merger of beer giants SABMiller and Anheuser-Busch InBev has given its blessing to the sudsy nuptials. This morning, Chinese regulators approved the deal, effectively clearing the road for the acquisition to move forward. [More]

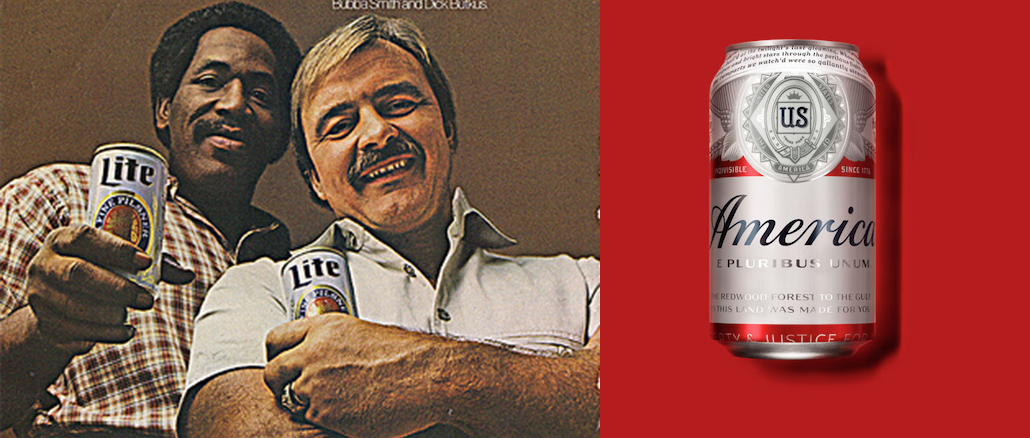

How America’s Two Signature Beer Companies Became Expats

Budweiser and Miller: Even if you don’t like them, you have to admit that they have long been considered the two beers most associated with America. Their ads feature vast fields of wheat, baseball, hard-workin’ and hard-partyin’ men and women — heck, Bud even went so far as to rebrand itself “America” for the summer — even though neither brand has been majority owned by an American company in years. And now that U.S. regulators have signed off on on the marriage of Bud and Miller’s parents, these once-American titans of industry have completed their transition to become worldly expatriates. [More]

Anheuser-Busch/SABMiller Mega-Merger Gets Justice Dept. OK, After Miller Agrees To Sell All U.S. Brands

The $107 billion (with a b) merger of beer titans Anheuser-Busch InBev and SABMiller has cleared a major hurdle today, with the U.S. Justice Department signing off on the merger — under the condition that Miller divest itself of all its remaining U.S.-based businesses. [More]

South African Regulators Give Green Light To $107B Anheuser-Busch, SABMiller Merger

Anheuser-Busch InBev has one more regulatory body to mark off on its “Places To Get Approval For $107 Billion Takeover Of SABMiller” checklist: South Africa’s Competition Commission gave its blessing to the mega-beer merger Tuesday after placing several conditions on the approval. [More]

Anheuser-Busch, SABMiller’s $107B Merger Passes Major Hurdle, Gains European Approval

When you’re trying to combine a Belgian-Brazilian beer giant (that loves to pass itself off as American) with a huge London-based beer company whose roots trace back to South Africa and Wisconsin, you’re going to need to shed some overlapping businesses to get all the approvals you need. It looks like Anheuser-Busch’s plan to sell off some SABMiller brands overseas has helped gain approval from European Union regulators who have given the green light to the $107 billion merger of the two companies.

[More]

AB InBev To Sell SABMiller’s Eastern European Brands For $8B

Anheuser-Busch InBev’s pending $107 billion merger with SABMiller will now include fewer brands: the beer behemoth announced today that it will sell several of its betrothed’s eastern European assets in order to appease federal regulators and speed up approval for the mega-merger. [More]

Mega-Beer Merger Clears Hurdle: SABMiller Officially Sells Peroni, Grolsch Brands For $2.9B

In order to grease the wheels for the mammoth $107 billion merger of beer giants Anheuser-Busch InBev and SABMiller, a number of Miller’s brew brands are being sold off as quickly as possible. Only a week after announcing that Miller might sell a number of premium labels — including Peroni, Grolsch, and Meantime — to Japan’s Asahi Group, the $2.9 billion deal is now official.

Anheuser-Busch InBev To Sell Peroni, Grolsch To Earn European Approval Of Beer Merger

A month after Anheuser-Busch InBev cleared one huge regulatory hurdle in gaining approval for its $107 billion SABMiller merger with the sale of SABMiller’s half of China’s largest brewer, the beer behemoth is looking to appease regulators on other continents. This time it happens to be the European Union and the sale of premium brands Peroni and Grolsch. [More]

Mega-Beer Merger Clears Hurdle: SABMiller Sells Chinese Beer Brand For Bargain Price

The $107 billion merger of Anheuser-Busch InBev and SABMiller is a truly global affair, with the betrothed companies having to appease regulators on multiple continents. While the mega-deal still faces numerous challenges, it has cleared one huge hurdle with SABMiller agreeing to sell its half of China’s largest brewer for only $1.6 billion.

Anheuser-Busch Distributor Incentive Program Raises More Concerns Of A Stifled Craft Beer Market

With its $107 billion merger with SABMiller making waves and federal regulators investigating its purchase of several small distributors, one might think that Anheuser-Busch InBev would lay low when it comes to rocking the distribution boat. But that’s apparently not the case, as the company recently unveiled an incentive program that would provide distributors with a sliding scale of bonuses if most of the beer they sell comes from the brewer. [More]

Anheuser-Busch CEO Tells Congress That Mega-Beer Merger Is Good For Everyone, Really

Executives involved in the billion-dollar beer merger between Anheuser-Busch and SABMiller tried to paint a rosy picture of its impending marriage — despite a wealth of contradictory testimony — assuring lawmakers that there’s really no downside to the deal: everyone will benefit, even consumers. [More]

Big Beer CEOs To Testify In Front Of Congress On The Awesomeness Of Mega-Merger Tuesday

There are billions of reasons (or rather dollars) for the executives for Anheuser-Busch InBev, SABMiller and Molson Coors Brewing Co. to prove that a mega-beer merger is a brilliant plan, and now it looks like they’ll have their chance to opine on its greatness by testifying in front of Congress tomorrow. [More]

Consumers Sue To Stop $107B Mega-Beer Merger

Anheuser-Busch InBev’s formal $107 billion bid to acquire SABMiller is far from a done deal: federal regulators will likely be combing through the details of the proposal for quite some time to determine how it will affect the global beer markets, and consumers’ wallets. But it looks as if lovers of the sudsy drinks are a bit ahead of the game, filing a lawsuit to stop the mega-merger. [More]

Anheuser-Busch InBev, SABMiller Finalize Merger, Agree To Sell MillersCoors Brand To Molson For $12B

After receiving more time to finalize its offer to acquire SABMiller, Anheuser-Busch InBev made a formal $107 billion bid for the company on Wednesday. The deal includes a record $75 billion loan and confirms the anticipated divestiture of SABMiller’s stake in its largest brand: MillerCoors. [More]

Anheuser-Busch InBev Gets More Time To Finalize Mega Beer Merger Offer

Anheuser-Busch InBev — the Belgian-Brazilian maker of “America’s beer” — was supposed to finalize its offer to acquire SABMiller by Oct. 14. That deadline was extended until this afternoon, but just like that really wealthy international student at college who never seemed to get his work done on time, AB InBev has been granted another extension. [More]