Checking accounts come in all shapes and sizes to fit every consumer’s needs – fine, not every consumer. While options can be good when you’re shopping around for a new bank, they also lead to a plethora of fees and risks for consumers. While some practices have improved, a new Pew Charitable Trusts report shows banks have a long way to go and it’s time the Consumer Financial Protection Bureau took action. [More]

pew charitable trusts

Chase Becomes First Bank To Implement New, Simpler Disclosure Box For Prepaid Cards

In 2012, nearly 12 million consumers loaded more than $64 million onto prepaid debit cards. With so many people turning to these cards, more companies are getting into the prepaid debit business. To assist consumers faced with a plethora of card options, Pew Charitable Trusts unveiled a new model disclosure box for easy comparison of prepaid card fees and terms and conditions. [More]

Prepaid Debit Cards: Salvation From Overdraft Fees Or Putting Your Money At Risk?

No overdraft penalties, no overspending and sometime low but occasionally ridiculous fees are all perks that have led consumers to an increased use of prepaid debit cards in the last year. And while the cards are convenient there are plenty of reasons consumers should by wary. [More]

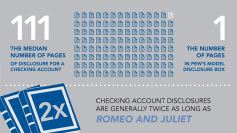

Checking Account Disclosure Documents Are Longer Than Romeo & Juliet, Contain Less Teen Sex

We recently wrote about the PIRG study showing how fewer than 40% of banks were willing to clearly disclose checking account fee schedules. Now a new report from the Pew Charitable Trust demonstrates just how far banks are willing to go to make it difficult for consumers to know what they are getting with their checking accounts. [More]