The premise of HGTV’s Rehab Addict is simple: The show’s star, and home remodeler Nicole Curtis buys a historic home in Detroit or Minneapolis that has been ravaged by years of neglect and returns it to its former glory. But nearly five years after purchasing one Minneapolis property, the city is suing Curtis, claiming she hasn’t done the work, resulting in complaints from neighbors and piled-up bills. [More]

property taxes

Big Retail Chains Keep Playing Chicken With Their Tax Bills

If a strategy used by a national chain retailer works in one city or state, they’re certain to try it on others. The dark store strategy that has helped retailers in some areas slash their property tax bills by sort-of-but-not-really threatening to close is spreading, and has now reached Wisconsin. [More]

Judge Upholds Sale Of Woman’s Home Prompted By Unpaid $6.30 Tax Bill

A woman who’s been fighting for home since it was sold in 2011 at auction has suffered a setback after a judge ruled the sale can stand. She failed to pay a $6.30 interest fee on a late tax bill, but has been living in the home since its sale in an effort to keep it. [More]

Property Tax Soars After Appraiser Adds Mythical Luxury Bathroom & 660 Sq. Ft.

A family in New Jersey says they have no choice but to sell their home after years of paying sky-high property taxes that resulted from the fertile imagination of a town appraiser who inexplicably added on hundreds of square feet and a luxury bathroom (complete with two sinks, just like on HGTV!), and that there’s little chance they’ll ever get any of that money back. [More]

Company Owns Thousands Of Property Liens But No One Knows Who Owns The Company

For the longest time, the tax lien investment business — in which investors buy property tax liens from cities and counties and then collect on the debt (or foreclose on the homeowner) — primarily consisted of small, local investors looking for a relatively quick profit. But in the last two decades, larger companies have taken to buying up as many liens as possible and then shaking down homeowners for the debt and often thousands of dollars in fees. But just because these lien-buyers are bigger and operate in multiple states doesn’t mean they are any more legitimate. [More]

North Dakota Voters Considering Doing Away With Those Silly Property Taxes

North Dakota has the rare boon of having a state budget that enjoys a nice little reserve, and as such, some of its residents say they shouldn’t have to pay property taxes any more. It’s not unheard of to scale back property taxes — California is one example of a state with lower taxes after passing a voter proposition — but the debate is stirring up emotions nonetheless. [More]

Why Homeowners Win When Home Prices Drop

The value of their homes is a major point of pride for many owners, who use the figure to prop up their net worth and justify the money they’ve poured into their dwellings. When the price declines, as it has been doing for most homeowners for years, they tend to overlook the positive side of the drop — one that affects them more immediately. [More]

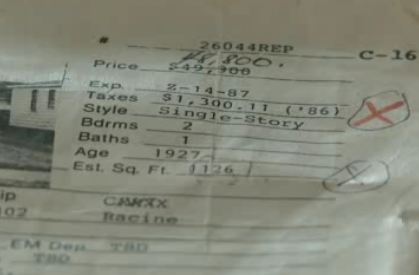

Homeowner Overcharged On Property Taxes For Two Decades. How Much Should City Repay?

An 84-year-old widow recently found out she’s been paying too much property tax on her home for more than two decades because of an error by the original assessor. But the city has only offered to pay her back for one year of the overcharge. [More]

Videos: Getting Your Property Value Reassessed

Filing an appeal to get your property value reassessed so you can pay less property taxes appears daunting, but this video series from the California State Board Of Equalization is here to helps walk you through the process. It’s designed for California, but there’s things in here that you can learn from regardless of where you live.

How To Lower Your Property Taxes

Free Money Finance dredged a fascinating statistic from Kiplingers that suggests 60% of homes are overvalued by assessors, and that 33% of tax appeals succeed. The stat comes from a dubious source, the National Taxpayers Union, described by the San Francisco Chronicle as the “the grand-daddy of the tax revolt organizations.” Assessments guide property taxes, which are universally reviled by homeowners. Even politicians, who suckle tax revenue with the vigor of a vampire on a vein, regularly crusade against property taxes during election season.