personal finance

"For Security Purposes, This Card Is Not Active" Is A Lie

When you get a new or replacement credit card in the mail, you have to call the number on the back to activate it, or else you can’t use it, right? Wrong. Despite the sticker on the back that says, “For security purposes, this card is not active,” credit card companies are mailing out cards that can be used without phone activation. This is a problem if the letter containing your credit card is intercepted by an identity thief, like what happened to reader PC Guy. The kicker? He didn’t even request the card, it was a forcible reissue when his store-branded card switched from Visa to Mastercard. His story, inside.

Tax Cat: Let's Learn About "Necessary And Ordinary Business Expenses"

If you have your own business, you can write off your expenses. This reduces you income, and lowers your tax bill. Sadly, you can’t just write off whatever you want.

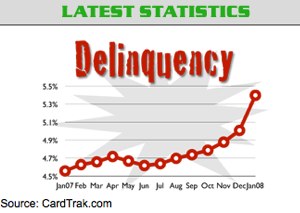

Late Payments On Credit Cards Highest In Three Years

CardTrack.com says “the percentage of people delinquent on their credit cards is the highest it’s been in three years,” according to CNN. Over the past year, U.S. consumers have charged “more than $2.2 trillion in purchases and cash advances.” The article gives the usual advice: Stop buying stuff!

ING Direct Doesn't Care You Never Got Your $1400

Rob writes:

I was the recipient of an international wire transfer into my Netbank Checking Account for $1000 EUR (about $1400 US) on 2007-08-08. After I noticed the amount didn’t post to my account, I contacted Netbank and the sending bank in Spain. The sending bank generated a multi-page “proof of transfer” document and indicated the money had been transfered. Netbank never got back to me. This began the 7 month nightmare of dealing with an inattentive bank in the middle of it’s being seized by the FDIC that continues to this day.

Pictured: CEO Arkadi Kuhlmann perched atop his Harley-Davidson in the ING-Direct company lobby.

Know Where To Fix Your Credit Score By Getting Your Reason Codes

If you want to improve your credit score, a score from 300-850 that lenders use to determine whether you qualify for a loan and how much interest to charge you if you do, you’ll want to know your “reason codes.” These are 2-digit numbers that come with you credit score when you purchase it. Each bureau usually gives you four reason codes with their report, so get your score from each one for a total of 12. One wiki tutorial says that reason codes are listed in order of importance. Armed with that, The Mechanics Of Credit site decodes all the reason codes and prescribes solutions for each one. With this info and tactics, you should be able to boost your score a couple of points and save a bundle.

Government-Mandated Mutual Funds For Everyone! No Thanks.

There was a NYT op-ed last week, “Go On A Savings Spree,” suggesting that, as opposed to the tax-rebate stimulus, the best way to heal the economy is for the government to create universal mutual funds for every tax-payer. At one point, author Dalton Conley writes, “Some research suggests that asset-holders behave more responsibly and are more civic-minded than those without wealth. After all, they have a stake in the future of the economy and their community…Investing motivates people of all income levels to defer gratification and become knowledgeable about the economy and society.”

How To Avoid Pre-Screened Offers Of Credit

Joseph writes in with a helpful reminder:

Now might be a good time to remind people that they can opt-out of pre-screened offers of credit. In light of the HSBC debacle I’ve been victim of, I checked out my credit report yesterday. I was amazed at how often the major credit card companies (AMEX, Capital One, Bank of America, etc…) access my credit history in order pre-screen me for promotional purposes. Consumers can opt-out at: www.optoutprescreen.com

../../../..//2008/02/19/bank-of-america-still-isnt/

Bank of America still isn’t giving customers, and now, reporters, a straight answer when asked why they’ve been jacking up people’s interest rates to 23, 29%. [Star-Telegram]

College Grad Succeeds With $25 And A Gym Bag

This college grad decided to live on the streets with just $25 and a gym bag to see if he could make it without any of the trappings of his upbringing, privileges, or contacts. After 10 months, he was moving into an apartment, bought a pickup truck, and had a savings of around $5,000. The point of the story is supposed to be that people are poor because they have bad attitudes. Which is technically true, but maybe he should do an experiment to see what being born poor will do for your “positive outlook.”

ATM Fees Slink Upwards

Everyone with an ATM card is used to paying withdrawal fees when using another bank’s ATM and it’s no big deal, it’s only a buck or so, and the ATMs are so convenient. If that screen said, “This ATM will charge you $4.75 to withdraw money,” you might look around to make sure you hadn’t accidentally stepped into a casino or strip club. But since many banks charge you an extra per-transaction punishment fee for using another bank’s ATM, that’s exactly what’s happening. You just don’t notice because it gets lumped together into one ATM fee on your bank statement. Not only that, but these fees are slowly and steadily on the rise, as seen in this NYT graph. Average ATM surcharges by “other banks” have gone up from $.75 to $1.75 from 1999 to 2007. Average punishment fee for cheating with another bank’s ATM has gone from $2.00 to $3.00 in the same period. Obviously, one way to beat the fees is to only visit your bank’s ATMs. Another is to bank with a place like USAA, which refunds other bank’s ATM surcharges. Any other solutions out there for ending the fee spree?

HSBC Won't Tell You Someone In Bulgaria Is Stealing $2,000 From You

Keith writes:

On Friday February 15th I called HSBC customer service. I explained that there was a $1,000 difference between my “Bank Balance” and I was concerned because I hadn’t used my ATM card. They said that the money was “on hold.” They could give no further explanation. I pressed them and said “How is it possible that $1,000 of my money is out in space” They had no reply. I asked to speak to a supervisor to which the person I was speaking to refused and said “They have the same information I do and they are not available.” I was talking to outsourced “customer service reps” from the Philippines so I hung up and dialed 716.841.7212 again. I kindly explained my store from scratch to Helga REP # 6124, also in the Philippines, not Buffalo, NY. She said the same thing as the guy before (at least they were consistent), and refused to let me speak to a supervisor.

Study Says Payday Lenders More Prevalent In Areas Of High Christian Conservative Power

A law professor and associate professor of geography set out to create the most comprehensive map of U.S. payday lenders to date. What they found, to their surprise, was “a surprising relationship between populations of Christian conservatives and the proliferation of payday lenders.” And it’s not a side effect of a poor population that happens to be Christian, according to the authors: “Our research showed that the correlation between payday lenders and the political power of conservative Christians was stronger than the correlation between payday lenders and the proportion of a population living below the poverty line.”

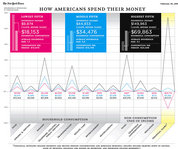

How You Spend Your Money

Our brain nearly broke looking at this graph the New York Times published this weekend called How Americans Spend Their Money (click to enlarge). By the looks of it, poor people spend twice as much as they earn in taxable income. Rich people outspend the middle fifth on financial stuff by a factor of ~20:1. What the middle fifth and the lowest fifth spend on goods and services is closer than what the middle fifth and the highest fifth spend. The lowest fifth financial flows are very much in the negative. And that’s about all the staring at a crazy graph we can do for the moment. What other trends can you see?